CBRE’s Residential Valuations National Survey elicited responses from 190 residential valuers - this is what they said

Contact

CBRE’s Residential Valuations National Survey elicited responses from 190 residential valuers - this is what they said

New CBRE survey highlights the country’s most in demand residential real estate and key city-based trends - Perth, Sydney and Adelaide tipped to record Australia’s strongest high price growth.

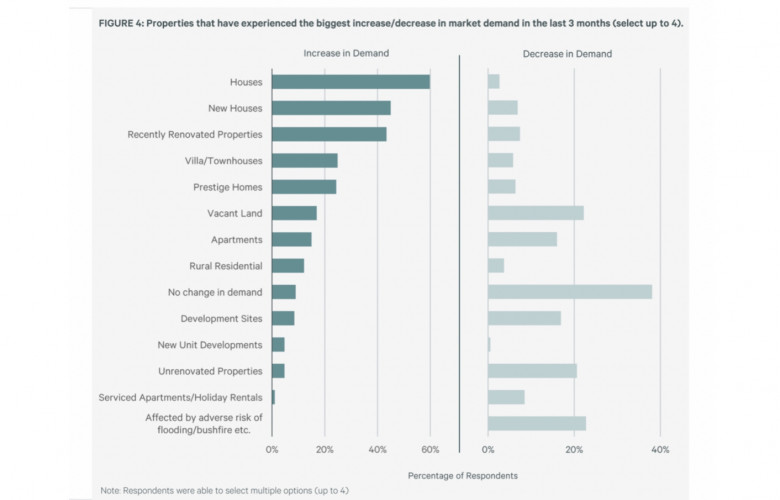

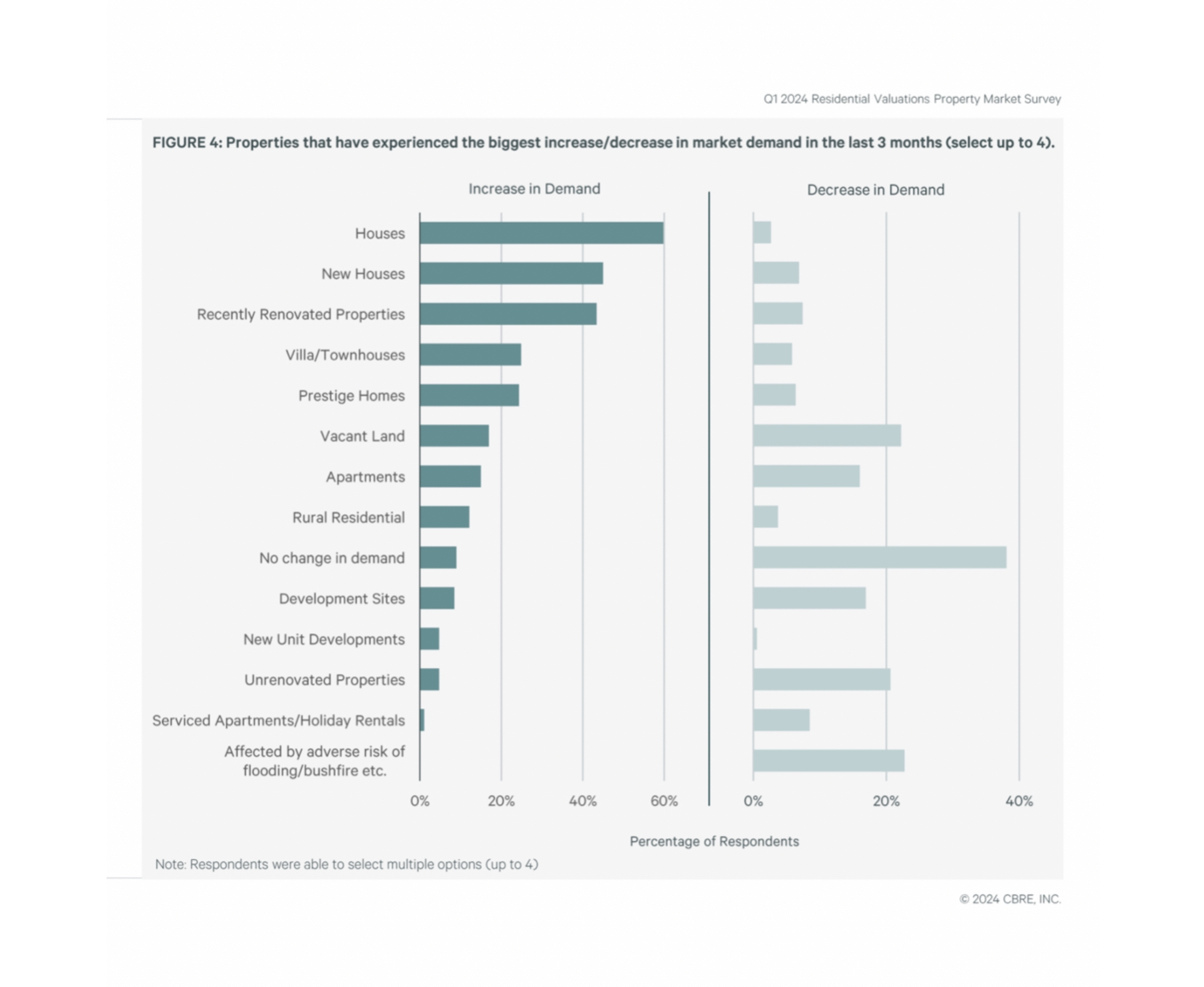

New CBRE survey highlights the country’s most in demand residential real estate and key city-based trends. Houses and recently renovated properties are the most in demand residential real estate in Australia according to a new CBRE survey, as softer conditions prevail for unrenovated properties and development sites.

CBRE’s inaugural Quarterly Residential Valuations Property Market survey elicited responses from 190 of CBRE’s residential valuers across the country – providing a pulse check on current activity and future expectations.

On the demand front, six times as many valuers - or 49% of the respondents - reported strong to very strong purchaser demand in their local markets over the past three months relative to those reporting soft or very limited demand.

Demand was found to be particularly strong in Perth, Adelaide and Brisbane, as these cities continue to benefit from affordability and lifestyle drivers. In contrast, softer demand is evident in the ACT, Regional Victoria and Melbourne.

In another key finding, 78% of the respondents said they expect house values to increase over the next 12 months, with the highest growth expected in Perth, Sydney and Adelaide.

More than 40% of those surveyed expect an increase of up to 5%, more than 30% expect 5-10% and just under 20% expect house values to remain stable.

