Quarterly housing report shows affordability improved

Contact

Quarterly housing report shows affordability improved

The REIA's quarterly report gives a snapshot of the housing industry showing a slight improvement before the effects of Coronavirus.

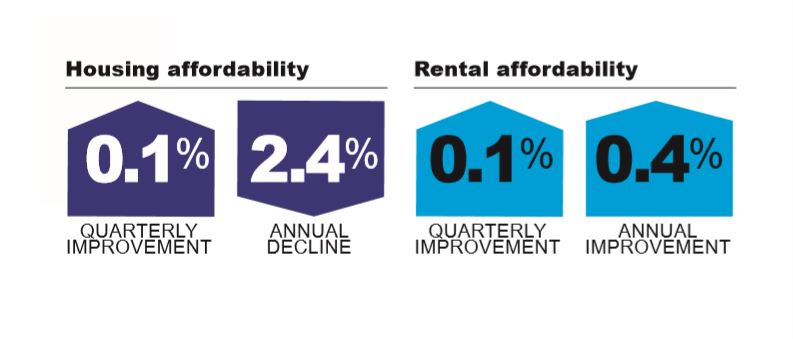

It is like the calm before the storm as the REIA Housing Affordability Report for the March quarter shows a marginal improvement across the country to housing affordability.

It also shows the proportion of income required to meet loan repayments decreased by 0.1 percentage points to 34.7 per cent over the quarter.

REIA president Adrian Kelly analyses the snapshot of the property industry across Australia.

At a Glance:

- Proportion of income required to meet loan repayments decreased by 0.1 percentage points to 34.7 per cent

- With the exception of Victoria, Tasmania and Western Australia, housing affordability improved across the states and territories

- Rental affordability improved in the March quarter with the proportion of income required to meet rent payments decreasing to 23.5 per cent by 0.1 per cent

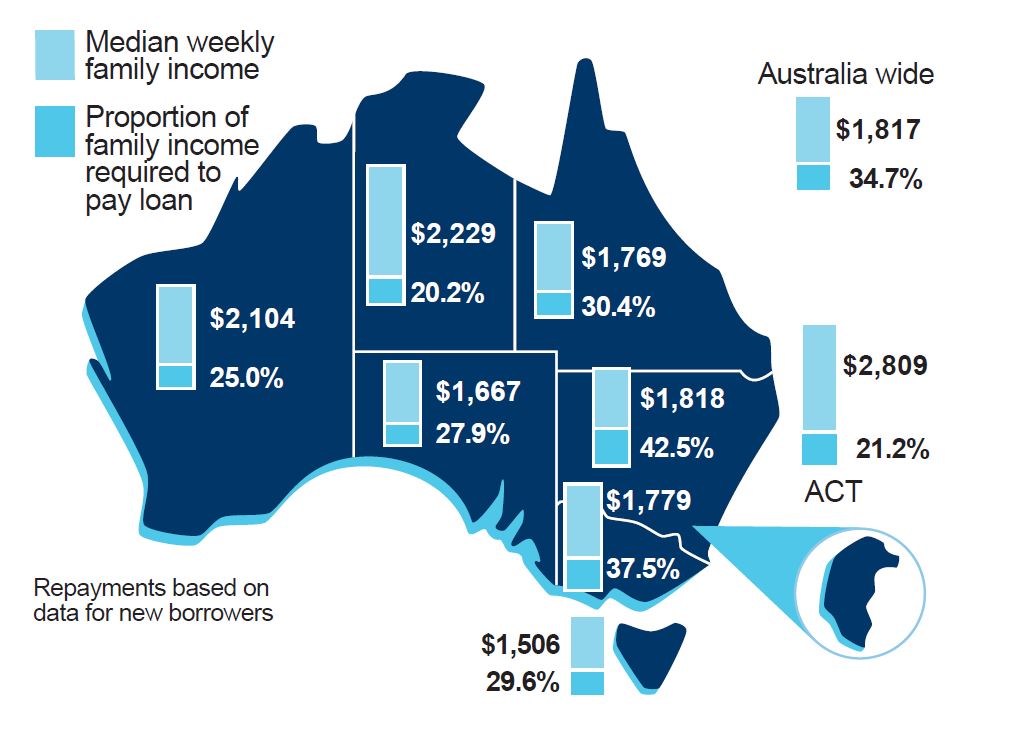

“With the exception of Victoria, Tasmania and Western Australia, housing affordability improved across the states and territories with the Australian Capital Territory having the largest improvement 1.1 percentage points,” said Mr Kelly.

