ArchiStar.ai survey offers property developer industry snapshot

Contact

ArchiStar.ai survey offers property developer industry snapshot

Property intelligence platform ArchiStar.ai has identified the top three challenges for the property development industry based on market survey conducted last week.

Last week ArchiStar.ai conducted a comprehensive market survey with the aim of sharing the key trends, challenges and forecasts associated with acquiring development sites.

Developers and other development property professionals were asked to give their view on the current market.

The top three industry challenges are published below and ranked from most challenging to least challenging.

Challenge #1: Finding feasible projects with realistic vendor price expectations

According to the survey, the single biggest challenge facing Australian property developers is actually finding feasible sites that stack up.

Many developers claimed to have found great development sites, but with the recent downturn in the eastern seaboard property market, said they were finding it hard to have reasonable vendor pricing expectations.

Click here to find out more about how ArchiStar.ai can help you analyse your next development

What they said:

“Unrealistic vendors and agents that will tell the vendor what they want to hear to ensure they list the property.”

“There are more and more developers who need to unload – the problem is they bought in the peak of the cycle so they are unrealistic on price.”

“Unrealistic price expectations from vendors. They have not come to terms with the fact that when the resale market drops 20 per cent, develop site values drop by approximately 50 per cent – that’s just how feasibilities work”

“The biggest challenge is the landowners expectation of land value, which often stymies a potentially fantastic opportunity, as the feasibility doesn’t stack up.”

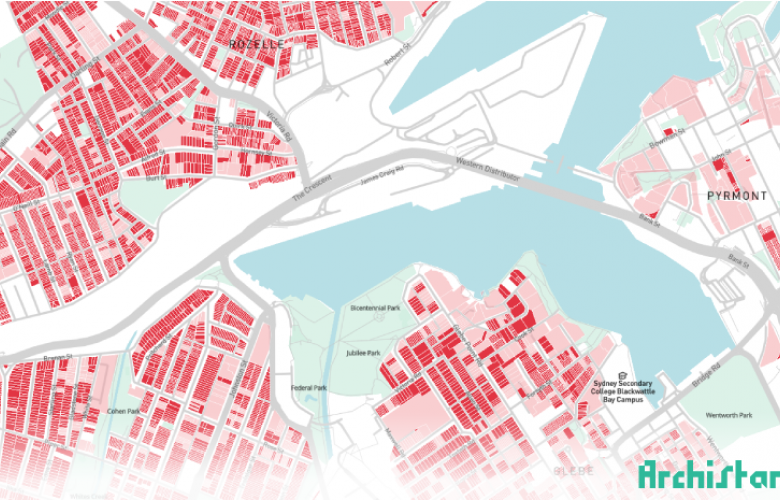

Related Reading: How ArchiStar is helping property professionals find residential development hot spots

“Due to the property boom land owners have unrealistic price expectations which would leave the development with very little profit margin.”

“Finding properties with development approval at the right price. There are a lot of properties out there but the prices are as if we have already built on them.”

Some smaller developers conveyed that actually finding the opportunities itself was the hardest part.

What they said:

“To identify the sites which have the potential to develop.”

“Trying to find a place that can be developed into four townhouses and with a healthy profit margin.”

“Struggling to widen the network of site finders who are willing to work with a small developer looking for smaller size projects.”

“Being able to search with very specific criteria. No sites offer that functionality. It's like using a hammer to build ships inside glass bottles.”

“Prices are becoming unaffordable in the areas I operate in and bigger developers who have the capacity to land bank are buying and holding.”

Challenge #2: Running speedy and accurate feasibilities

A close second major challenge was being able to run quick and accurate feasibilities.

Many developers have a lot of potential sites come across their desk, but it takes significant time to assess each site.

It can be particularly challenging for small developers without large analyst teams.

Another common challenge in this category involved finding accurate current market, sales and construction cost data.

Developers said listing and sold prices were often out of date and median prices didn’t reflect the premium that new dwellings command, while others complained about having to go to many different websites and disparate information sources.

Click here to see how ArchiStar.ai can help you Find development opportunities. In minutes

What they said:

“Running feasibility studies tend to take lots of my time. By the time I have completed my feasibility that place has been bought by another developer.”

“Acquiring accurate costings for project builds, having tight feasos, knowing how to value land/property where no known data/up-to-date data is available”

“Compiling all the info into one place, not having to bounce between 5 sites and 5 screens. Having complicated documentation and key indicators, quickly at my disposal. Layers that have state and local draft planning, over lays that identify state housing and news articles on the local area.”

“Quickly and easily obtaining current and relevant information relating to property details”

“Finding sales data of development sites. Property platforms in many cases does not save the sales data of the site acquisition. The listed sales prices will be the ones of subdivided units or blocks of land.”

“Insufficient Information on the local markets — information that focuses on the suburb/catchment etc.”

“Using realistic revenue figures to assess the residual land value which drive the go/no go decisions.”

Challenge 3: Hard to get bank construction finance

A combination of the property market downturn, the royal commission and general pessimism have made it harder to secure bank construction finance.

Many developers have turned to private financiers, family offices and mezzanine lenders.

What they said:

“Bank's tightening on construction lending.”

“Increased hurdle rate in valuation is bringing the residual land value down. And developers can risk making too high an offer.”

“Finance availability, purchasers for off-the-plan.”

This is a sponsored post

Similar to this:

How ArchiStar is helping property professionals find residential development hot spots

Introducing the ‘next generation of RP Data’: our latest proptech innovation