Pay off your house in four years

Contact

Home ownership is the great Australian dream, but it’s also a ticket to financial success.

However, throughout my years in the industry, I’m struck by the number of agents who have an exterior display of ‘wealth’ yet continue to struggle with something as basic as owning their own home.

To that end, I’m going to share with you how I paid off my mortgage in less than four years, and how you can too.

How I paid off my home

I started in real estate when I was 20 years old with the goal of achieving financial freedom. I’d grown up poor with a single Mum who worked 3 jobs. I was determined to have a better life.

By age 27, I was doing well as an agent, but getting ahead on my personal wealth was tough.

I’d invested in property but was $2 million in debt to the bank with both my house and investment properties. My repayments were $10,000 a month after tax.

The problem was that while I was writing $700,000 GCI, $300,000 of that was going directly to the agency. From the portion left over, superannuation, personal marketing, running costs, my assistant’s wages, and tax were deducted, leaving me with only $180,000 a year - but $120,000 of that was being used to pay my loans!

That left just $5,000 a month for my own living expenses – a comfortable existence, but not enough to get ahead in life.

Then I had a revelation.

The magic formulae

Here’s what I did.

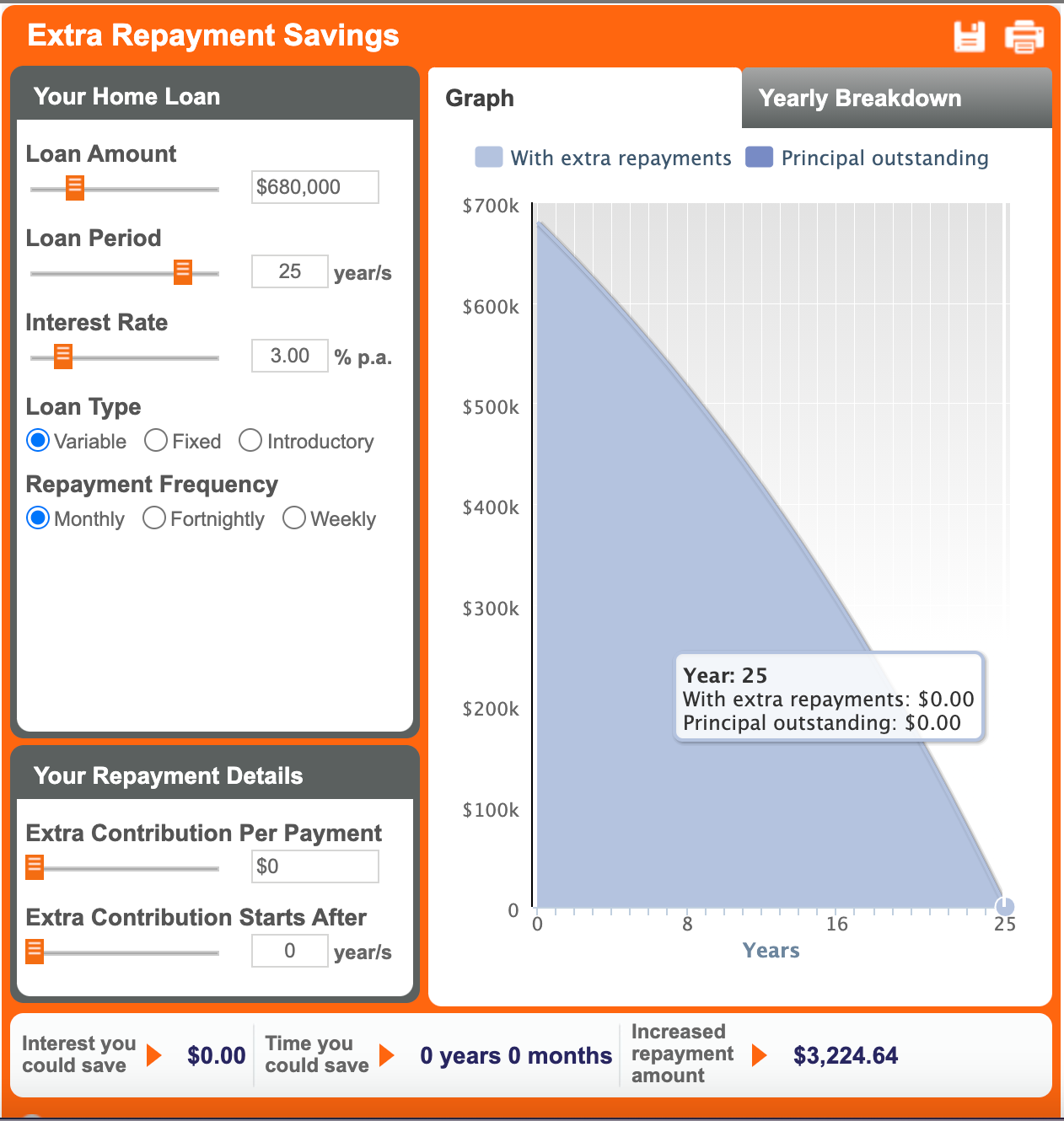

Say you have a 25-year loan of $680,000 with a variable interest rate of 3%.

Stick to your minimum repayment and it’ll obviously take 25 years to pay off your loan. In five years, you’ve only paid off $100,000, i.e. you’re paying down just $20,000 a year.

When I did this calculation, I was 27 years old. Suddenly I was staring down the barrel of not owning my own home until I was 52! That was not where I wanted to go in life. I wanted to own ten houses and relish the spoils of smart investing while I was still young enough to enjoy them.

So I decided to do something about it. I needed to contribute more towards the monthly repayments which meant I had to increase my income.