Source: REIA

“Rental affordability improved in the March quarter with the proportion of income required to meet rent payments decreasing to 23.5 per cent, a decrease of 0.1 percentage points over the quarter.

“Rental affordability improved in Queensland, Western Australia and the Northern Territory, but declined in New South Wales, Victoria, South Australia, Tasmania and the Australian Capital Territory.”

When it comes to loans the total number has declined compared to the December quarter of the previous year.

“This is not unusual for the first quarter of the calendar year, however there was a 4.2 per cent increase on the number of new loans from the same quarter of 2019,” said Mr Kelly.

“The number of first home buyers decreased to 27,082, a decrease of 10.7 per cent during the quarter but an increase of 23.1 per cent compared to the March quarter 2019.

“With the introduction of the First Home Buyer Deposit scheme on 1 January we expect that share of first home buyers will continue to grow.”

The report shows the number of first home buyers decreased in all states and territories over the March quarter with the largest decrease in the Australian Capital Territory (-22.2 per cent).

Compared to the corresponding quarter 2019, the number of first home buyers increased in all states and territories, with the largest increase in the Australian Capital Territory (57.6%).

Mr Kelly advises the true nature of the impacts of Coronavirus on housing affordability will be reflected in the next quarterly report.

Source: REIA

State by State

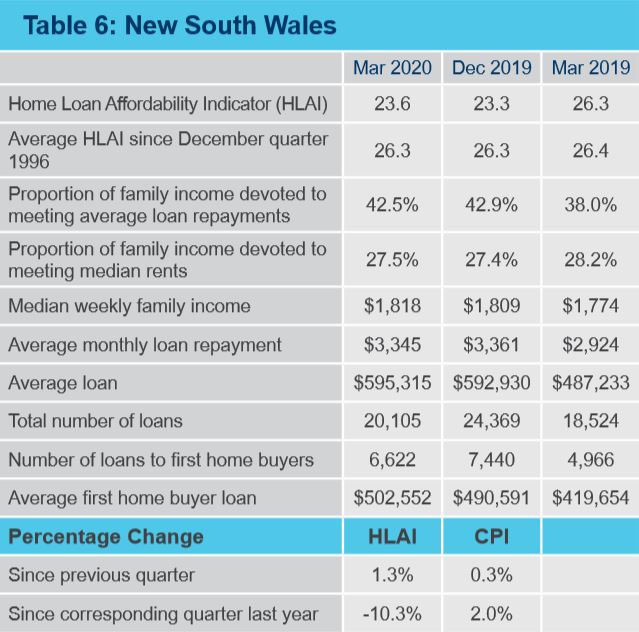

NSW

- Housing affordability improved with the proportion of income required to meet loan repayments decreasing to 42.5 per cent

- Proportion of income required to meet loan repayments 7.8 percentage points higher than the nation’s average

- Rental affordability declined marginally with the proportion of income required to meet median rents increasing to 27.5 per cent

- Loans to first home buyers decreased to 6,622 a decrease of 11 per cent over the quarter but an increase of 33.3% compared to the March quarter 2019

- 24.5 per cent of first home buyers were from New South Wales while first home buyers make up 32.9% of the state’s owner-occupier market

- The average loan to first home buyers increased to $502,552

- The number of dwelling loans decreased to 20,105, a decrease of 17.5 per cent over the quarter but an increase of 8.5 per cent compared to the March quarter 2019

- The average loan size increased to $595,315, an increase of 0.4% over the quarter and an increase of 22.2% compared to the corresponding quarter of 2019.

Source: REIA

Victoria

- Housing affordability declined in Victoria with proportion of family income devoted to meeting average loan repayments increasing to 37.5 per cent

- Rental affordability in Victoria declined over the quarter with the proportion of income required to meet median rent increasing to 23 per cent

- The number of loans to first home buyers in Victoria decreased to 8,624, a decrease of 16 per cent

- Of the total number of first home buyers that purchased during the March quarter, 31.8 per cent were from Victoria

- The average loan to first home buyers was $437,871, an increase of 2.3 per cent over the quarter and an increase of 14 per cent compared to the March quarter 2019.

