Sales of super-prime properties with tennis courts spike in 2020 due to COVID-19 lifestyle changes

Contact

Sales of super-prime properties with tennis courts spike in 2020 due to COVID-19 lifestyle changes

Knight Frank has released its first Australian Residential Tennis Court Premium report. The research found sales of super-prime properties with tennis courts spiked in 2020 during COVID-19, with $682.8m transacting across 38 sales, up 230% on a weak 2019.

Knight Frank has released its first Australian Residential Tennis Court Premium report. The research found sales of super-prime properties with tennis courts spiked in 2020 during COVID-19, with $682.8m transacting across 38 sales, up 230% on a weak 2019, when there were just 14 sales. These properties commanded a price 22% higher, on average, than super-prime properties without tennis courts.

Super prime properties with tennis courts are tightly held, rarely transacting across Australia, but according to the latest research from Knight Frank these sales spiked in 2020.

The Australian Residential Tennis Court Premium, which assesses the sales performance of Australian super-prime residential properties with a tennis court, found the volume of sales for these properties in 2020 far outstripped 2019.

Knight Frank Report at a Glance:

- Knight Frank has released its first Australian Residential Tennis Court Premium report

- The research found sales of super-prime properties with tennis courts spiked in 2020 during COVID-19, with $682.8m transacting across 38 sales, up 230% on a weak 2019,when there were just 14 sales

- Sydney was the strongest performing market with $436.6m in sales, followed by Melbourne ($134.6m), the Gold Coast ($50m), Perth ($41.5m) and Brisbane ($20.1m)

- Nearly a quarter - 23% - of super-prime residential sales last year were properties with a tennis court

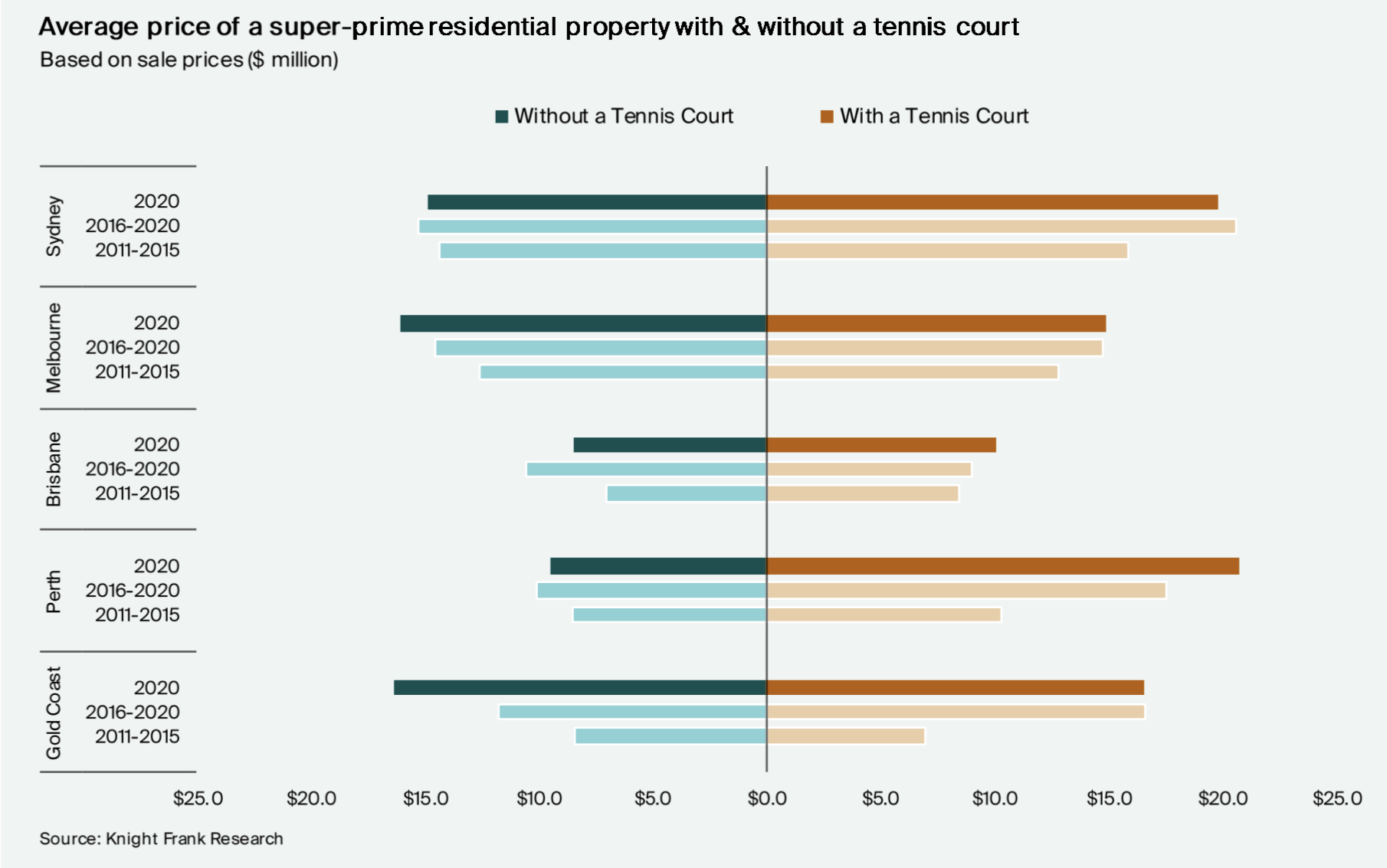

- These properties commanded a price 22% higher on average than super-prime properties without tennis courts, with the average price rising by 1.6% to $18 million in 2020

