Peppermint Grove, Perth, Australia's least affordable suburb: Bankwest First Time Buyer Report

Contact

Peppermint Grove, Perth, Australia's least affordable suburb: Bankwest First Time Buyer Report

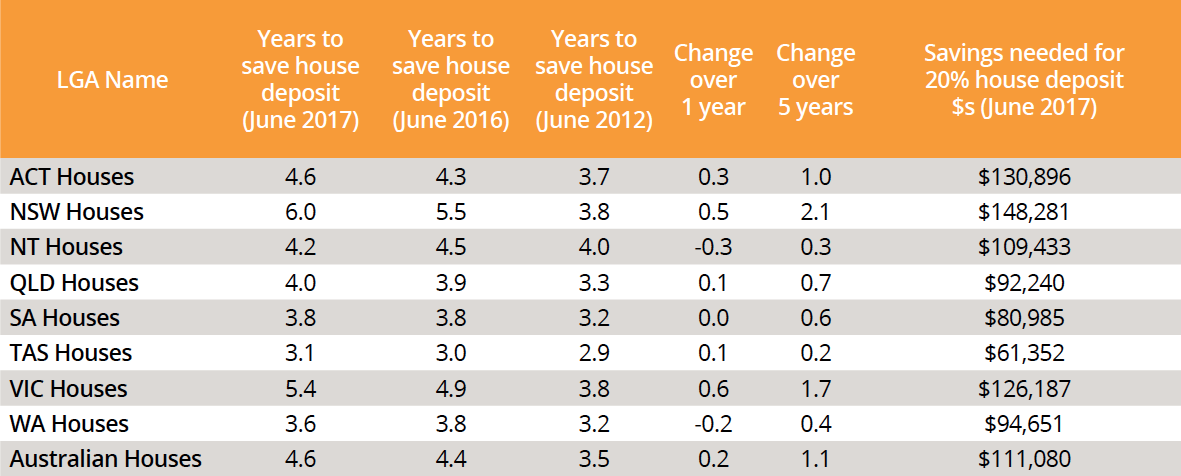

The average Australian will have to save for 4.6 years to save enough for a 20 per cent deposit on a median-priced home, according to Bankwest's First Time Buyer Report.

The average Australian will have to save for 4.6 years to save enough for a 20 per cent deposit on a median-priced home, according to Bankwest's First Time Buyer Report.

It is the longest period recorded since Bankwest began compiling the report nine years ago, and up three months on last year's result.

While New South Wales is the least affordable state, Victoria saw the largest year-on-year rise in saving time, with an increase of seven months to 5.4 years.

First time buyers made up 13.7 per cent of total properties purchased in the year to June 2017, up marginally from 13.4 per cent in 2016.

First-time buyer deposit trends by state / territory

* Saving time for 2017 and 2016 has been modelled using CoreLogic Valuation Model, 2012 saving times modelled using Residex Valuation Model.

Source: Bankwest First Time Buyer Report.

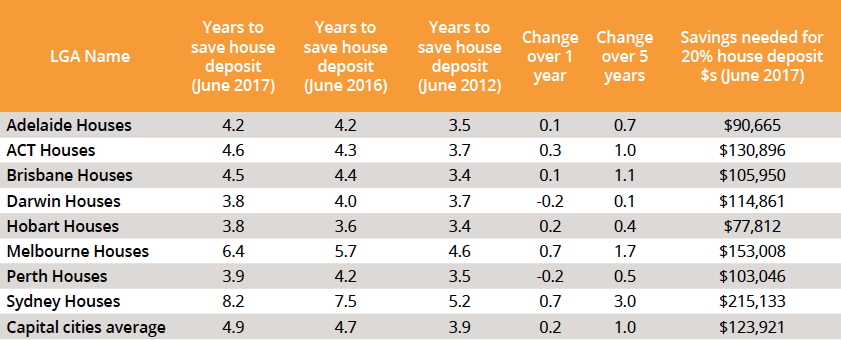

Sydney the nation's least affordable capital city, Peppermint Grove the least affordable suburb

Not surprisingly, it takes 8.2 years in save for a deposit in Sydney, the longest period of any capital city.

The most affordable capitals are Hobart and Darwin, where it takes 3.8 years to save for a deposit, the equal shortest in the country.

First time buyer deposit trends in capital cities

* Saving time for 2017 and 2016 has been modelled using CoreLogic Valuation Model, 2012 saving times modelled using Residex Valuation Model.

Source: Bankwest First Time Buyer Report.

