Sydney one of 5 cities to buck global slowdown in super-prime (US$10m+) residential sales - Knight Frank

Contact

Sydney one of 5 cities to buck global slowdown in super-prime (US$10m+) residential sales - Knight Frank

Sydney is one of five cities to buck a global super-prime slowdown, with the city seeing a rise in sales volumes for properties of US$10 million-plus over the third quarter of this year compared to Q3 2022, according to the latest Knight Frank research.

Sydney is one of five cities to buck a global super-prime slowdown, with the city seeing a rise in sales volumes for properties of US$10 million-plus over the third quarter of this year compared to Q3 2022, according to the latest Knight Frank research.

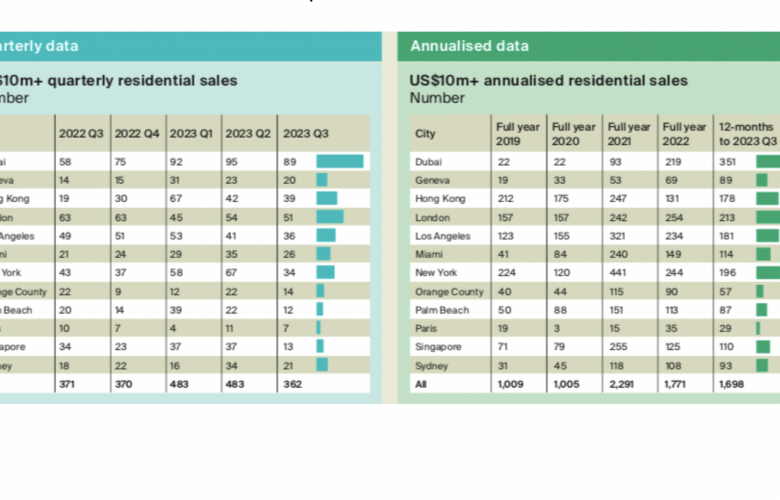

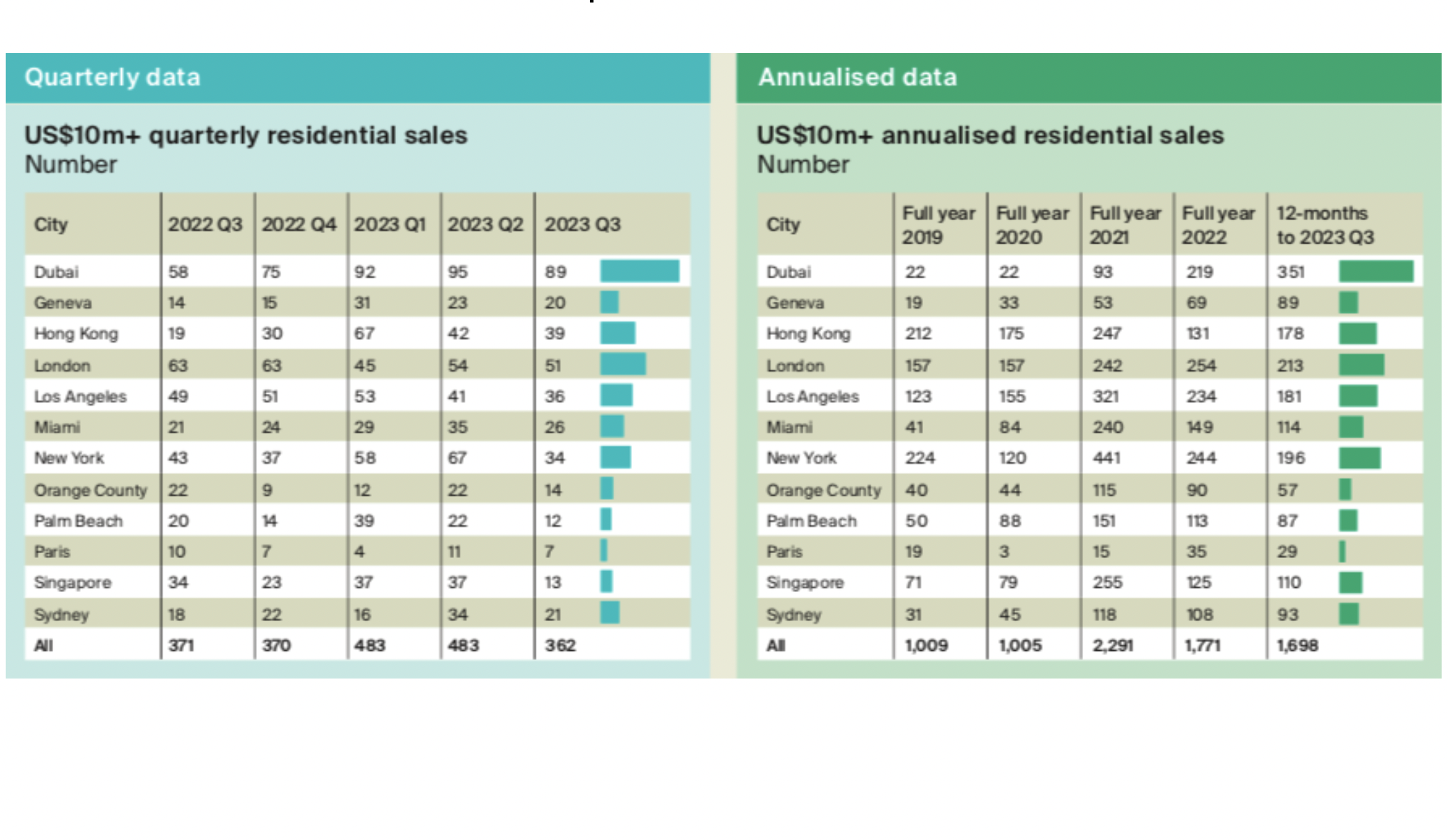

Knight Frank’s Global Super-Prime Intelligence Q3 2023 report found global super-prime ($10m+) residential sales fell 2.4% in Q3 2023 on a year-on-year basis, with 362 sales across the 12 markets covered in the three months to September compared to 371 in the same period last year.

However, five markets saw volumes rise through Q3 on a year-on-year basis, with Sydney, Hong Kong, Dubai, Geneva and Miami seeing more sales in Q3 this year against Q3 2022.

Sydney recorded 21 super-prime sales in Q3 2023 compared to 18 in Q3 2022. The aggregate value of sales in Q3 2023 was US$354 million compared to US$248 million in Q3 2022.

The sales volume and aggregate value for super-prime sales in Sydney fell, however, from Q2 2023 to Q3 2023, with the sales volume declining from 34 to 21 and the aggregate value falling from US$686 million to US$354 million.

The sales volume in Q2 2023 was the highest volume of luxury home sales for Sydney since Q4 2021 when 56 super-prime sales were recorded.

Knight Frank Head of Residential Research Michelle Ciesielski said based on the first three quarters of the year, 2023 was on track to surpass 2022 on an annual basis for the aggregate value and total number of super-prime sales in Sydney.

“This year to the end of Q3 Sydney has seen 71 super-prime sales with no signs of slowing, while for 2022 as a whole Sydney had 108 super-prime sales,” she said.