- Across Australia’s major cities of Sydney, Melbourne, Brisbane, Perth and the Gold Coast, the total value of transactions of super-prime residential sales with tennis courts was $682.8 million in 2020 across 38 transactions, up by 230% on a weak 2019, when there were just 14 transactions.

- Super-prime residential property* is the most desirable and most expensive property in a given location, generally defined as the top 1% of each market by value.

Knight Frank’s Head of Residential Research, Michelle Ciesielski said every Australian city analysed had overtaken the 2019 sales volume in 2020, with Sydney the strongest performing market.

“In 2020, Sydney saw $436.6 million of tennis court-featured super-prime sales across 22 transactions, although this total volume fell short by 3 per cent of surpassing its highest volume reached in 2018.

"Melbourne was next with $134.6 million worth of sales last year across nine transactions, although its greatest volume was recorded in 2016 at $156.2 million.

“Perth’s super-prime sales market recorded the greatest uptick of 453 per cent in properties with tennis courts over 2020, although that was across only two sales totalling $41.5 million, with the market much smaller than Sydney and Melbourne. Perth didn’t record any sales of this nature in 2016 and 2018.

“The Gold Coast lifestyle became more popular through COVID-19 resulting in last year being the only year in the past give to register any super-prime sales accommodating tennis courts, with a volume of $50 million – outperforming both the Brisbane and Perth markets, which recorded $20.1 million and $41.5 million in sales value.”

Based on sales since 2011, the top three suburbs in Australia for super-prime properties with tennis courts were Toorak in Melbourne (39 sales), Bellevue Hill in Sydney (23 sales) and Vaucluse and Mosman, which came equal third with 16 sales.

Knight Frank’s National Head of Residential, Shayne Harris said tennis court properties became much more sought after in 2020 following COVID-19, with people forced to stay at home for long periods of time.

“Australians transformed the way they lived in 2020 due to COVID-19, with the role of the home expanding to become a place of work, education and vacation due to periodic lockdowns during the pandemic,” he said.

“Our research conducted a few months into the pandemic found 66 per cent of global residential buyers listed outdoor space as the top factor to be considered when choosing a home, and we have seen a corresponding rise in interest in super-prime properties with tennis courts.

“Sales numbers for tennis court super-prime properties grew three-fold in 2020 from the 14 sales in 2019 and are still significantly higher than 2018, when there were 25 sales in total and 2017 and 2016, which each had 24 sales.

“When considering the super-prime residential markets across the major cities of Australia, access to private and secure tennis courts have provided unrivalled lifestyle, particularly over the past year.

“During the pandemic we have also seen a rise in social tennis, with people wanting to get outdoors and enjoy a non-contact sport.

“This demand saw tennis coaches become heavily booked out, and a significant trend emerged where players were opting for private tuition on their own court at home.”

The Knight Frank research found nearly a quarter - 23% - of super-prime residential sales last year were properties with a tennis court.

These properties commanded a price 22% higher, on average, than super-prime properties without tennis courts, with the average price rising by 1.6% to $18 million in 2020.

Melbourne had the highest share of sales of super-prime properties with a tennis court in 2020, with 56% of super-prime properties with a tennis court being sold. Brisbane was close behind at 50%, followed by Perth (40%) and the Gold Coast (33%).

In Sydney, super-prime land with enough space for a tennis court is limited, but this city saw a record 17% share of super-prime sales with a tennis court in 2020.

Sydney has dominated the distribution of the tennis court property sales over the past nine years, comprising 51% of the total number of sales from 2011 to 2020, followed by Melbourne (36%), Brisbane (7%), Perth (4%) and the Gold Coast (2%).

Of the super-prime properties with a tennis court sold in 2020, 94% also had a swimming pool and 11% were located on the waterfront with direct access to maritime facilities.

Across Australia’s major cities, the average land area for a super-prime property with an outdoor tennis court was 2,870 sqm, based on sales occurring between 2011 and 2020.

This compares to the average land area of 1,510 sqm for an Australian super-prime property without a tennis court.

Definition by Knight Frank:

*Super-Prime (luxury) residential property as defined by Knight Frank – This is the most desirable and most expensive property in a given location, generally defined as the top 1% of each market by value. In Sydney and Melbourne, these reported sales have a threshold of AU$10 million. Brisbane, Perth and the Gold Coast sales are captured above AU$7 million.

Click here to view and download the report.

Similar to this: