Rent Roll Multiples – 2022 Predictions

Contact

Rent Roll Multiples – 2022 Predictions

With the rigours of 2021 behind us and 2022 underway, already there are discussions as to what lies ahead for rent roll multiples and real estate businesses.

With the rigours of 2021 behind us and 2022 underway, already there are discussions as to what lies ahead for rent roll multiples and real estate businesses.

Given the rampant spread of Omicron across the country, will this impact the demand for rent rolls and increase the agency merger market?

Interestingly, these discussions started late last year and have gained traction over the past couple of weeks - with Omicron the immediate driving force of market sentiment.

The unknown, long term impact Omicron may have on the greater economy is at the crux of consumer confidence which may be impacted over the next two to three months.

Although we are early into the calendar year, enquiries have come in strong with a noted increase from principals enquiring to sell and others wishing to purchase.

The underlying fundamentals for residential rent roll values remain strong with no change expected for the foreseeable future.

Commercial portfolios with a balanced composition of industrial, retail and office assets under management, will continue to remain high on exceptionally thin supply. Those commercial portfolios with a heavy weighting to strip retail and or Tier 2 – 4 office managements will be less appealing to the market.

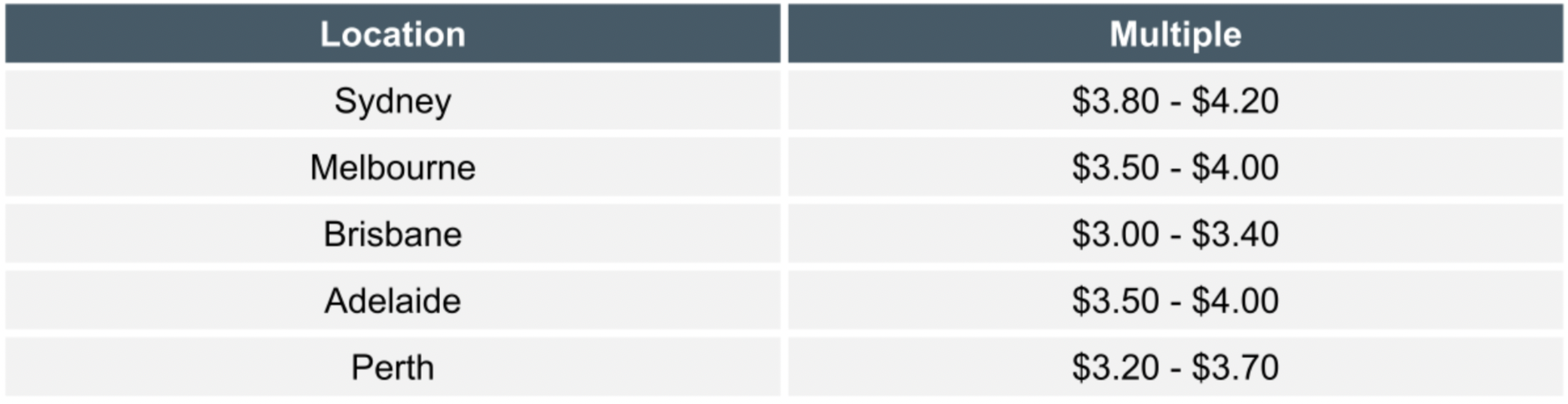

Residential Rent Roll Multiple Predictions (Tier 1)

There will always be some exceptions that fall outside of the above table, however these are where we expect each market to sit.

Tier 2 and Tier 3 portfolios will typically transact in a band between 5% - 15% below Tier 1 portfolios.

As people navigate their way through Omicron, it is predicted to have an impact on sales and rental markets, but not on the demand for portfolios.

This is the legacy from the last twelve to eighteen months where many portfolios experienced negative growth. Businesses continue to “bulk up” through acquisition and we expect this trend to continue for Tier 1 assets.

With Omicron we predict there to be greater risk analysis conducted by lenders as to portfolio performance particularly around increased natural churn of managements, which may remain high in many market segments.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

Similar to this:

Valuations confirm industry consolidation

What can go wrong when converting management authorities – A case study