Now is the time to buy a holiday home - Ray White

Contact

Now is the time to buy a holiday home - Ray White

According to William Clark Ray White Group Data Analyst, price growth is back on the move, reaching the lowest point at the end of last year.

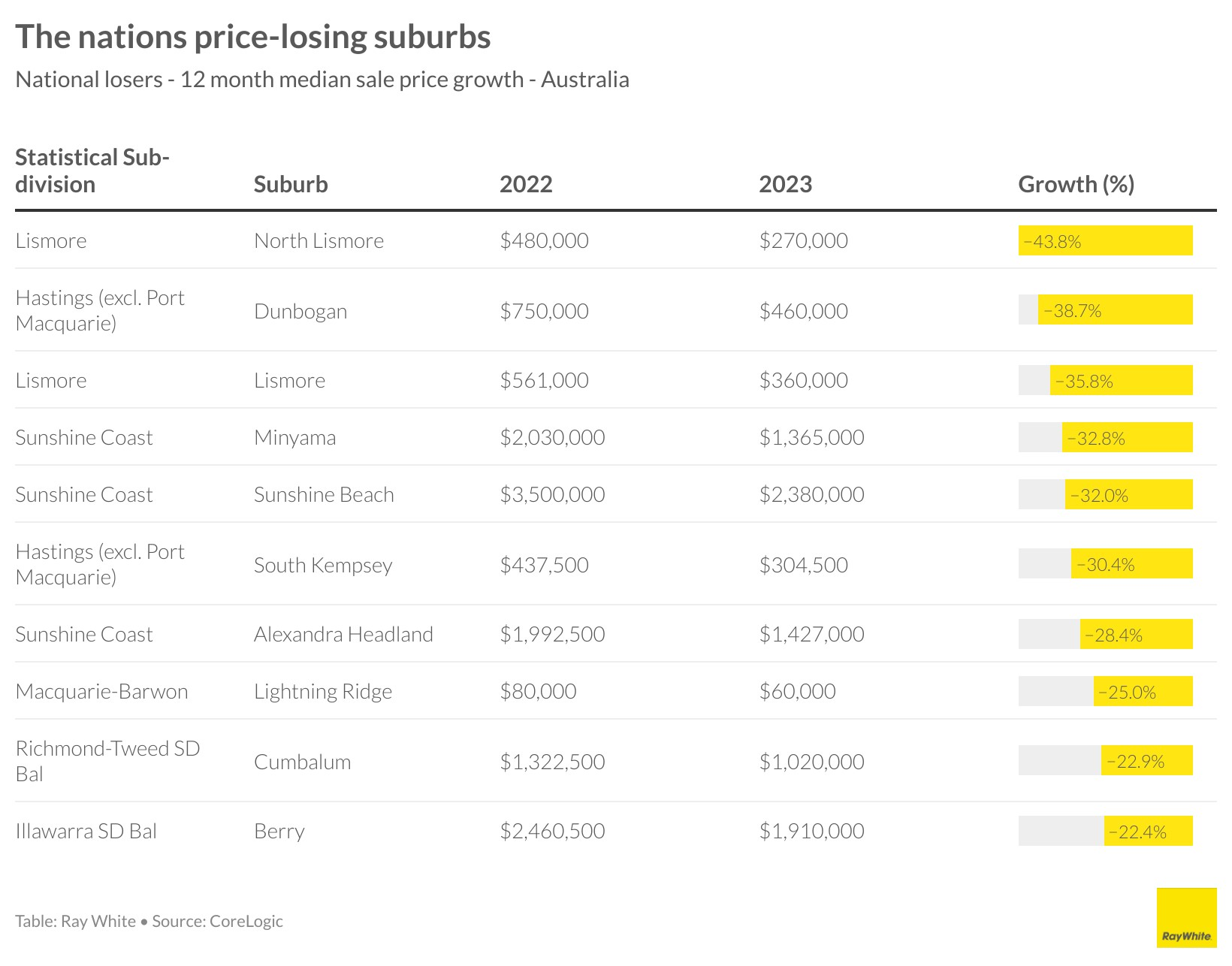

Price growth is back on the move, reaching the lowest point at the end of last year. But this price growth is not happening everywhere. Looking at suburb level data, we can see that many have gone backwards in price, as the rest have moved on. So what suburbs are these, and are there any similarities?

We see from the list that coastal suburbs have been heavily affected with a reverse seachange occuring. Interest in having a holiday home surged during the pandemic but with rising interest rates and growing restrictions on short term rentals, this is a luxury that few can afford. As a result, prices are declining in these areas, particularly in parts of the Sunshine Coast and coastal New South Wales.

It isn’t just the holiday house market affected. Lismore, North Lismore and South Kempsey experienced heavy flooding in February 2022. And while it has been over 18 months since the waters receded, it looks like those who were left with homes in a marketable condition had to walk away with potentially more than 40 per cent losses on sales, or over a $200,000 loss on their net wealth for the median sale. Lightning Ridge in New South Wales showing up on the list was a severe case of the changeable fortunes of mining towns. It’s one of few surviving opal mining towns. It appears that even a return in popularity amongst some jewellery designers for the gem isn’t enough to turn around conditions.

While many holiday home towns and some select mining towns have seen declining prices, it isn’t consistent across the board. While some selected Sunshine Coast suburbs have seen declines in prices, across the region, prices are back where they were during the 2022 peak. In Western Australia, green energy minerals are pushing up values in places that have previously been very low in growth. It is likely that in 2024, we will be looking at quite a different list of suburbs.