Sale volumes across the majority of Australia’s smaller state capitals exceed historic averages - CoreLogic

Contact

Sale volumes across the majority of Australia’s smaller state capitals exceed historic averages - CoreLogic

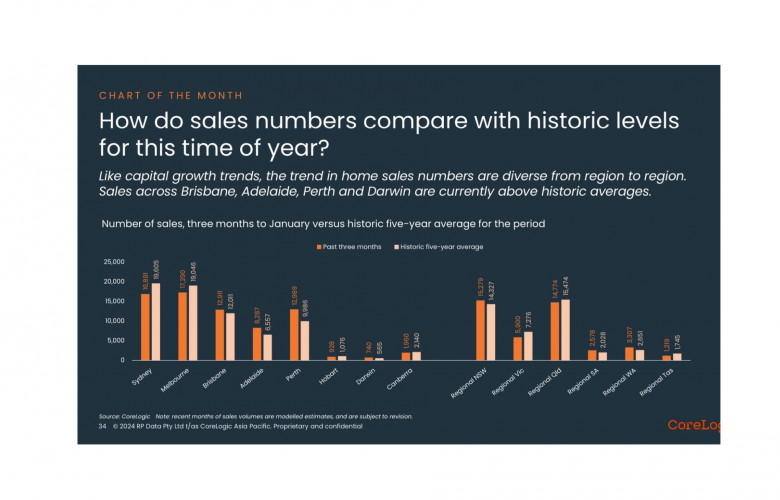

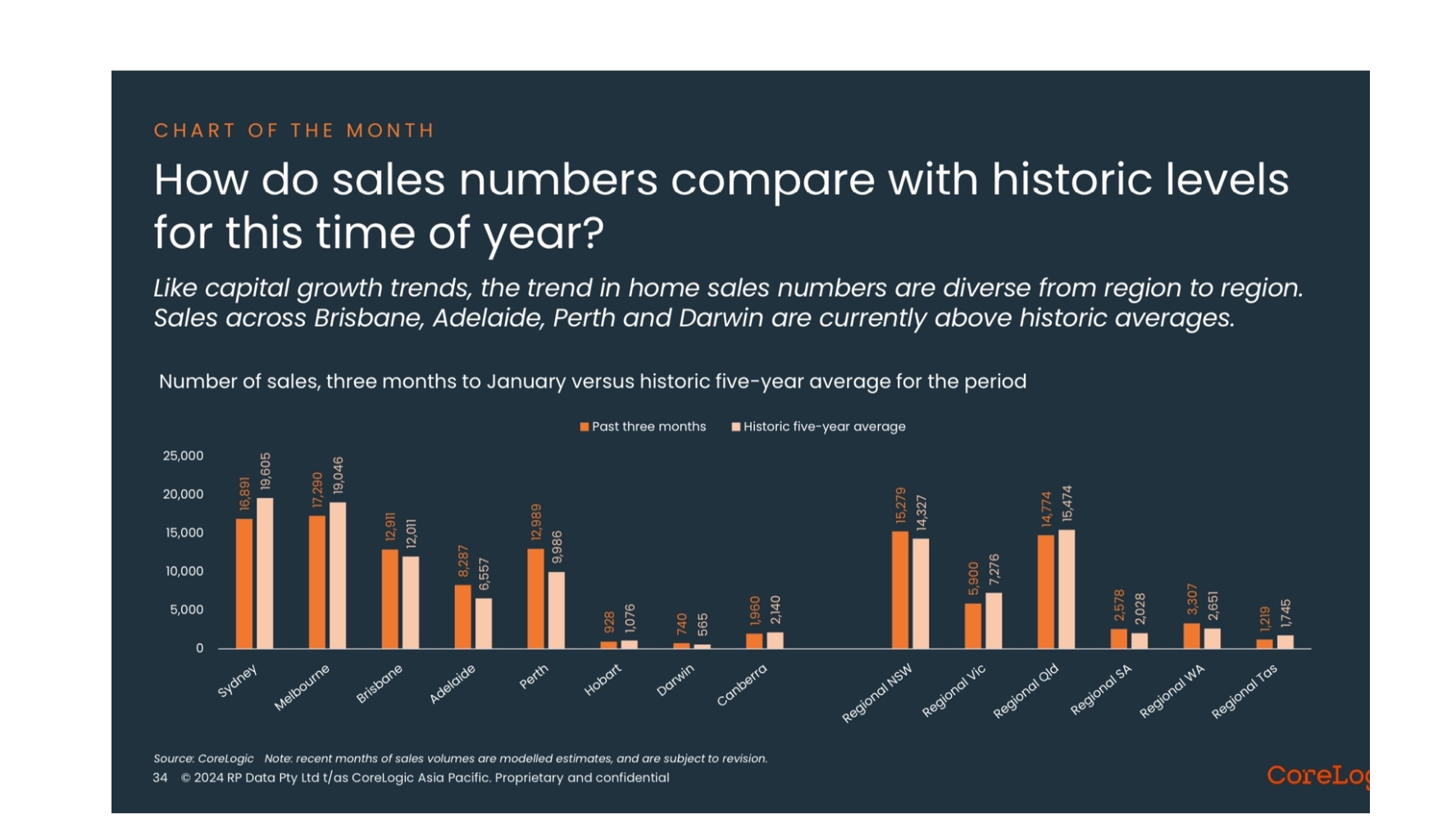

CoreLogic’s February Housing Chart Pack highlights that sale volumes across Brisbane, Adelaide, Perth, and Darwin currently exceed historic-averages.

Corelogic Australia have released their February Housing Chart Pack.

Like capital growth trends, the trend in home sales numbers are diverse from region to region.

CoreLogic’s February Housing Chart Pack highlights that sale volumes across Brisbane, Adelaide, Perth, and Darwin currently exceed historic-averages.

Highlights from the CoreLogic Monthly Housing Chart Pack include:

