National dwelling values stabilise - CoreLogic

Contact

National dwelling values stabilise - CoreLogic

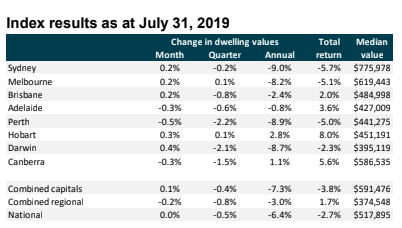

The primary drivers for the turnaround in housing market performance were Sydney and Melbourne, where values have ticked higher over the past two months, taking values 0.3% off their floor in Sydney and 0.4% higher in Melbourne.

The housing conditions are stabilising following improvements in credit availability and lower mortgage rates, with national dwelling values flat over the month, supported by a subtle rise across most of the capital cities, according to the CoreLogic July 2019 home value index results.

“Our national dwelling value index may have found a floor in July, with dwelling values holding firm over the month following a consistent trend towards

smaller month-on-month declines through the first half of the year," said CoreLogic head of research, Tim Lawless. "Since peaking, the national index is down 8.3%.

“The stabilisation in housing values is becoming more broadly based, with five of the eight capital cities recording a subtle rise in values over the month, while the regional areas of South Australia, Tasmania and Northern Territory also recorded a lift in housing values in July,” he said.

At a glance:

- The housing conditions are stabilising following improvements in credit availability and lower mortgage rates, with national dwelling values flat over the month, supported by a subtle rise across most of the capital cities, according to the CoreLogic July 2019 home value index results.

- The primary drivers for the turnaround in housing market performance were Australia’s two largest cities, Sydney and Melbourne, where values have ticked higher over the past two months, taking values 0.3% off their floor in Sydney and 0.4% higher in Melbourne.

- While most regions of the country are recording relatively subdued rental growth, the only cities where rents are lower over the past twelve months are Sydney (-2.4%) and Darwin (-4.0%). The strongest rental conditions are in Hobart, with a 5.5% increase over the past twelve months.

According to Mr Lawless, a number of factors are supporting the turnaround in housing conditions, however lower mortgage rates, improved access to credit, a boost in housing market confidence post the federal election and recent tax cuts are likely the primary drivers.

Other factors include improvements in housing affordability and a reduction in advertised supply levels.

“All of which is creating a stronger selling position for vendors,” said Mr Lawless.

Source: CoreLogic.

The improved housing market conditions have lifted the annual rate of change to -6.4% nationally, with the annual rate of decline across the combined capitals index easing from a recent low of -8.4% to - 7.3%, while the combined regional markets are recording an annual rate of decline of -3.0%.

The drivers for the turnaround in housing market performance were Sydney and Melbourne, where values have ticked higher over the past two months, taking values 0.3% off their floor in Sydney and 0.4% higher in Melbourne.

The 0.2% lift in Brisbane values was the first month-on-month rise since November last year.

Mr Lawless said, “Despite an unprecedented amount of new apartment stock entering the market, Sydney and Melbourne unit values have consistently outperformed the detached housing sector through the downturn, and this trend is continuing into the recovery phase.”

Sydney house values remain -0.2% lower over the past three months, while unit values have shown a slight rise (+0.02%). In Melbourne, house values were down -0.3% over the most recent three month period while unit values are 1.1% higher.

The stronger performance across the unit sector may be attributable to ongoing affordability challenges in Sydney and Melbourne which, according to Mr Lawless, could be driving demand towards the medium to high-density sector.

Source: CoreLogic.

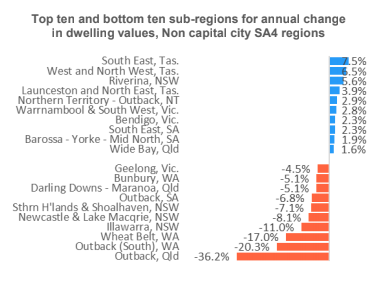

Although housing values have stabilised over the month across most markets, on an annual basis only three of the forty-six capital city, sub-regions have recorded a rise in values. While Hobart and Canberra top the list of best performers, areas of Brisbane and Adelaide comprise the remaining top ten best performing sub-regions over the past twelve months, although seven of the top ten have recorded a decline over this period.