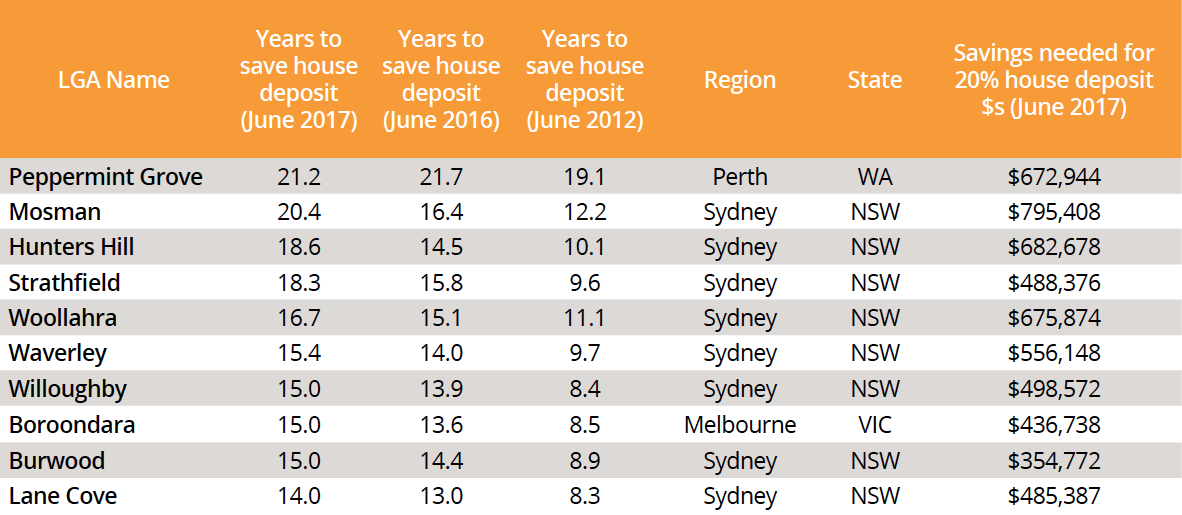

Peppermint Grove in Australia's least affordable suburb, with all other cities in the top 10 being in Sydney, except Boroondara in Melbourne.

Top 10 Australian LGAs where it takes the most time to save for a deposit

* Saving time for 2017 and 2016 has been modelled using CoreLogic Valuation Model, 2012 saving times modelled using Residex Valuation Model.

Source: Bankwest First Time Buyer Report.

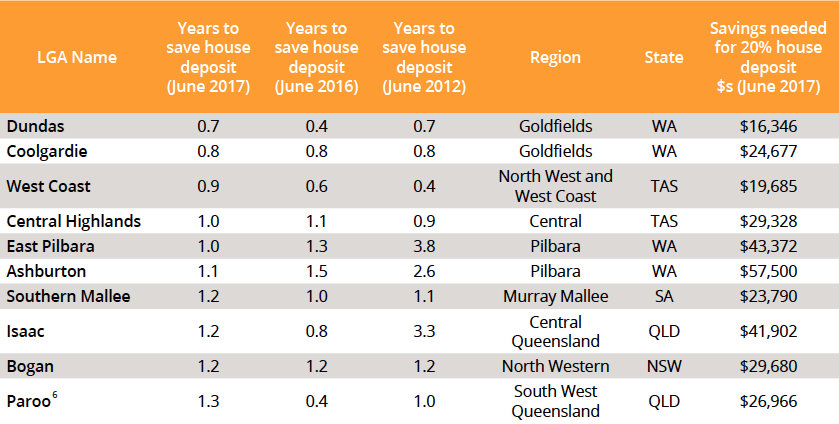

Australia's most affordable property is in Dundas, WA

Top 10 Australian LGAs where it takes the least time to save a house deposit

* Saving time for 2017 and 2016 has been modelled using CoreLogic Valuation Model, 2012 saving times modelled using Residex Valuation Model.

Source: Bankwest First Time Buyer Report.

The Bankwest First Time Buyer Report

The Bankwest First Time Buyer Report tracks the time it would take first time buyers to save a 20 per cent deposit for a home in 421 local government areas across Australia. The report uses data for local income and house price data, and data from the First Home Owners Grant, where available.

The deposit saving time is calculated on the basis of a first time buyer couple setting aside 20 per cent of their combined pre-tax income each year, and depositing it into an online savings account which accrues interest.

The report shows that despite increases in housing supply and softening markets in some areas, affordability isn't improving as property prices keep rising and wages growth remains slow.

Read more about housing affordability in Australia:

Affordability is improving, and first-home buyers are back in the market