Financial comfort at record high despite pandemic

Contact

Financial comfort at record high despite pandemic

ME Bank's Household Financial Comfort Report has unearthed some surprising results in the middle of tumultous times.

In a surprise twist, the flood of government stimulus combined with financial actions of households in response to the COVID-19 pandemic has pushed the nation’s household financial comfort to a near record high, according to the latest report from ME Bank.

The question has to be asked, however, what will happen if government support is tapered too much and too soon?

These are the key findings of ME Bank’s Household Financial Comfort Report, a bi-annual survey which quantifies how comfortable Australian households feel about their financial situation.

At a Glance:

- 22 per cent of owner/occupiers expect their dwelling prices to rise during 2020/21 in comparison to 47 per cent of households in December 2019

- Expectations vary significantly across major capital cities, with occupiers in Sydney less pessimistic than Adelaide, Brisbane and Melbourne

- Perth owner-occupiers are highly pessimistic, with 40 per cent expecting lower prices in comparison to Sydney, Melbourne and Brisbane expecting a fall of 22 per cent, 29 per cent and 27 per cent

- Investors are more optimist about dwelling prices than six months ago, 26 per cent now expect the value of their investment property to rise in the next twelve months

- Across households, those most worried about debt include 51 per cent of those paying off a mortgage compared to 21 per cent of households that own their home

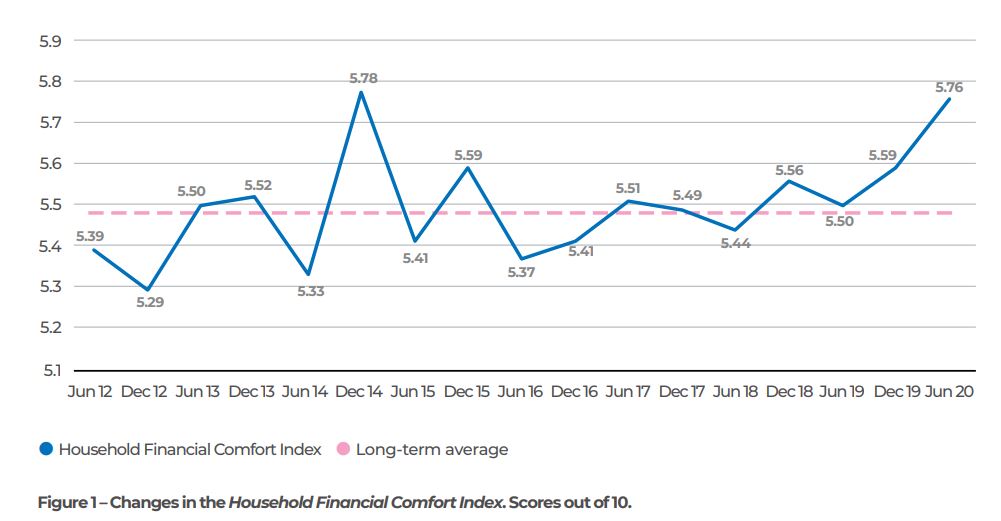

ME’s 18th survey showed Australian household financial comfort increased 3 per cent to 5.76 (out of 10) in the past six months to June 2020 − just shy of its historical high of 5.78 recorded in December 2014.

Contrary to expectations, financial comfort has jumped the most among typically struggling cohorts – such as casual workers, the unemployed, low income households and single parent households (though their comfort levels remain a great deal lower than the average household and higher-income Australians).