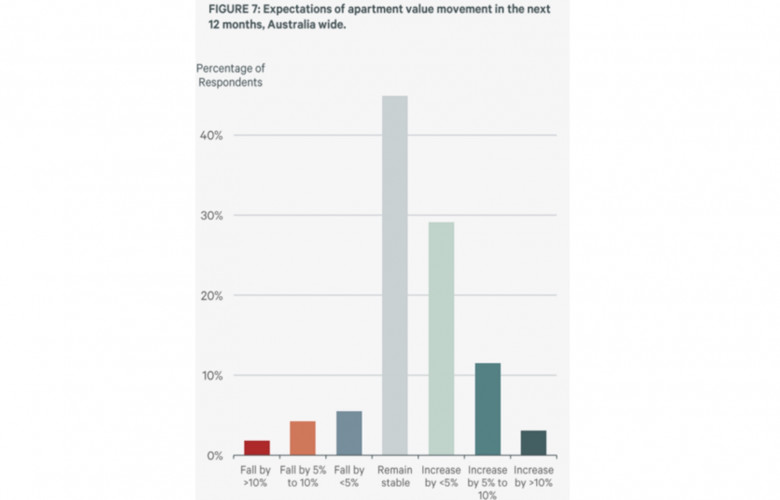

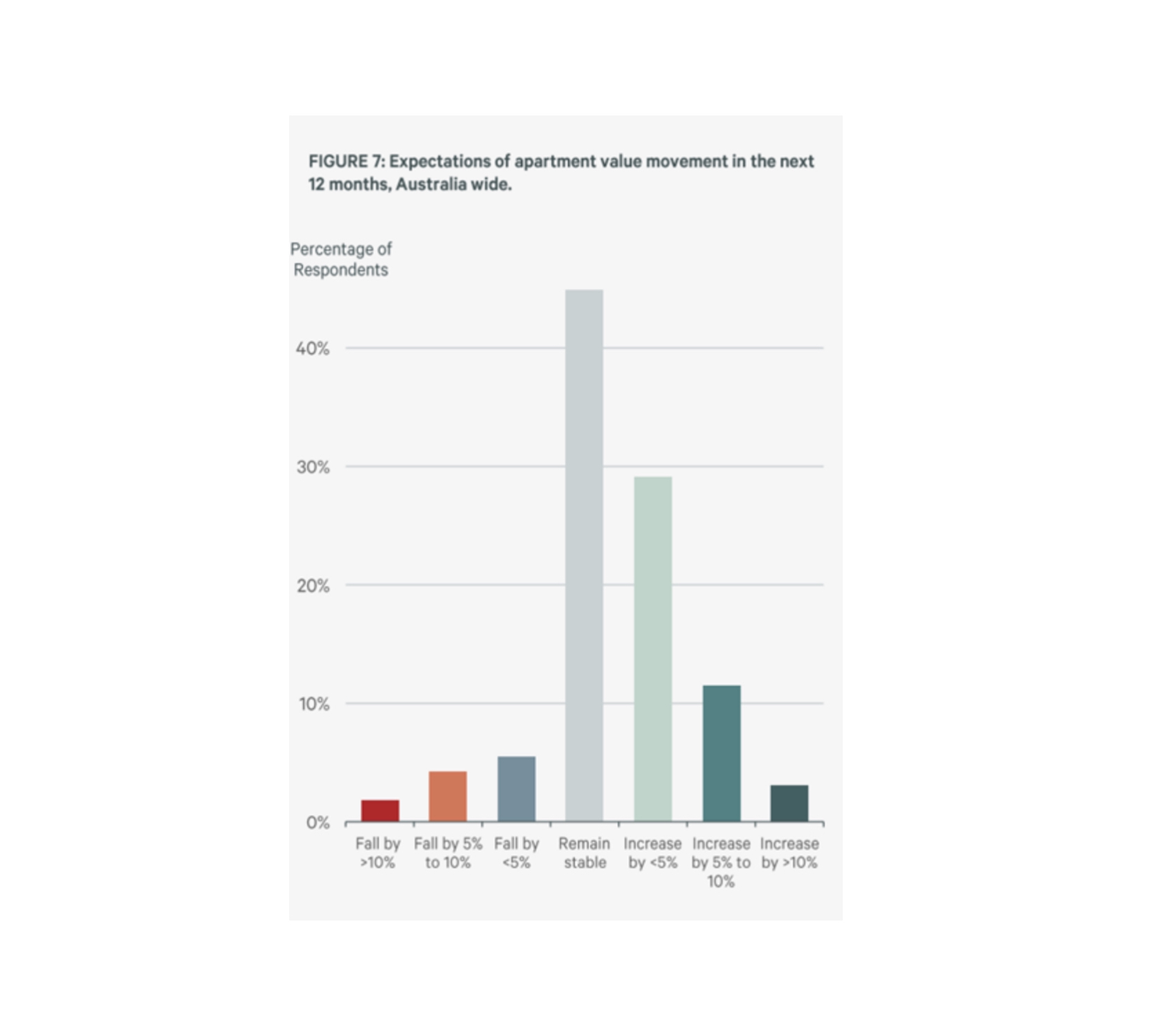

Nationally, four times as many valuers, or 44% of the respondents, expect apartment prices to grow over the next 12 months, with the highest conviction in Brisbane, the Gold Coast / Sunshine Coast and Sydney.

Kat Hale, CBRE’s Residential Valuations National Director said the outlook for value growth in house and apartment prices could be attributed to the strain on the rental market and property affordability.

“Low rental vacancy rates are driving up rental prices, prompting some tenants to consider apartment purchases due to overall housing affordability. Early signs of value growth in the property market are emerging driven by purchasers willing to buy ahead of potential interest rate cuts. Overall, there is a preference for high-quality or renovated homes,” Ms Hale said.

CBRE’s Pacific Head of Research, Sameer Chopra said the survey highlighted a high level of demand from upgraders and downsizers, with these buyer segments less sensitive to interest rate movements.

“So, while there is an issue around affordability, high-interest rates being the culprit, a reasonable part of the market is less sensitive to this when acquiring property. The results also point to high construction costs and funding costs continuing to put a lid on demand for unrenovated properties and vacant land, which ultimately creates tighter market conditions,” Mr Chopra said.

“We also see material differences in the demand and price expectations across different geographic markets. For instance, metro markets, despite being more expensive, are out-performing.”

Other key findings include:

- Two-thirds of valuers reported demand from first-home buyers and upgraders. Local and inter-state investors were also found to be active, alongside downsizers.