- The total number of loans decreased to 21,396, a decrease of 15.8 per cent during the quarter but an increase of 4.3 per cent compared to the March quarter 2019.

- The average loan size was $514,741 over the quarter, an increase of 4.1 per cent and an increase of 18.8 per cent when compared to the corresponding quarter 2019.

Source: REIA

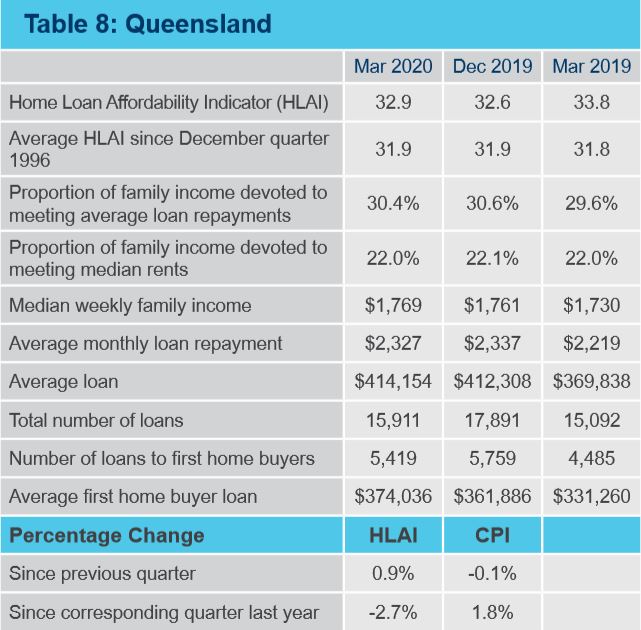

Queensland

- Housing affordability improved with the proportion of income required to meet home loan repayments decreasing to 30.4 per cent

- Rental affordability improved over the quarter with the proportion of the median family income required to meet the median rent decreasing to 22 per cent

- The number of loans to first home buyers in Queensland decreased to 5,419, a decrease of 5.9 per cent over the quarter but an increase of 20.8 per cent compared to the same quarter of 2019.

- Of all Australian first home buyers over the quarter, 20 per cent were from Queensland while the proportion of first home buyers in the state’s owner-occupier market was 34.1%

- The average loan size to first home buyers increased to $374,036, an increase of 3.4 per cent during the quarter and an increase of 12.9 per cent compared to the March quarter 2019.

- The number of loans decreased in Queensland to 15,911, a decrease of 11.1 per cent over the quarter but an increase of 5.4 per cent compared to the March quarter of the previous year.

- The average loan size increased to $414,154, an increase of 0.4 per cent during the quarter

Source: REIA

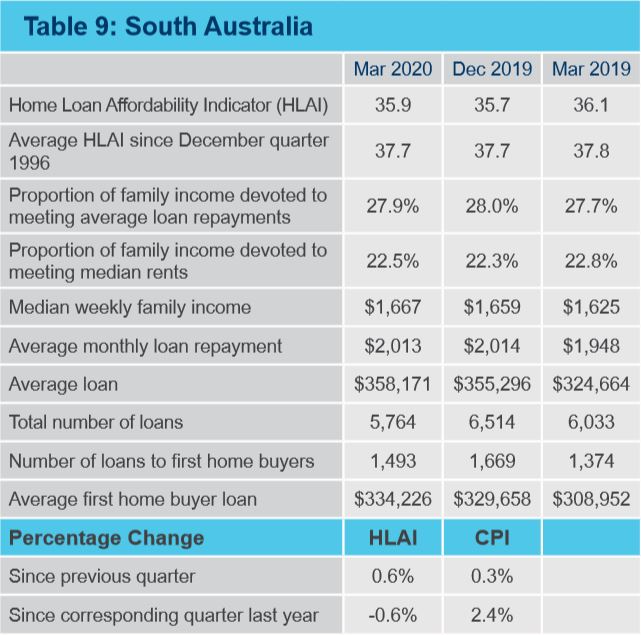

South Australia

- Housing affordability in South Australia improved with the proportion of income required to meet monthly loan repayments decreasing to 27.9 per cent

- Rental affordability declined over the quarter with the proportion of income required to meet rent payments increasing to 22.5 per cent

- Number of loans to first home buyers in South Australia decreased to 1,493, a decrease of 10.5 per cent over the quarter

- Of all Australian first home buyers over the quarter, 5.5 per cent were from South Australia while the proportion of first home buyers in the state’s owner-occupier market was 25.9 per cent

- The average loan size to first home buyers increased to $334,226, an increase of 1.4 per cent over the quarter and an increase of 8.2 per cent when compared to a year earlier.

- The total number of loans decreased to 5,764, a decrease of 11.5 per cent over the quarter and a decrease of 4.5 per cent compared to the March quarter 2019.

- The average loan size increased to $358,171, an increase of 0.8 per cent over the quarter

Source: REIA

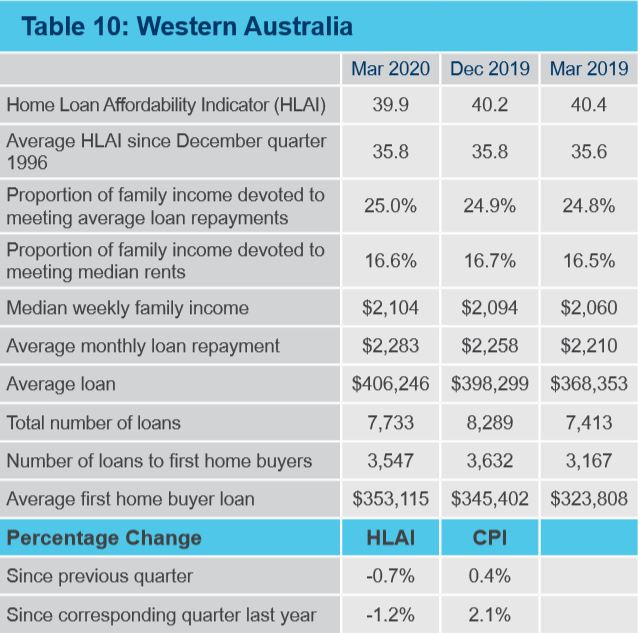

Western Australia

- Housing affordability in Western Australia declined with the proportion of income required to meet loan repayments increasing to 25 per cent

- Rental affordability improved with the proportion of family income required to meet the median rent decreasing to 16.6 per cent

- The number of first home buyers decreased to 3,547 in the March quarter, a decrease of 2.3 per cent over the quarter

- Of all Australian first home buyers over the quarter, 13.1 per cnet were from Western Australia while the proportion of first home buyers in the state’s owner-occupier market was 45.9 per cent

- The average loan to first home buyers increased to $353,115, an increase of 2.2 per cent over the quarter and an increase of 9.1 per cent when compared to the March quarter 2019

- The total number of loans in Western Australia decreased to 7,733, a decrease of 6.7 per cent over the quarter but an increase of 4.3 per cent compared to the March quarter 2019.

- The average loan size increased to $406,246, an increase of 2 per cent over the quarter and an increase of 10.3 per cent compared to the March quarter 2019.

- Western Australia’s average loan size is 16.4 per cent lower than the national average.

Source: REIA

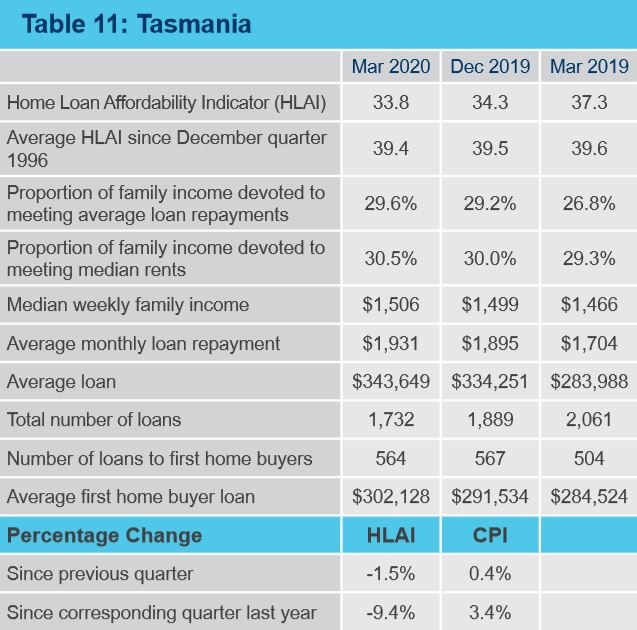

Tasmania

- Housing affordability declined with the proportion of income required to meet home loan repayments increasing to 29.6 per cent

