Houses, units, townhouses or villas: can deductions be a guide?

Contact

Houses, units, townhouses or villas: can deductions be a guide?

Investors often ask, "Which type of property will earn me greater deductions?"

Choosing the right type of investment property is often not an easy task for investors. There is much to consider including location, proximity to local services and facilities, employment drivers, and historical growth of the area.

Investors must also decide on the type of property to add to their portfolio based on their budget and the expected rental yield that can be obtained once the property has been purchased and rented.

Finally, they must consider the deductible expenses involved, such as property management fees, rates, interest, repairs, maintenance and depreciation. These expenses are all tax deductible. By claiming these deductions investors can make owning a new property more feasible and put themselves in a far better position to handle loan repayments and reduce loan liabilities.

When making property selections, often the question ‘which type of property will earn me greater deductions?’ is asked about depreciation. This can be quite difficult to answer, as there are a range of factors which affect how depreciation is calculated.

Firstly, depreciation deductions are split into two parts. Investors can claim deductions for the structure of the building (capital works) and for the assets (plant and equipment depreciation) contained within the property.

When looking at the deductions available for the structure of the building, there are some factors investors should be aware of when considering the purchase of an investment property.

Firstly the construction date of the property will affect the deductions found. The Australian Taxation Office (ATO) allows investors to claim capital works deductions for residential properties in which construction commenced after the 15th of September 1987 at rate of 2.5 per cent per year for forty years, regardless of the type of residential property that is purchased.

This doesn’t necessarily mean those who choose older properties won’t be eligible for capital works deductions. If any renovations have been completed to a property constructed prior to 1987 within dates legislated and enforced by the ATO, the owner may still be eligible for capital works deductions for these structural additions, even if they were made by a previous owner of the property.

When comparing depreciation deductions found for houses, units, townhouses and villas, the size of the property is a factor which will also affect capital works deductions. Many investors might think that because a house is likely to have more floor space, the depreciation deductions will be higher, but this isn’t necessarily the case. Often the amount of infrastructure involved in the construction of a residential unit compared to a house will impact depreciation deductions.

Unit, apartment and townhouse owners are also entitled to claim deductions for areas shared between the premises. This means that the construction of pool areas, lifts and stairwells may become a factor in working out both the capital works and plant equipment deductions available for the owners.

Depreciable plant and equipment assets in particular can have a significant impact on the deductions found for any type of property. These assets are not restricted by date, rather their individual quality. Investors are entitled to claim these assets based on an individual effective life set by the ATO. Items such as carpets, dishwashers, air-conditioning units and even less obvious items like door closers and garbage bins can be claimed by the owners of all property types.

Unit, apartment, townhouse and villa owners may also be able to claim depreciation deductions for shared plant and equipment assets such as pool chairs, pool pumps and gym equipment.

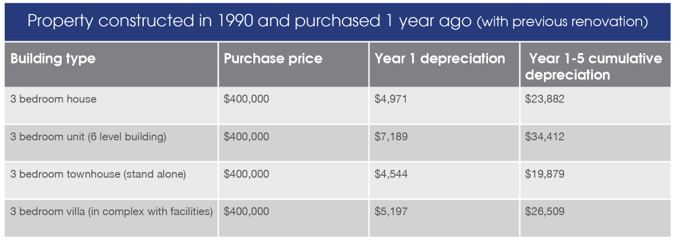

To demonstrate, let’s look at the depreciation deductions found for three bedroom properties constructed at various dates for houses, units and townhouses located in New South Wales (see tables above).

As you can see the deductions found for all property types vary. The deductions found for an older property constructed in 1990 are lower than a property constructed in 2012. However, there are still substantial deductions available in the first year and over the first five years of ownership for those who chose the older property. In the example, all four properties constructed in the 1990’s had since had some renovations, which also influenced the deductions that could be found for their owner.

When looking at three bedroom units and villas within a complex, depreciation deductions are slightly higher than a house or a stand alone townhouse which do not include any common property areas. The additional infrastructure involved in constructing a six level building is also a factor influencing the deductions found for three bedroom unit owners.

The variations in deductions found for the properties in this table outline the importance of seeking expert advice. Without speaking to an experienced Quantity Surveyor prior to purchase of an investment property, investors won’t have a full picture of their after tax position once they have invested.

Quantity Surveyors are recognised by the ATO under Tax Ruling 97/25 as one of a select group of professionals qualified to estimate construction costs for depreciation purposes. A depreciation estimate prior to purchase can make investment decisions clearer for property investors.

It is also important to ask a specialist Quantity Surveyor to complete a tax depreciation schedule immediately on settlement of the property. To provide the schedule, a Quantity Surveyor should always visit the property to perform a site inspection to establish the precise number of plant and equipment items on the property and take measurements, photos and notes to maximise deductions.

They will also correctly determine the share of common property the owner is entitled to claim based on factors such as the units size and its position within a development from the building plans.

See also:

Mistakes costing property investors thousands

Add value and increase deductions with an alfresco area

The deductions property investors often throw away