CoreLogic Mapping the Market Report indicates decline in affordable housing "much less severe"

Contact

CoreLogic Mapping the Market Report indicates decline in affordable housing "much less severe"

CoreLogic head of research Cameron Kusher said the geographical context of the housing market provides a relevant perspective on the performance of the housing market and the spatial distribution of housing values.

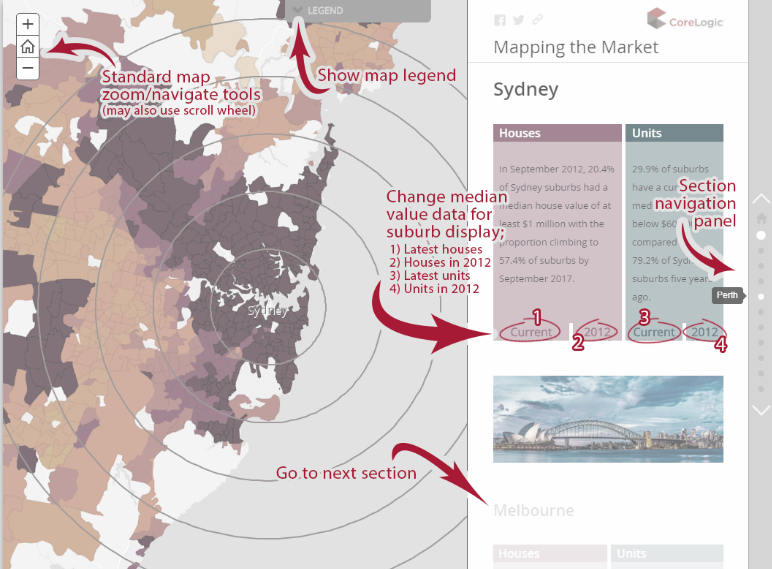

The new CoreLogic Mapping the Market Report is a geographical compilation of housing market values that highlight the deterioration in affordable housing over the past five years, particularly within Sydney and Melbourne.

Commenting on the report, CoreLogic head of research Cameron Kusher said, “While topical headline trends are important, the geographical context of the housing market provides an equally relevant perspective on the performance of the housing market and the spatial distribution of housing values.”

Late in 2017 dwelling values started to fall, with the declines most pronounced across higher-value housing stock. This may result in some reduction in suburbs with a median value above $1 million over the coming year.

At a glance:

- The new CoreLogic Mapping the Market Report is a geographical compilation of housing market values that highlight the deterioration in affordable housing over the past five years, particularly within Sydney and Melbourne.

- A key finding from the analysis by Mr Kusher, indicates that outside of Sydney and Melbourne, housing has become a little more expensive, however, he noted that the magnitude of the decline in more affordable housing has been much less severe.

- In Sydney, 10.6 per cent of suburbs had a median value of more $2 million in June 2019 compared to 3.2 per cent of suburbs in June 2014. While in Melbourne in June 2014, 41.7 per cent of suburbs had a median house value of less than $500,000 compared to 6.9 per cent by the end of June 2019.

Mr Kusher said, “Despite the recent fall in values across most cities, at a suburb level values typically remain higher than they were five years ago. There are of course exceptions in markets such as Perth and Darwin where dwelling values have been falling throughout the five year period.”

A key finding from the analysis by Mr Kusher, indicates that outside of Sydney and Melbourne, housing has become a little more expensive, however, he noted that the magnitude of the decline in more affordable housing has been much less severe.

In Sydney, 10.6 per cent of suburbs had a median value of more $2 million in June 2019 compared to 3.2 per cent of suburbs in June 2014. While in Melbourne in June 2014, 41.7 per cent of suburbs had a median house value of less than $500,000 compared to 6.9 per cent by the end of June 2019.

Click here to read the CoreLogic Mapping the Market Report.

The report also highlighted that in Sydney, 31.4 per cent of Sydney suburbs currently have a median unit value below $500,000 compared to 53.1 per cent of suburbs five years earlier. And in Melbourne, the share of suburbs with a median unit value of more than $500,000 has increased to 57.2 per cent in June 2019 from 25.3 per cent in June 2014.

In Brisbane, the share of suburbs with median house value under $500,000 has shrunk from 52.4 per cent in June 2014 to 40.3 per cent in June 2019. When looking at units, 12.5 per cent of Brisbane suburbs have a current median unit value in excess of $500,000 compared to 8.0 per cent of suburbs in June 2014.

In Adelaide, at the end of June 2019, 93.7 per cent of Adelaide suburbs had a median house value of less than $1 million compared to 97.7% of suburbs five years earlier. Additionally, as at June 2014, 26.0 per cent of Adelaide suburbs had a median unit value of less than $250,000 compared to 21.5 per cent in June 2019.

Source: CoreLogic

In Perth, as of June 2014, 15.0 per cent of Perth suburbs had a median house value of more than $1 million with the share rising slightly to 10.3 per cent by June 2019. The share of Perth suburbs with a median unit value of less than $250,000 increased from 15.8 per cent in June 2014 to 25.9 per cent in June 2019.

Hobart has also experienced growth, with the share of suburbs with a median house value of more than $500,000 increased from 8.8 per cent in June 2014 to 50.4 per cent in June 2019. In June 2014, 46.2 per cent of Hobart suburbs had a median unit value of less than $250,000 and by June 2019 that figure had fallen to 9.7 per cent.

Similarly in Darwin, in June 2014, 30.5 per cent of suburbs had a median house value of less than $500,000 compared to a greater 65.9 per cent as at June 2019. At the end of June 2019, 6.6 per cent of Darwin suburbs had a median value of more than $500,000 compared to 14.8 per cent five years earlier.

The share of Canberra suburbs with a median house value of more than $1 million increased from 6.7 per cent in June 2014 to 11.4 per cent in June 2019. As at June 2019, 70.5 per cent of Canberra suburbs had a median unit value under $500,000 compared to 87.6 per cent five years earlier.

Similar to this:

Home sales stabilising, with Adelaide market trending above decade average - CoreLogic

How robotics can help improve customer experience - CoreLogic

Housing downturn loses some steam with CoreLogic House Value Index down 0.6% in March