“In addition, aggregate values for Sydney super-prime transactions to the end of Q3 this year are already sitting at US$1,300 million compared to US$1,738 million.

“In 2023, 54% of Sydney’s super-prime sales were recorded in the Eastern Suburbs, a significantly lower share than recorded a decade ago when this prime region accounted for 80% of all super-prime sales.

“The North Shore, meanwhile, rose from a 13% share 10 years ago to 31% in 2023, whilst the CBD and Inner Sydney share has seen only modest growth from 7% to 8%; despite several new luxury apartments built over this time.

“Overall, the total number of established super-prime apartment sales across the prime regions of Sydney have increased from 13% in 2013, to 17% in 2023.”

Knight Frank Head of Residential Erin van Tuil said prestige homes had become a safe haven from global headwinds, with buyer demand strong in Sydney.

“Buyer appetite is strong, but existing super-prime homes continue to be tightly held and supply from new builds will always be limited given the scarcity of well-positioned sites on the harbour,” she said.

“Increasingly more apartment sales in Sydney have been reaching super-prime status over the past few years than we have seen ever before in our harbour city.

“In the past, it was mostly a prestige home on a large parcel of land transacting at this price point and a handful of penthouse apartments with stunning water views.

“Going forward, there will be an increasing focus by developers delivering super-prime residential projects from the ground floor to the rooftop.

“Each time our ultra-wealthy population return from an overseas travel, we find a growing number seeking the ease of apartment living with exceptional amenities which allows for privacy, security and lateral living, plus a lock-up-and-leave option for their next trip.

Knight Frank’s Global Super-Prime Intelligence Q3 2023 report found Dubai once again led the ranking of quarterly sales, a position it has held since Q4 2022. London follows in second position, with Hong Kong sitting in third place.

Related reading:

Sydney tops list of Australian cities for luxury residential property price growth - Knight Frank

Sydney records the biggest quarterly increase in $US10+ sales over Q2 - Knight Frank

Sydney waterfront property commands the highest premium globally - Knight Frank