APRA talks mortgage risk with securitisation industry

Contact

APRA talks mortgage risk with securitisation industry

APRA is turning its attention to how lenders estimate living expenses and assess total debt.

In a speech at the Australian Securitisation Forum in Sydney yesterday, APRA chairman Wayne Byres outlined the regulator's new focus on how lenders estimate living expenses and how they assess borrowers' debt.

APRA said it would like to see lenders pay more attention to gathering better estimates of borrowers' living expenses, he said.

"From APRA’s perspective, we would like to see the industry devote more effort to the collection of realistic living expense estimates from borrowers and give greater thought to the appropriate use and construct of benchmarks in instances where those estimates are deemed insufficient," said Byres.

Byres said APRA is also examining how to improve lenders' assessments of total debt.

In Australia, Byres said, "other financial commitments remain something of a blind spot for lenders".

Byres said that the government’s recent introduction of mandatory comprehensive credit reporting, beginning from next year, will improve the quality of credit assessments.

Related content: New rules mean lenders see 'positive data' when assessing loans

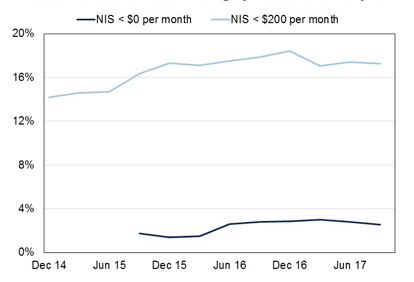

Byres said APRA is paying close attention to the level of loans with a low 'net income surplus' - the lender’s assessment of the surplus income borrowers would have left over after taking into account living expenses, debt repayments, and adding some buffers.

Lenders must be able to ensure the borrowers "are not unduly exposed if their circumstances were to change", he said.

"The upward trend in low NIS lending appears to have moderated over the past few quarters," said Byres.

Share of new lending by net income surplus

Source: APRA.

Byres said there has only been a "slight moderation" in the proportion of borrowers getting loans that are more than six times their income.

"As a rule of thumb, an LTI of six times will require a borrower to commit 50 per cent of their net income to repayments if interest rates returned to their long term average of a little more than 7 per cent," he said.

"High LTI lending in Australia is well north of what has been permitted in other jurisdictions grappling with high house prices and low interest rates, such as the UK and Ireland."

Byres also flagged the risks associated with higher numbers of loans being generated by non-bank lenders.

The trend could be "concentrating risk in the parts of the system that are less transparent or receive less regulatory scrutiny", he said.

With housing loans representing more than 60 per cent of lending in the Australian banking sector, the regulator is keen to strengthen measures to restrict loans to investors amid fears of real estate bubble conditions in Sydney, Melbourne, and parts of Brisbane.

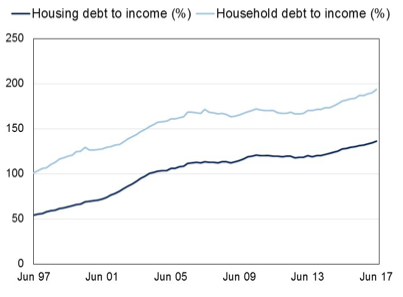

Byres said Australia's high level of indebtedness has been drawn out by a long period of low interest rates, weak wages growth, and high property prices.

Household debt to income

Source: APRA.

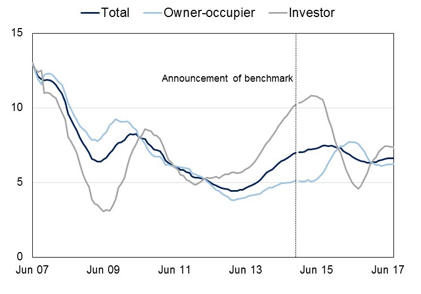

Byres said that APRA's measures to curtail lending to investors has been largely successful.

"It is clear that the strong growth in lending to investors has been curtailed," he said.

Housing credit growth (%pa)

Source: APRA.

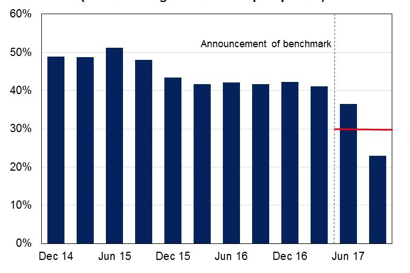

APRA's introduction of a 30 per cent limit on new interest-only loans had also been effective.

Authorised Deposit-Taking Institutions new interest only loans (% of housing loans funded per quarter)

Source: APRA.

Byres said that APRA's ongoing prudence of lending practices is still required.

"It is easy to run up debt, but far harder to pay it back down when circumstances change."

"As with the desirability of a flourishing securitisation market in Australia, I am sure that is another issue on which APRA and the ASF would wholeheartedly agree," he concluded.

Click here to read Wayne Byres speech 'Housing - The importance of solid foundations'.

Read more about APRA:

New rules mean lenders see 'positive data' when assessing loans