- Rental affordability declined over the quarter with the proportion of income required to meet median rents increasing to 30.5 per cent

- The number of first home buyers in Tasmania decreased to 564, a decrease of 0.5 per cent over the quarter but an increase of 11.9 per cent compared to the same quarter of the previous year

- Of all Australian first home buyers over the quarter, 2.1 per cent were from Tasmania while the proportion of first home buyers in the state’s owner-occupier market was 32.6 per cent

- The average loan to first home buyers increased to $302,128, an increase of 3.6 per cent over the quarter and an increase of 6.2 per cent compared to the March quarter 2019.

- The total number of new loans for dwellings in Tasmania decreased to 1,732, a decrease of 8.3 per cent over the quarter and a decrease of 16 per cent compared to the corresponding quarter 2019

- The average loan size increased to $343,649, an increase of 2.8 per cent over the quarter and an increase of 21 per cent compared to the same time last year

Source: REIA

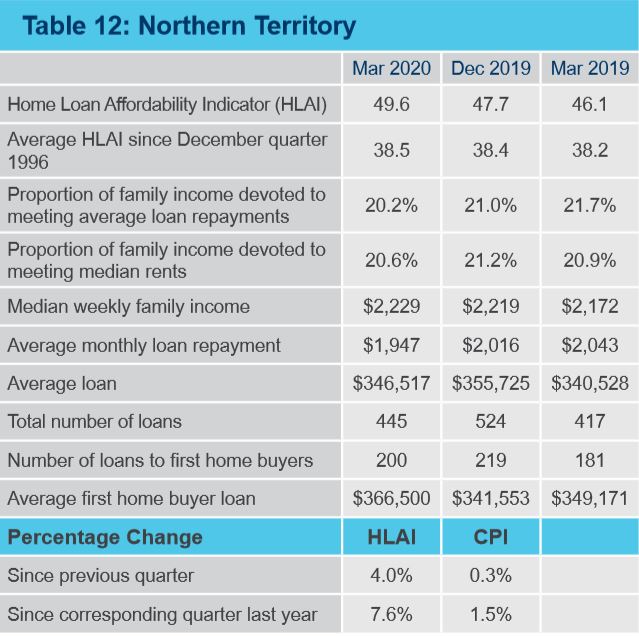

Northern Territory

- Housing affordability improved with the proportion of income required to meet loan repayments decreasing to 20.2 per cent

- Rental affordability improved with the proportion of income required to meet the median rent decreasing to 20.6 per cent

- The number of loans to first home buyers decreased to 200, a decrease of 8.7 per cent

- Of all Australian first home buyers over the quarter, 0.7 per cent were from the Northern Territory while the proportion of first home buyers in the Territory’s owner-occupier market was 44.9 per cent

- The average loan size to first home buyers increased to $366,500, an increase of 7.3 per cent over the quarter and an increase of 5 per cent compared to the March quarter 2019.

- The number of new loans decreased to 445, a decrease of 15.1 per cent over the quarter

- The average loan size decreased to $346,517, a decrease of 2.6 per cent over the quarter

Source: REIA

Australian Capital Territory

- Housing affordability improved with the proportion of income required to meet home loan repayments decreasing to 21.2 per cent

- Rental affordability declined with the proportion of income required to meet the median rent increasing to 19 per cent

- The number of loans to first home buyers decreased to 613, a decrease of 22.2 per cent

- Of all Australian first home buyers over the quarter, 2.3 per cent were from the Australian Capital Territory while the proportion of first home buyers in the Territory’s owner-occupier market was 32.6 per cent

- The average loan for first home buyers increased to $446,330, an increase of 4.8 per cent over the quarter and an increase of 14.8 per cent compared to the corresponding quarter 2019.

- The number of loans in the Australian Capital Territory decreased to 1,883, a decrease of 20.9 per cent over the quarter but an increase of 20.9 per cent compared to the March quarter 2019.

- The average loan size decreased to $458,471, a decrease of 3.8 per cent over the quarter but an increase of 6.8 per cent compared to the March quarter 2019.

Source: REIA

Similar to this:

Housing affordability improves while rental affordability declines: report

House price expectations become positive, yet housing affordability remains a big issue