Valuer General releases study on impact of bushfires on land value

Contact

Valuer General releases study on impact of bushfires on land value

The latest report on the impact of recent bushfire events on land values has been released by the NSW Valuer General, Dr David Parker.

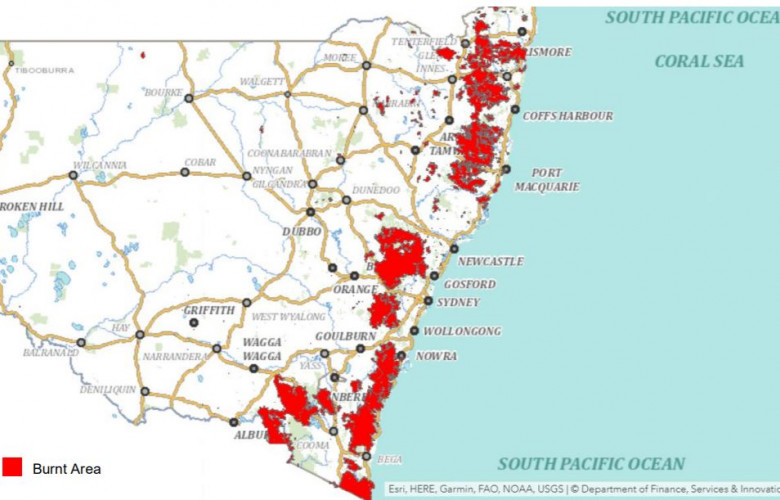

The NSW Valuer General, Dr David Parker, has released a study on the impact of past bushfire events on land values following the recent bushfire crisis that affected large areas of NSW.

“The study reviewed a number of past bushfire events across the state and compared sales of property that had occurred before and after the fires,” said Dr Parker.

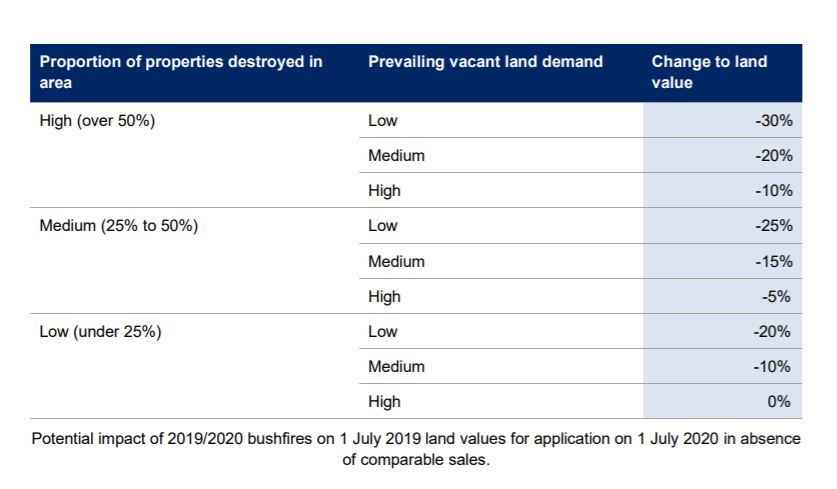

“The study found the impact of bushfires on land values varied depending on the location of properties in a bushfire affected area, the proportion of properties damaged, and the prevailing level of demand for land in that locality.”

At a Glance:

- Impact of bushfires on land values varied depneding on the location of properties in the bushfires

- Impact varied from where few properties are lost to a 30 per cent decrease in land value with high property loss

- The study reviewed past bushfire events and compared sales of property before and after the fires

The impact varied from no change for areas with few properties lost and a high level of demand to a 30 per cent decrease in land value for areas with high property loss and low

demand for land.

Dr Parker said land values for all land in NSW are determined annually.

Source: Valuer General

“Property sales are generally the most important factor considered by valuers when determining land values," said Dr Parker.

“In the absence of sufficient sales evidence following the most recent bushfires, the study will assist valuers in determining the 1 July 2020 land values for bushfire affected properties.”

Land values determined by the Valuer General are used annually by Revenue NSW for land tax and at least once every three years by local councils for rating purposes.

The 1 July 2019 land values were issued to both Revenue NSW and local councils.

These values were determined prior to the recent bushfires.

“Many communities have been devastated by the bushfires and people have suffered property damage, lost homes, businesses and farm buildings," said Dr Parker.

“To support communities affected by the recent bushfires, I am offering councils the opportunity to receive 1 July 2020 land values for rating which will reflect the impact of the fires”.

A copy of the study is available here.

Similar to this:

WA land holders feel pain of state gov's land tax hike

What to do if you don't agree with your land tax valuation

Fears new land tax reforms will cripple South Australian market