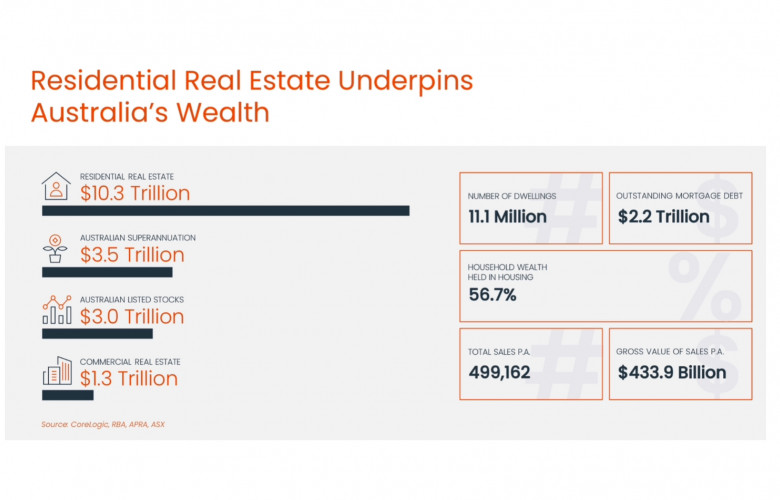

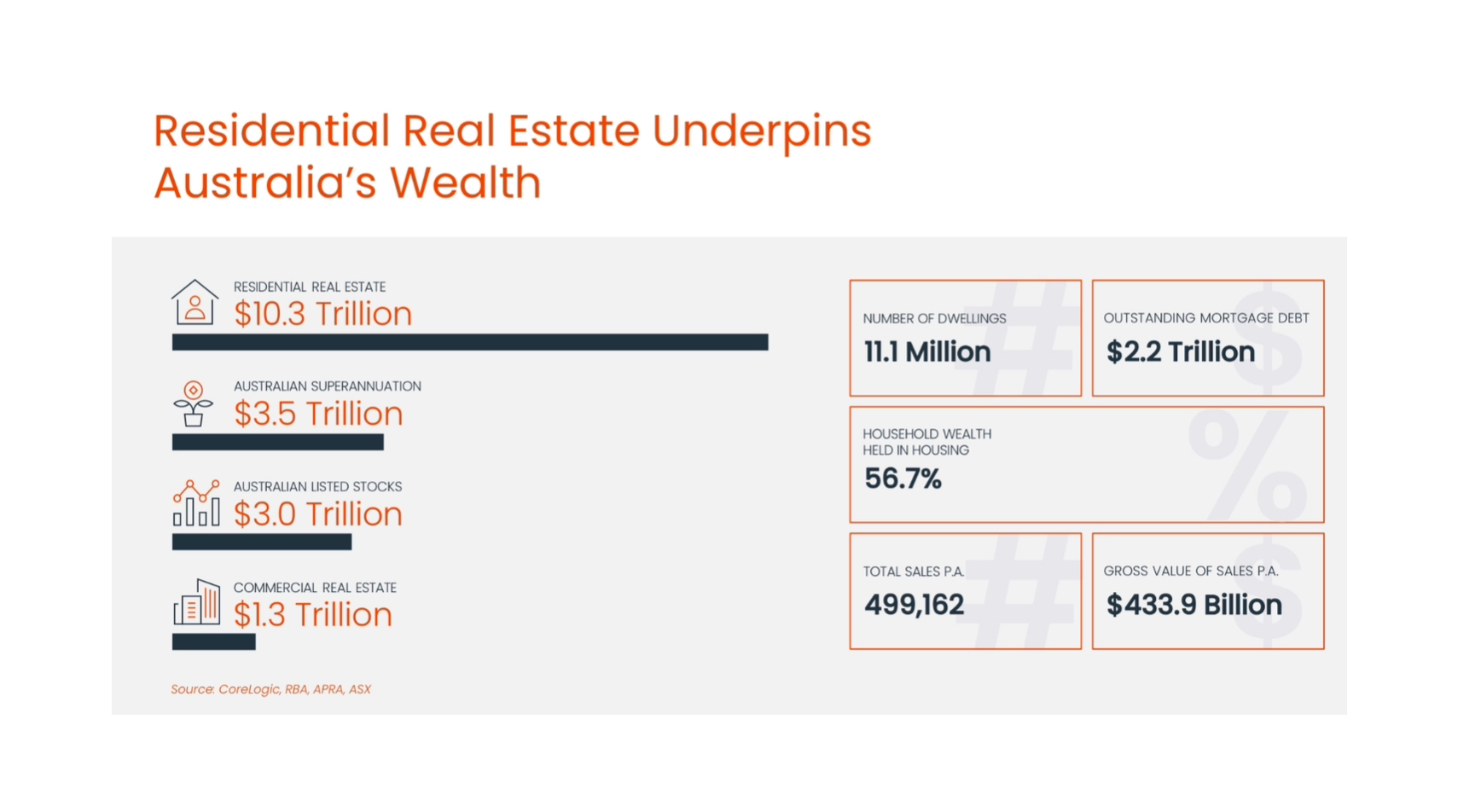

- The value of residential real estate was an estimated $10.3 trillion at the end of January, which was relatively steady on the previous month.