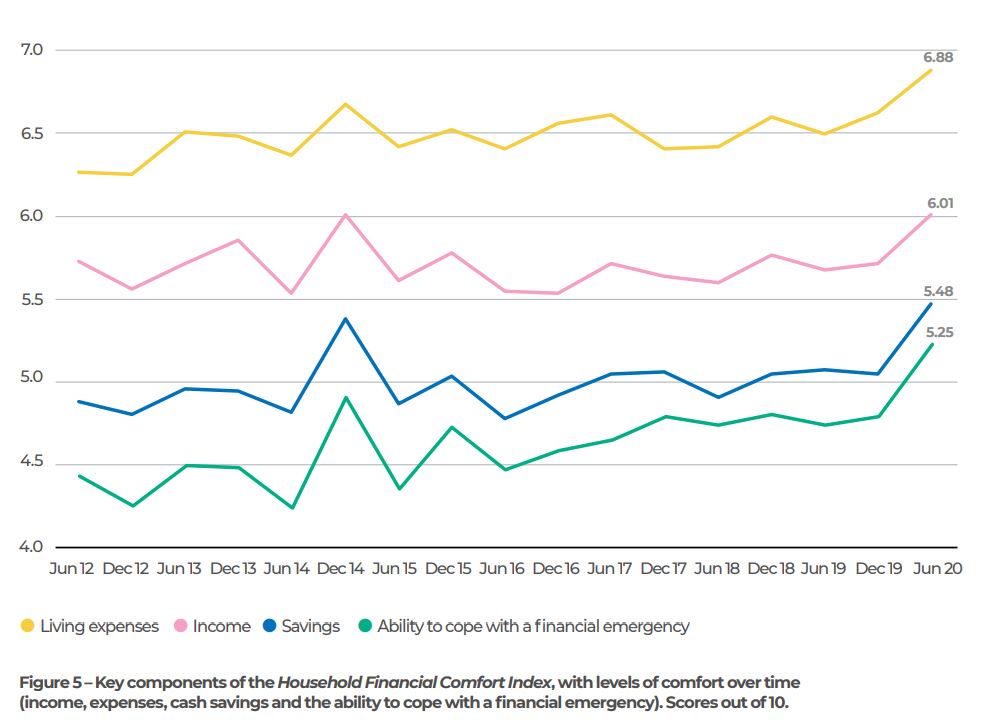

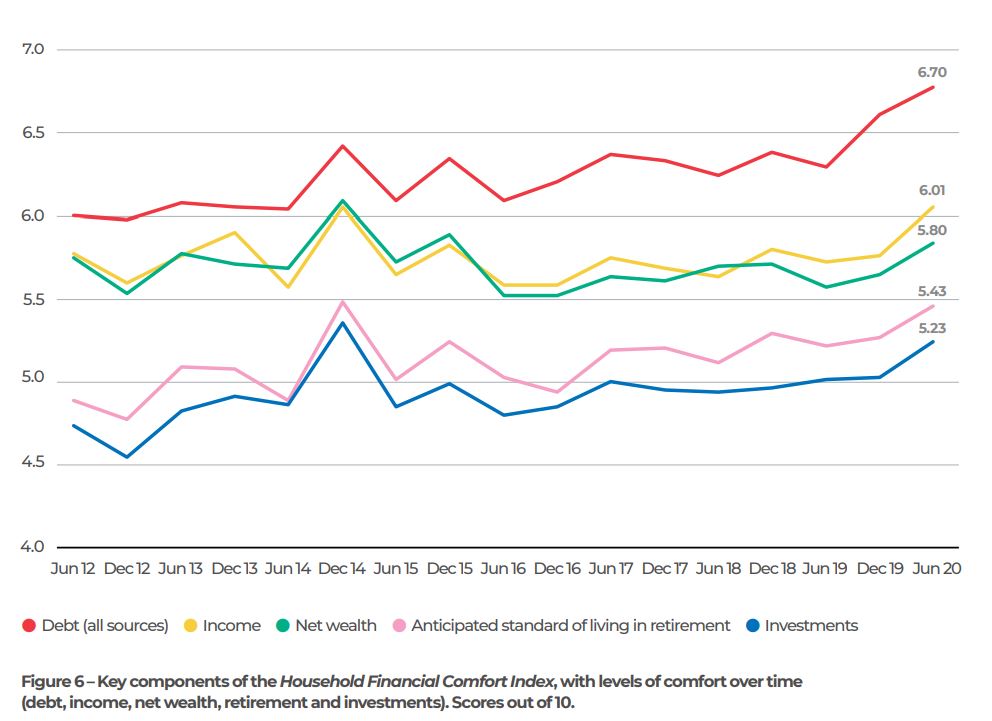

Almost all 11 measures that make up the Household Financial Comfort Index improved, notably ‘comfort with the ability to cope with a financial emergency’ (up 9 per cent to 5.25, the best level on record) and ‘cash savings’ (up 8 per cent to 5.48).

ME Bank’s Consulting Economist, Jeff Oughton, attributed the high financial comfort to a combination of prudent financial actions by households in response to the both the health and economic crisis, and unprecedented government support.

“Fear of COVID-19 and a very weak labour market triggered many households to increase precautionary savings, reduce spending, draw on long-term savings, such as superannuation, and delay bills or loan repayments,” said Mr Oughton.

“In June, 57 per cent of households ‘spent less than they earned each month’ – up 8 percentage points to the highest level of households saving since the survey began nine years ago.