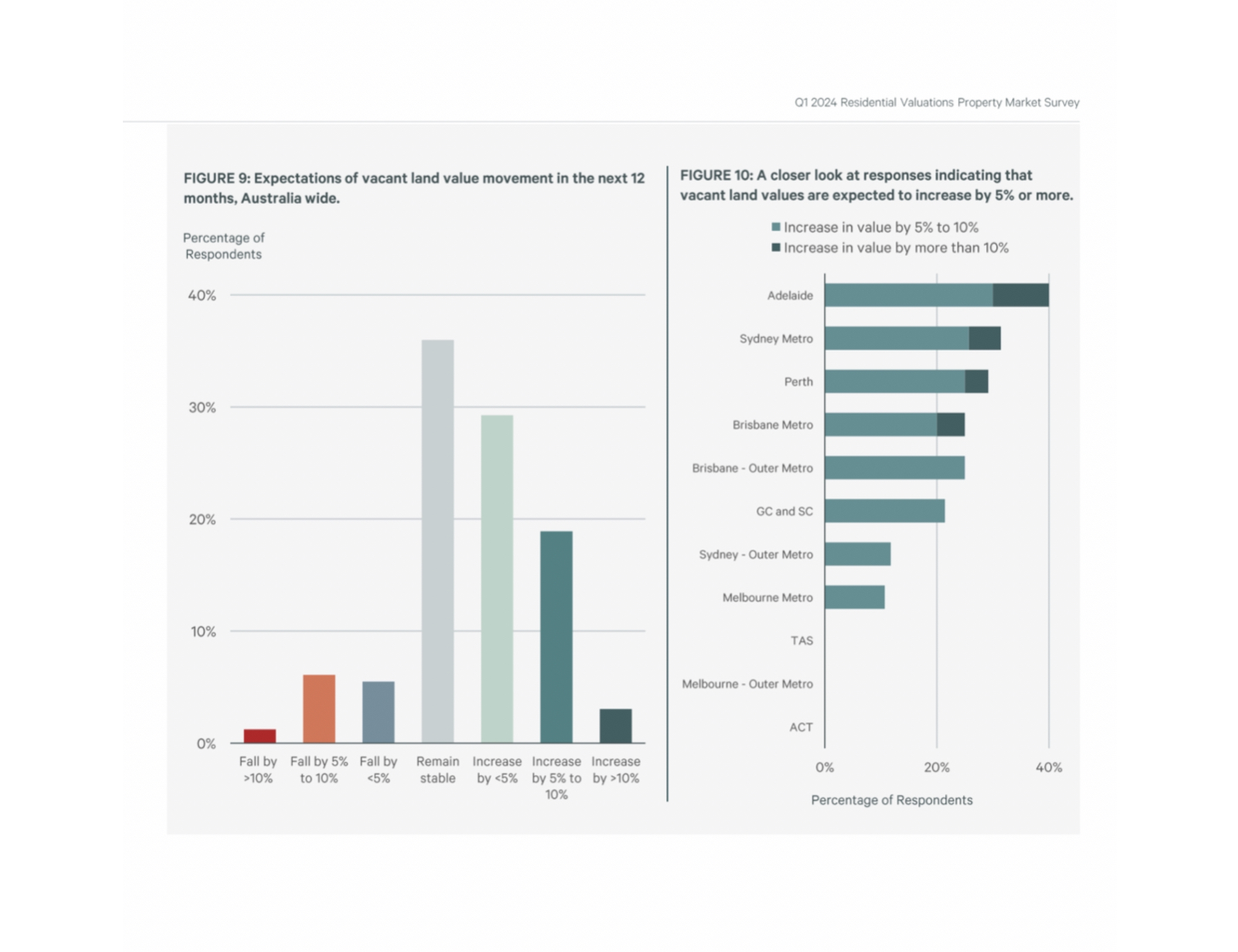

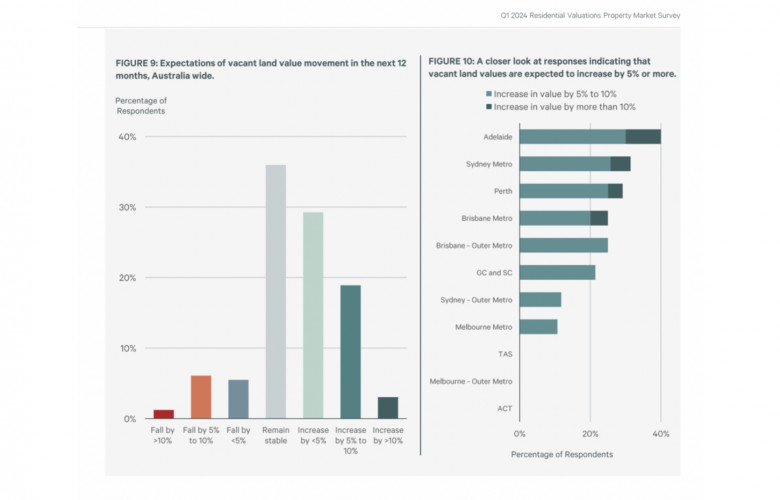

- Vacant land values are expected to increase over the next 12 months with the most growth expected in Adelaide, Sydney and Perth.

- There is scope for increased supply within the next 12 months.

- In relation to future demand, 57% of valuers expect buyer demand to grow in the next 12 months with 5% expecting a decrease and 38% believing demand will stay the same.

View CBRE’s inaugural Quarterly Residential Valuations Property Market survey

Related Reading:

Australian home values surge 8.1% in 2023 | The Real Estate Conversation

John McGrath – Market predictions for 2024 | The Real Estate Conversation

John McGrath – Where did prices rise the most in 2023? | The Real Estate Conversation