So I decided to cut out the ‘middle man’ agency that was taking such a large chunk of my commissions, and start working for myself.

A revelation

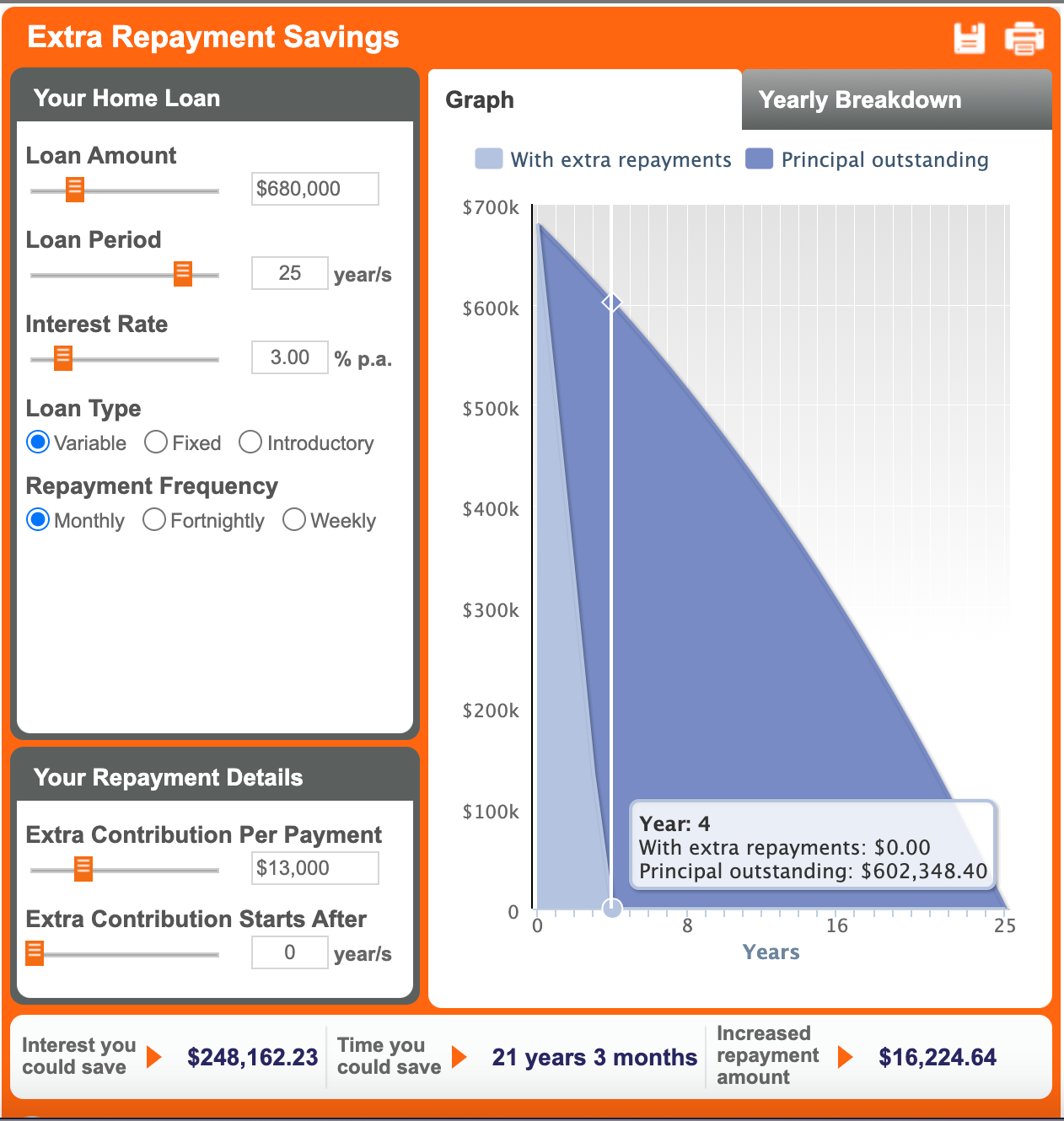

I continued to earn $700,000 GCI, and ran my business as efficiently as I could. As a result, I was around $13,000 per month better off. But instead of blowing that extra dough, I devoted it toward my mortgage.

Here’s what happened:

My home was paid off in less than four years.

There was another bonus. Because every single payment reduced the principal, my interest bill also plummeted, so I saved $248,000 in interest. That’s a bucket load of cash you get to reinvest.

And here’s the best thing. By working for myself and building my own brand, my GCI increased from $700,000 to $1.2 million. I was now able to devote $25,000 per month of this extra income to paying off my other properties. Then it was $30,000 extra and it kept rising– all in response to my rising income.

In fact, when I celebrated my business’s success by purchasing a beach house in Noosa, I was devoting $40,000 a month to my loans and paid off that coastal property in just two years.

Now your reality might be different to mine – I certainly am not providing individual financial advice in any way shape or form. However, I think you can see from my example, there is a path to financial freedom and property ownership for agents.

The first step to financial freedom

If you’re working for an agency and thinking, ‘That’s all well and good Dan, but where am I going to find an extra $13,000 a month?”, I believe you have two choices:

1 – Work twice, or three times, as hard in your current job, sacrificing your sanity, spare time, family life and social connections. It might be possible to get that extra income, but I guarantee you’ll risk burning out.

2 – Work smarter, not harder, by cutting out the middleman (agency business owner), and work for yourself. You get to keep more of your commission and make solid financial decisions that ensure an excellent future for you and your family.

The solution is simple. Don’t let fear hold you back because sure as shit, your boss isn’t going to pay off your home for you.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.