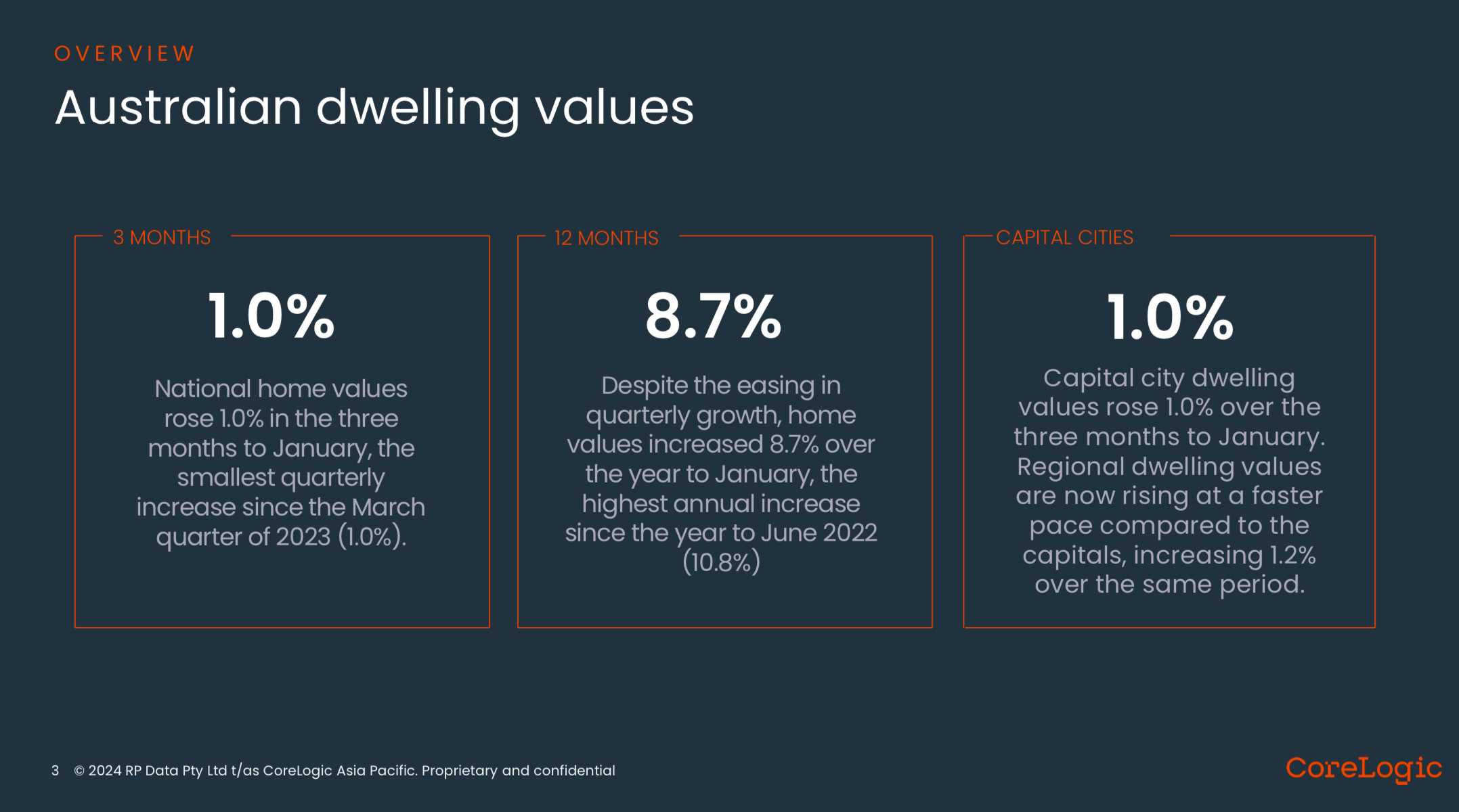

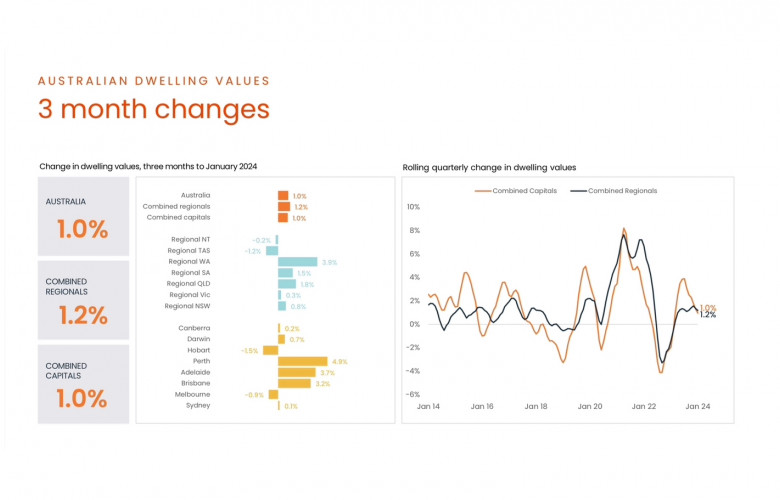

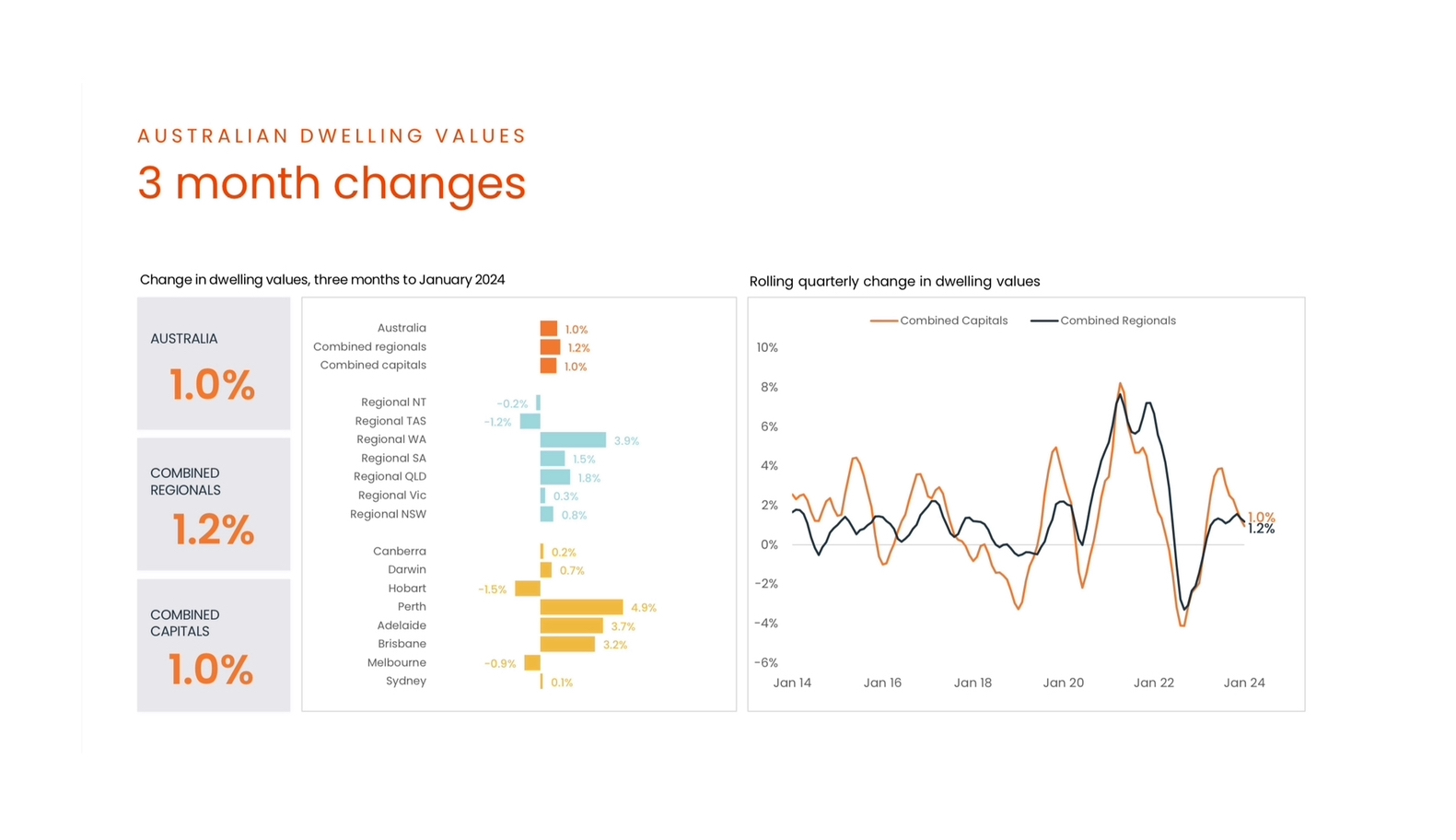

- Regional dwelling values are now rising at a faster pace compared to the capitals, increasing 1.2% compared to 1.0% in the combined capital city market.

- Perth led capital growth performance in the greater capital city markets. In the year to January, Perth home values increased 16.7%. Perth dwellings also had the strongest quarterly growth of the capital city dwelling markets, rising 4.9%.

- CoreLogic estimates there were 28,917 sales in January taking the national annual count to 499,162. This is roughly in line with the numbers seen over the year to January 2023 (496,926) and 3.6% above the average annual volumes seen over the previous 5 years.

- The time it takes to sell a home continued to trend higher in January, thanks in part to the seasonal slowdown in sales activity. Over the three months to January, the median selling time for a capital city dwelling was 29 days, while the median selling time in regional Australia was 44 days.

- The 2024 auction market started strong, with the combined capitals clearance rate shifting significantly higher compared to the final weeks of 2023, when the clearance rate fell below 60%.

- Australian rent values increased a further 0.8% over the month of January up from the 0.6% increase recorded in December. This uptick has seen annual growth in rent values accelerate slightly, from the 8.1% lift seen over the year to October 2023, to 8.3% in January.

- Dwelling approvals dipped -9.5% in December. This was driven by a -22.4% decline in the more volatile unit segment, while house approvals were relatively stable, dropping just -0.6%. While Approvals had trended a little higher through 2023, monthly approvals remain well below the previous decade average.

Related Reading:

Australian home values surge 8.1% in 2023 | The Real Estate Conversation

John McGrath – Market predictions for 2024 | The Real Estate Conversation

John McGrath – Where did prices rise the most in 2023? | The Real Estate Conversation