When will house prices be back to peak?

Contact

When will house prices be back to peak?

We’re now consistently seeing house price growth across every Australian capital city. Like every downturn, we’ve seen prices fall far less than what’s generally predicted. Housing markets almost always surprise with strength on the upside and see far less robust declines when the market turns, says Nerida Conisbee, Ray White Chief Economist.

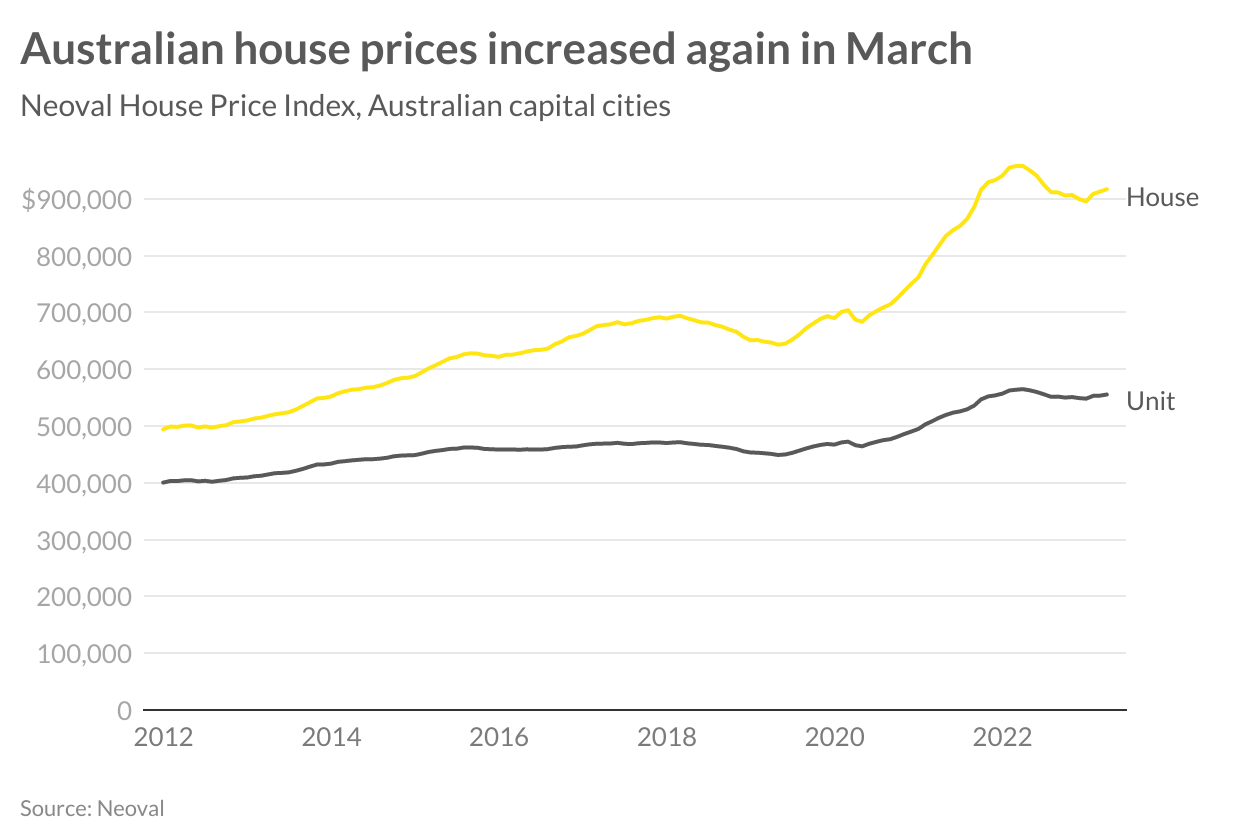

We’re now consistently seeing house price growth across every Australian capital city. Like every downturn, we’ve seen prices fall far less than what’s generally predicted. Housing markets almost always surprise with strength on the upside and see far less robust declines when the market turns. It’s certainly the case this cycle with peak to trough decline of Australian capital city house prices of 6.5 per cent, compared to COVID-19 driven price growth of 36 per cent. Leading the way are the cities that saw the biggest falls last year. Sydney’s prices fell by 11.8 per cent last year but have increased 4.1 per cent since December. Melbourne dropped by nine per cent but is now up three per cent.

House prices have now been rising for three consecutive months, suggesting that this is more than just a one off change in market conditions. Given the complexity of property markets, the increase is not unexpected. Rents are now rising at their fastest pace ever recorded, driven by an imbalance in supply and demand. This imbalance is now flowing through to house prices. There’s a shortage of properties for sale, as well as a shortage of new homes being built. At the same time, population growth is back to pre-pandemic levels. It may be more expensive and difficult to get finance but this is being offset by not enough homes.

The shortage of homes will not be fixed quickly. With prices recovering, we’re likely to see the number of homes for sale increase but the number of new homes remain constrained. A report recently released by the National Housing and Finance Investment Corporation (NHFIC) has calculated that Australia will have a shortage of 100,000 homes over the next four years. Ensuring adequate housing supply is the most effective way to ensure housing affordability, both for renters and buyers. Prices and rents are unlikely to drop again any time soon.

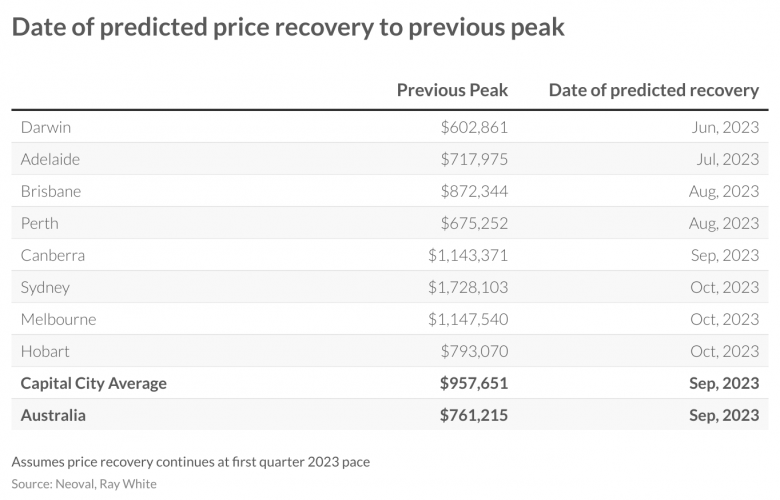

If prices continue to rise at their current levels, when can we expect them to be back to their 2022 peak? Assuming that the rate of price growth continues as it has over the past three months, Australian median house prices will be back to where they were at the peak of 2022 in September 2023. The cities that are expected to get back to peak quicker are Darwin and Adelaide. Sydney, Melbourne and Hobart are expected to take a bit longer but would still hit that level in October 2023.

However, these dates could change. We’re likely now at the peak of interest rates and if they start to come down this year, this will accelerate price growth, particularly in cities like Melbourne and Sydney. More negatively, if unemployment starts to rise, this could slow the pace of change.

By Nerida Conisbee, Ray White Chief Economist.

Related Reading:

Auction clearance rate hits highest level since May last year

John McGrath – Price growth strongest in rural markets

Just 660 capital city homes taken to auction over Easter - CoreLogic