The weakest sub-regions, based on the annual change in dwelling values, are confined to areas of Sydney, Melbourne, and Perth. As Sydney and Melbourne values level out and Perth values continue to trend lower, sub-regions of Perth are once again starting to comprise a larger portion of the top ten list for the largest annual fall in dwelling values.

Growth conditions across regional markets remain diverse, with the highest annual capital gains recorded across the south east and the west/north west sub-regions of Tasmania. NSW’s Riverina region is also continuing to show solid capital gains.

The weakest regional markets tend to be the broader outback and agricultural regions of Queensland, Western Australia, and South Australia, where drought conditions are weighing down housing activity and dwelling values.

Source: CoreLogic.

The regions surrounding the Sydney metro area have also recorded larger value falls over the past twelve months. With Sydney values now stabilising we might see a similar but lagged trend in these satellite markets as well.

The CoreLogic stratified hedonic index highlights the most expensive quarter of the housing market is leading the recovery trend. Across the combined capital cities, upper quartile housing values were down -0.2% over the three months ending July, while lower quartile values were down a larger -0.8% over the same period.

Mr Lawless said, “The stronger result across the upper quartile partly reflects the fact that Sydney and Melbourne housing values are more expensive relative to other cities, but also that the middle to upper end of the Sydney and Melbourne housing markets are showing the stronger trajectory in housing values after recording deeper declines during the down phase.

“With borrowing capacities recently increasing as a result of lower mortgage rates, and a reduced serviceability floor, existing owners may increasingly be looking to upgrade into more expensive homes.

“Despite value declines across the board, more expensive housing stock has generally recorded greater declines which may be offering home owners the opportunity to upgrade into a more expensive property despite the recent value declines.”

The only other capital city to be showing a stronger performance across the upper quartile of housing values is Perth, where top quartile values were -2.1% lower over the past three months while lower quartile values were down a more substantial -2.8%.”

Nationally, rents were down -0.1% over the month to be only 0.6% higher over the past twelve months.

While most regions of the country are recording relatively subdued rental growth, the only cities where rents are lower over the past twelve months are Sydney (-2.4%) and Darwin (-4.0%). The strongest rental conditions are in Hobart, with a 5.5% increase over the past twelve months.

Related reading: High yields central to appeal of Geelong’s Ritz development

With housing values stabilising and rents recording a slight fall, it looks like the yield recovery cycle has stalled. Capital city yields have nudged lower over the past two months, dropping from a recent peak of 3.88% in May to 3.84% in July.

Sydney remains the lowest yielding market, with gross rental yields tracking at 3.43%, down from a recent peak of 3.51% two months ago.

“The July home value index results provide further confirmation that the housing market has reacted positively to the recent stimulus of lower mortgage rates and improved credit availability, however, the response to-date has been relatively mild,” Mr Lawless said,

Source: CoreLogic.

Although the trend towards recovery in housing values is relatively fresh and centered within the largest cities, Mr Lawless said, “there is no sign of a ‘v-shaped’ recovery.”

Despite an improvement in credit availability, he said, “housing credit policies remain much tougher than they were prior to the Royal Commission as lenders continue to move away from the Household Expenditure Measure (HEM) and examine borrower spending behaviors and expenses more closely.”

“Also, lenders now have the benefit of comprehensive credit reporting whereby borrower debt profiles are more transparent, providing lenders with the ability to assess creditworthiness in more detail.”

“The ongoing tightness in housing credit is expected to keep a rapid rebound in housing values at bay, despite the lowest mortgage rates since the 1950’s.”

Source: CoreLogic.

Read the full CoreLogic July 2019 home value index report here.

Similar to this:

Residential construction costs outpace inflation - CoreLogic

CoreLogic Mapping the Market Report indicates decline in affordable housing "much less severe"

Home sales stabilising, with Adelaide market trending above decade average - CoreLogic