Where will rents grow the fastest across Australia’s major cities? - CBRE

Contact

Where will rents grow the fastest across Australia’s major cities? - CBRE

Low vacancy rates to drive growth of 30%+ across five city markets.

There’s no end in sight for rising apartment rents, with five Australian markets likely to record mid to high 30% rental growth between now and 2028 according to new CBRE forecasts.

CBRE’s Apartment Rent and Vacancy Outlook examines 53 precincts in Australia’s major capital cities.

Median rents for two-bedroom apartments across these precincts are expected to grow by $120/week (+26%) between 2023-2028, underpinned by a further decline in city vacancy rates from the current average of 1.8% to just 0.8% - around one-third of the previous decade average.

The highest growth of +30% is expected to occur in five markets: Sydney’s Eastern Suburbs, Parramatta, Melbourne North, Perth City and almost all precincts in Brisbane.

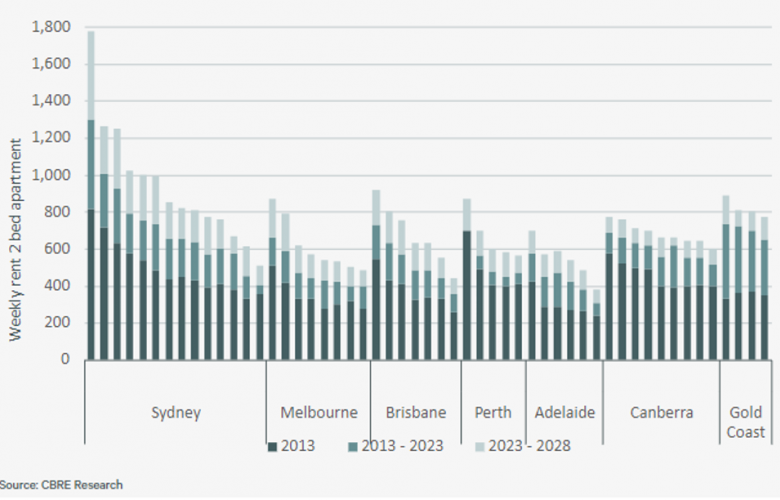

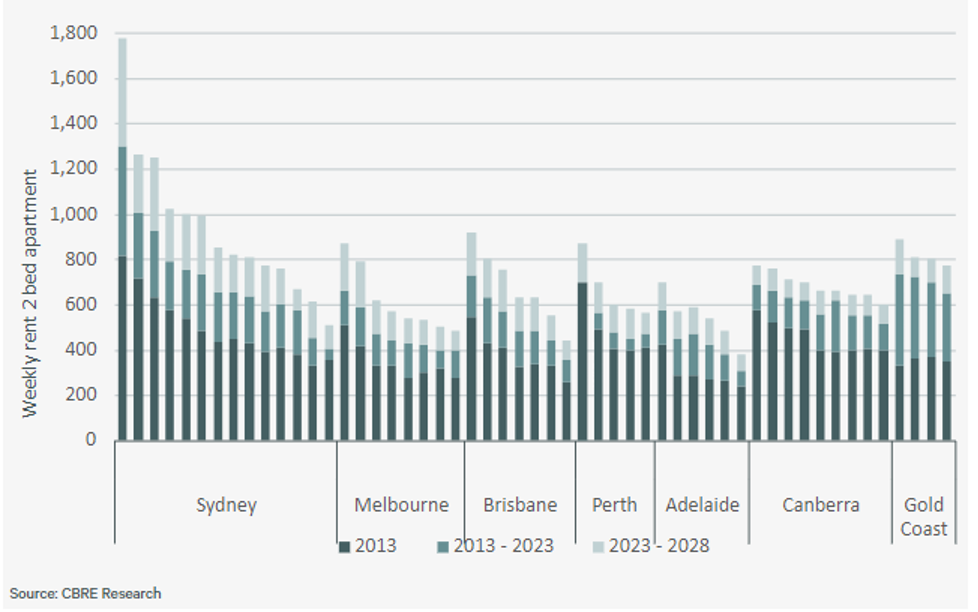

CBRE’s Pacific Head of Research Sameer Chopra noted, “At the start of 2013 just four precincts in Australia had an average rent of over $600/week for two-bedroom apartments, being the Sydney and Perth CBDs, Sydney’s Eastern Suburbs and Sydney’s Lower North Shore. By June this had grown to 20 precincts and by 2028 we expect 38 precincts - or over 70% of Australia’s two-bedroom apartments - to have a rent exceeding $600/week.”

Tightening vacancy rates have been a major driver, with Mr Chopra noting that vacancy rates need to be around 4%-5% for markets to be in balance.

To stave off further falls in vacancy rates ~75,000 of new apartments per annum would need to be delivered across Australia to keep pace with population growth.

But supply is lagging with CBRE forecasting new stock will be ~60,000 in 2024 and 2027 - 40% below the previous peak in 2017 and near decade lows.

Notwithstanding the outlook for rents and vacancies, Mr Chopra said he still expected the cost of renting to remain more affordable than purchasing across Australia’s major cities.

“Australia’s monthly apartments rents are currently 30% cheaper than purchasing at current prices across most precincts. The reversion of interest rates to say 2%-2.5% could see this relative rental affordability remain as capital values rise.”

Two-bedroom apartment rents across Australia’s major precincts

EASTERN SEABOARD OUTLOOK

Sydney: Apartment delivery to average 14,000 pa over 2024-28, well below 33,000 pa demand for housing stock. Vacancy rate is set to fall from 2.2% to 0.8% and average rent growth of 6% pa to 2028.

Melbourne: Apartment delivery to average 10,000 pa over 2024-28, nearly 40% below Sydney. Demand for housing stock (apartments and communities) is likely to average 38,000 pa over the next five years. This should continue to drive down city-wide vacancy from 1.7% to 0.9%.

Brisbane: Apartment delivery to average 6,500 pa over 2024-28. Demand for housing stock (apartments and communities) is likely to average 16,500 pa which will drive down city-wide vacancy from 1.1% to 0.8%.