Sydney records the biggest quarterly increase in $US10+ sales over Q2 - Knight Frank

Contact

Sydney records the biggest quarterly increase in $US10+ sales over Q2 - Knight Frank

Sydney has had the biggest quarterly increase in the number of super-prime sales – residential sales of US$10 million-plus – from Q1 to Q2 this year out of 12 key international global markets, according to the latest research from Knight Frank.

Sydney has had the biggest quarterly increase in the number of super-prime sales – residential sales of US$10 million-plus – from Q1 to Q2 this year out of 12 key international global markets, according to the latest research from Knight Frank.

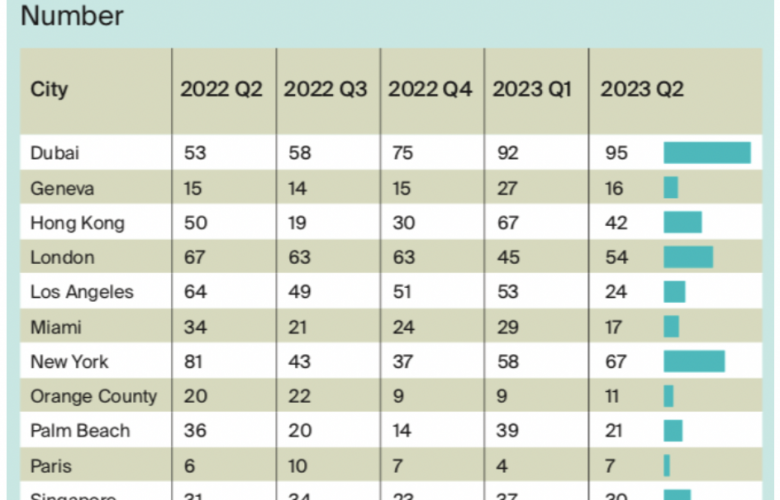

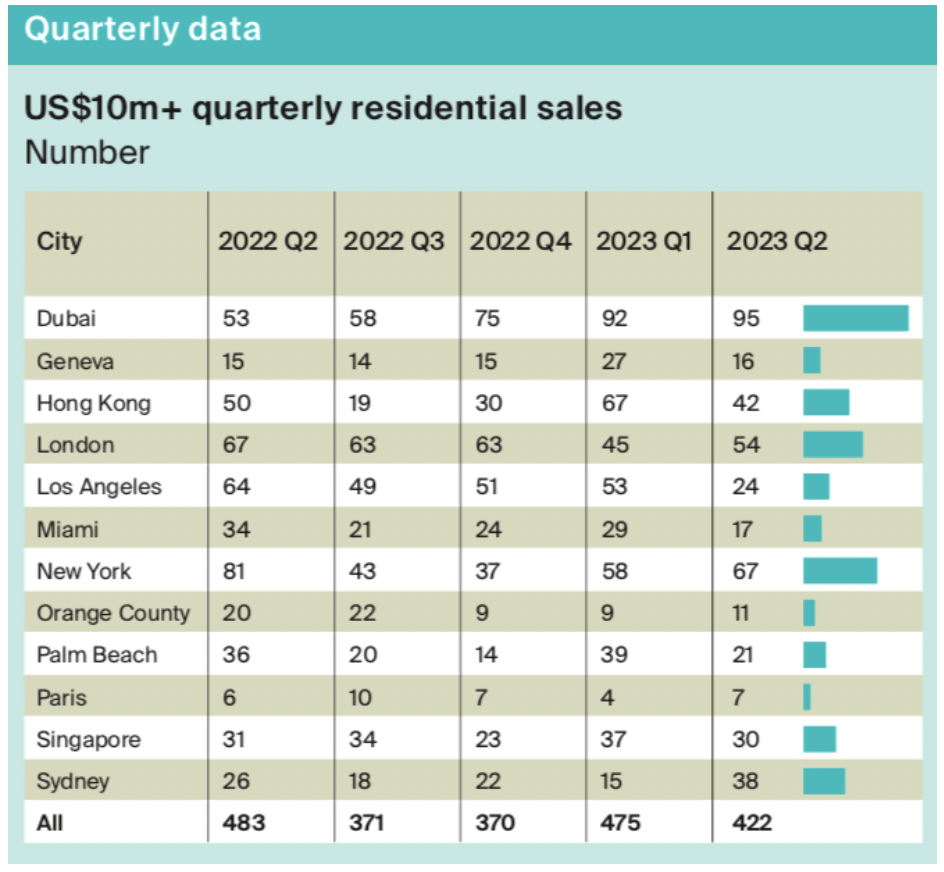

Knight Frank’s Global Super-Prime Intelligence Q2 2023 report found Sydney had 38 super-prime sales over Q2 2023, compared to 15 in Q1. It was the highest volume of luxury home sales for Sydney over at least the past five quarters.

The 38 luxury home sales for Sydney in Q2 equated to US$686 million in value, or an average sale price of $18 million.

Dubai had the highest volume of sales in Q2, with 95 luxury homes selling, followed by New York (67), London (54), Hong Kong (42) and Sydney (38).

The total value of Sydney’s sales over Q2 was the fifth highest behind Dubai (US$1.582 billion), New York (US$1.142 billion), London (US$1.034 billion) and Hong Kong (US$834 million), however the average sale price in Sydney was the fourth highest behind Hong Kong (US$19.9 million), London (US$19.2 million) and Geneva ($19 million).

Over the past year (between Q2 2022 and Q2 2023), the volume of super-prime sales in Sydney rose by 46%, which was the second highest behind Dubai (up 79%). Sydney was followed by Paris (up 17%) and Geneva (up 7%). These were the only four cities to record a rise in sales volumes over the 12 months to Q2 2023.

The rise in sales volumes for Sydney over both the quarter and the past 12 months came despite an 11% decline in overall super-prime sales across the 12 key international markets analysed between Q1 and Q2 this year, with volumes falling from a total of 475 in Q1 2023 to 422 in Q2 2023.

There was also a 13% fall in total volumes over the past 12 months, with 483 sales seen in Q2 2022. The biggest declines over the year were seen in key US markets, led by Los Angeles (down 63%).

The total value of sales over the 12 analysed markets in Q2 amounted to US$7.3 billion, down from $8.4 billion in Q1 2023, and $8.7 billion in Q2 2022.

Despite a fall in overall sales volumes for luxury residential homes, sales in the 12-month period up to June this year (totalling 1,638 globally) are still running well ahead of the levels seen pre-pandemic (1,009 in 2019).

Total sales in the 12 months up to June in all markets stood at under US$30 billion, down from the peak of US$40.7 billion seen in 2021 but well ahead of the pre-pandemic figure of US$18.6 billion in 2019.

Knight Frank Head of Residential Erin van Tuil said the luxury segment was not immune to the impact of higher interest rates seen around the globe, hence the overall decline in sales volumes globally, but Sydney’s super-prime residential market was showing resilience.

“Sydney’s super-prime market has witnessed strong sales in the last quarter, driven by a rapid surge in demand, partly from overseas but also from a significant portion of domestic buyers,” she said.

“Given the limited supply, buyers are actively seeking off-market opportunities to reduce competition.

“Looking ahead, there’s a shortage of super-prime construction in the pipeline, indicating that the supply shortage is likely to persist.”