"However, paradoxically, this cautious behaviour and a lack of spending may cause a negative knock-on effect to the economy and a deeper recession.

“Government stimulus has bought some time and helped boost the financial resilience of Australian households for now.

"But a household savings cliff remains as government support tapers.

"Unless the economy gains momentum, tapering government support too soon could have disastrous consequences on the financial comfort of households.”

Savings cliff and high underemployment point to households still on the brink in June, only 32 per cent of households indicated they could ‘maintain their lifestyle for more than three months if they lost their income’.

Many households were already under pressure before COVID-19, particularly with low household income growth and cost of living concerns.

Around 21per cent of households have less than $1,000 in savings (on average, about $300 – significantly lower than the current JobSeeker fortnightly payment).

Of these households, only 3 per cent reported they could maintain their current lifestyle for more than six months if they lost their incomes, and only 7 per cent for more than three

months (or when JobSeeker payments begin to taper).

A record number of workers reported that it would be ‘difficult to find a new job in two months if they become unemployed’ − up 10 points to a new survey record of 59 per cent.

Notably almost 30 per cent indicated it would be ‘very difficult’.

Furthermore, the proportion of part-time or casual workers seeking more hours jumped to 39 per cent, compared to 27 per cent six months ago.

On average, these workers would like an extra 18 hours per week, compared to 17 in December 2019.

“Financial comfort levels are up for now, but many households are on the cliff’s edge," said Mr Oughton.

"They’ve lost income, their jobs and entire livelihoods, their wafer-thin savings buffer is dwindling, and government support is the main action stopping them from falling over.

“This survey shows that the financial consequences for households of this pandemic remain critical.

Many eyes will be on what governments do in the final months of 2020 and into next year.”

Prior to government income payments and other available assistance and their own financial actions, around 34 per cent of households reported to be ‘worse off’ from the pandemic, compared to 20 per cent ‘better off’, while 46 per cent reported ‘the same’ comfort despite the pandemic.

More Victorians reported to be ‘a lot worse off’ (11 per cent) - the highest of any state or territory and fewer ‘a lot better off’ (5 per cent) than other states.

Households were also asked the main reasons for a worsening or improved financial situation.

Households experiencing a ‘worsening financial situation’ cited ‘changes to employment arrangements and job security’ (33 per cent), ‘changes to income’ (24 per cent), and for the first time, ‘the impact of COVID-19’ (24 per cent).

However, 8 per cent of households specified ‘support from government’ as a reason for an improved financial situation, compared to only 1 percent in December 2019.

Households were also asked what assistance and actions they adopted in response to the pandemic.

Almost 40 per cent of households have benefited from at least one or more of these major government payments and other assistance and/or taken their own financial actions in response to the pandemic.

By June:

- Around 1 in 5 households tapped into one or both Federal government payment supports − specifically, JobKeeper (12 per cent) and JobSeeker (9 per cent). Across generations, Gen Z was the largest recipient of JobSeeker (20 per cent) and the second largest of beneficiary of JobKeeper (14 per cent) behind Gen X (18 per cent).

- 12 per cent dipped into their existing savings – rising to 27 per cent among Gen Z.

- 8 per cent accessed up to $10,000 of their superannuation – rising to 30 per cent among Gen Z (around three times more than Gen Y and Gen X).

Key winners and losers in ME’s 18th Household Financial Comfort Report:

Winners:

- Single parents – greatest increase in financial comfort across households (up 13 per cent to 5.04)

- Households with ‘low comfort’ – record high comfort (up 9 per cent to a still very low 3.49)

- Households with low savings (<$1,000) or low annual income (<$40,000) – comfort increased by 19 per cent to 4.19 and 18 per cent to 5.15, respectively

- Unemployed – comfort increased by 30 per cent to 5.17

- South Australian households – comfort hit a new high and sits above the largest states (up 13 per cent to 5.90)

- Baby Boomers, Gen Z and Gen Y – largest rises in comfort across generations.

Losers:

- Households with average ($75,000 to $100,000) and high (>$100,000) annual incomes – comfort decreased by 4 per cent and 2 per cent to 5.67 and 6.37, respectively

- Gen X – the lowest level of financial comfort of the generations, unchanged at 5.35

- Victorian households – comfort fell by 3 per cent to 5.64

- Part-time employed – comfort fell by 6 per cent to 5.56.

The full copy of ME’s 18th Household Financial Comfort Report can be found here.

Similar to this:

Household financial comfort slides across regional Australia