Regional markets lag capitals' rent and value growth - CoreLogic

Contact

Regional markets lag capitals' rent and value growth - CoreLogic

After recording stronger growth and milder declines through the recent cycles, a new analysis of Australia's regional housing markets shows many areas have lagged their capital city counterparts over the past year.

After recording stronger growth and milder declines through the recent cycles, a new analysis of Australia's regional housing markets shows many areas have lagged their capital city counterparts over the past year.

CoreLogic's refreshed Quarterly Regional Market Update, which now analyses value and rent changes across the country's largest 50 non-capital Significant Urban Areas (SUAs), shows rising interest rates, higher cost of living pressures and normalising internal migration patterns appear to have hit the regions harder.

Since bottoming out in January, values across the combined capitals have risen to new record highs, while the combined regional market remains -2.5% below the peak recorded in May 2022.

However, CoreLogic Economist and report author Kaytlin Ezzy said results across Australia's largest 50 non-capital SUAs vary, with 12 (8 in QLD, 2 in NSW and 2 in WA) recording new peaks in October, and an additional four sitting within 1% of their previous record highs.

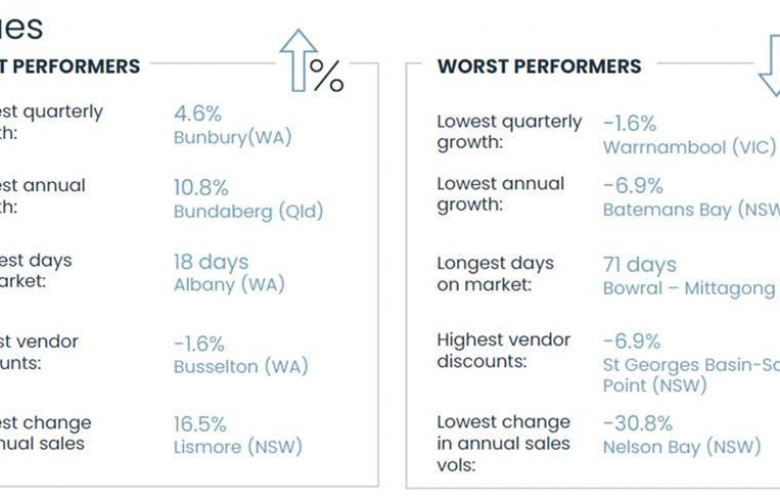

"Looking at quarterly value growth, WA's Bunbury recorded the strongest rise, up 4.6% over the three months to October, followed by NSW's Lismore, and St Georges Basin – Sanctuary Point, up 4.3% and 3.9% respectively," Ms Ezzy said.

"Despite not taking out the top spot, NSW and Queensland were undeniably the best-performing states, each making up four of the top 10 positions in terms of quarterly value growth. Queensland also made up half of the top 10 for annual value growth, with Bundaberg and SA's Mount Gambier both recording annual growth above 10%.

"In contrast, regional Victoria saw some of the largest quarterly declines, with dwelling values across Warrnambool and Ballarat falling -1.6% and -1.5%, respectively, while the coastal town of Batemans Bay in New South Wales (-6.9%) recorded the largest annual decrease. These markets are now seeing weaker growth conditions after strong gains during the pandemic upswing," Ms Ezzy said.

Sales activity falls across the regions

While three in four of the largest SUAs recorded a rise in dwelling values over the year, only one market saw a lift in sales activity. The flood-ravaged town of Lismore (NSW) saw the number of home sales rise from a flood affected low base, lifting 16.5% over the year to August.

The smallest decline in sales volume was recorded across Gladstone (QLD), falling just -1.2% from the strong volumes recorded the year prior, while Kalgoorlie–Boulder and Geraldton, both in WA, recorded mild declines of -3.1% and -6.1%. The remaining markets all recorded double-digit drops in sales activity, although Nelson Bay (-30.8%) in New South Wales was the only market to see a decrease in excess of 30%.

South West WA sells fast while NSW prestige pockets record challenging selling conditions

Properties in WA's Albany, Bunbury, and Busselton regions recorded the fastest selling times over the past three months, with a median time on the market of 18, 19, and 20 days, respectively. Busselton (1.6%) and Albany (2.3%) were also offering the smallest discounts to secure a sale, reflecting some of the strongest selling conditions across the country. At the other end of the scale, markets in the Southern Highlands and Shoalhaven region of NSW had some of the worst selling conditions, with St Georges Basin - Sanctuary Point offering the highest vendor discounts at -6.9% and the Bowral – Mittagong area recording the highest median time on market at 71 days.

Regional rental markets

Ms Ezzy said similar to values, growth in regional rents has lagged the capitals.

"Fuelled by strong net overseas migration, smaller household sizes and limited stock, the combined capitals have seen rents rise 1.8% over the past three months. In contrast, normalising migration patterns have seen regional rents record a milder 0.8% rise."

Across the largest 50 non-capital SUAs, 38 saw rents rise over the three months to October, with eight recording a rise of 3.0% or more. Approximately an hour south of Adelaide, the coastal region of Victor Harbor – Goolwa recorded the highest quarterly increase in rents, rising 4.6%. This was followed by WA's Bunbury (3.9%), and Queensland's Bundaberg (3.5%) and Maryborough (3.5%).

Three markets in WA (Kalgoorlie - Boulder, Bunbury and Busselton) and Victoria's Shepparton – Mooroopna saw rents rise by 10.0% or more over the year to October, adding between $40 and $60 per week to the median weekly rental value. With the exception of Kalgoorlie - Boulder (1.2%), each of these markets recorded a vacancy rate below 1.0% in October. Bunbury tied with Mount Gambier in South Australia to record the lowest vacancy rate among the regions at 0.4%.

At the other end of the spectrum, NSW's Bateman’s Bay recorded some of the weakest rental growth, with rents dropping -5.4% over the quarter – the largest decrease across the regional markets. Bateman’s Bay also recorded the highest annual decline in rental values, falling -9.3% over the year.

"Mining and port regions were well represented in the top 10 list for the highest gross rental yields," Ms Ezzy said.

"WA's Kalgoorlie – Boulder region offered investors the highest gross rental yields at 9.3%, followed by WA's Geraldton at 6.7%, Queensland's Mackay and Gladstone at 6.5% and 6.4% respectively. At the other end of the scale, one of Australia's most expensive SUAs, Bowral-Mittagong in NSW, returned both the lowest yield and the highest vacancy rate, at 3.1% and 3.2% respectively."

Regional Outlook

Following the RBA's decision to lift the cash rate another 25 basis points and the upwards revision in inflation forecasts, Ms Ezzy said there was a good chance of softer housing market conditions ahead.

"We're already seeing an easing in the pace of monthly growth across our largest cities, and this is a trend we can expect to see playing out more broadly at least until interest rates top out,” she said.

"Higher interest rates, higher housing prices, higher rents and high cost of living pressures are likely to weigh on buyer sentiment leading into 2024."

To download your copy of the Regional Market Update, visit www.corelogic.com.au/news-research/reports/regional-market-update.