Australia expected to see more branded residences in line with global growth: Knight Frank research

Contact

Australia expected to see more branded residences in line with global growth: Knight Frank research

Australia is ripe for the development of more branded residences in the future as the latest research from Knight Frank shows the property type is growing in popularity around the world.

Australia is ripe for the development of more branded residences in the future as the latest research from Knight Frank shows the property type is growing in popularity around the world.

The Knight Frank Global Branded Residences Report 2023 confirms the market is enjoying sustained growth globally despite significant recent economic turmoil, with predicted growth in the number of global branded residences of 55 per cent by 2026.

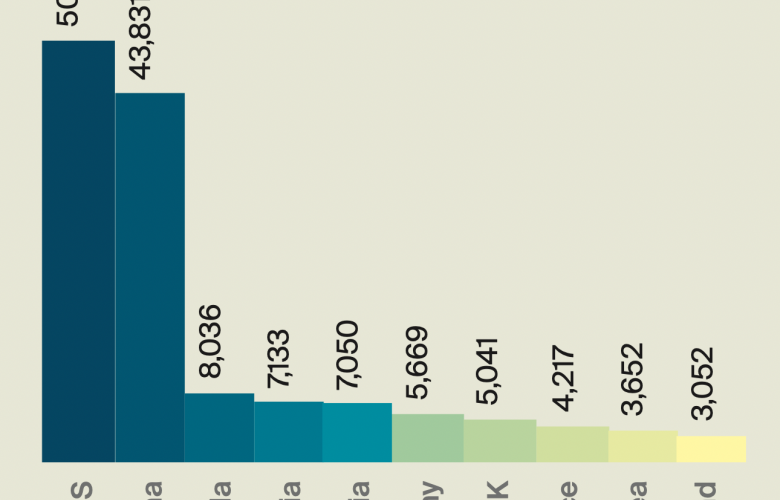

Tracking the portfolios of 15 leading luxury branded residence operators, Knight Frank's report identifies 186 live schemes globally, which will be joined by 32 new schemes this year, 23 in 2024, 26 in 2025 and 22 in 2026. The research also identifies a further 35 schemes in the pipeline with no confirmed launch date. The number of new schemes with known opening dates represents a 12% annual growth rate up to 2026 - or 55% overall over the period to 2026.

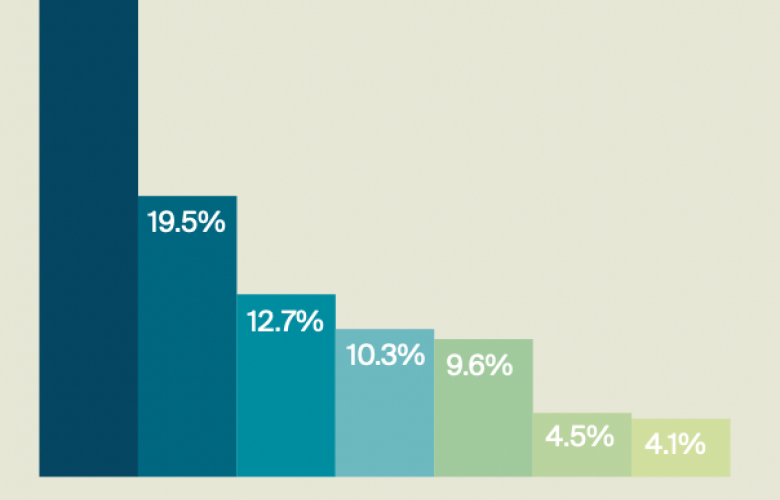

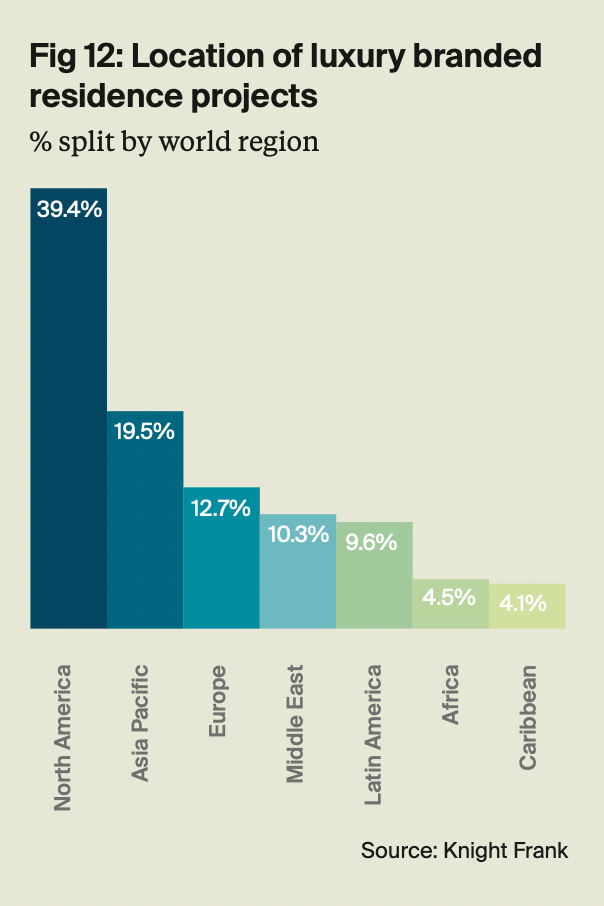

North America accounts for nearly 40% of all projects, followed by Asia-Pacific (20%) – which includes Australia - and Europe (13%). The schemes are located across 52 countries, dominated by the US (106 schemes), and with Mexico, the UAE, Thailand, the UK and China all with double-digit numbers of schemes.

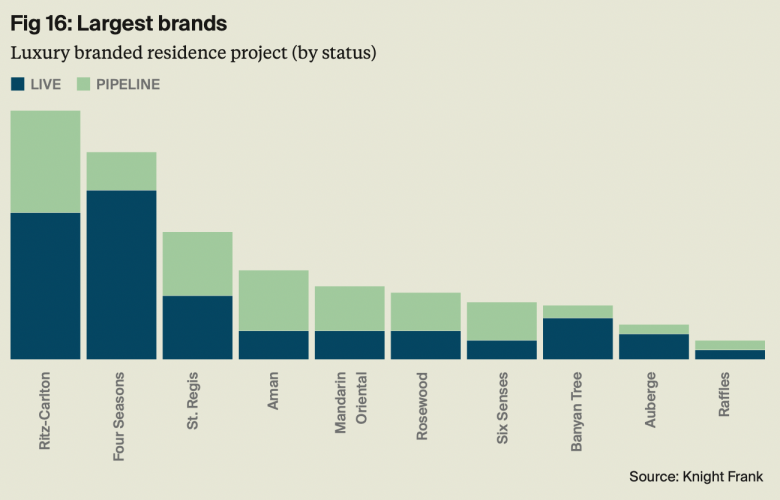

In terms of brands Ritz-Carlton leads with the highest numbers of schemes, followed by Four Seasons. In terms of rate of growth, Aman and Six Senses lead with 68% and 67% respectively of their total portfolio currently in their development pipelines.

Knight Frank's research confirms this growth in supply will be matched by demand - evidenced by growing wealth creation, increasing travel volumes and prestige property dynamics, with future demand for second homes expected to be driven by rising affluence, increased mobility, and the desire of wealthy investors to expand their residential property portfolios.

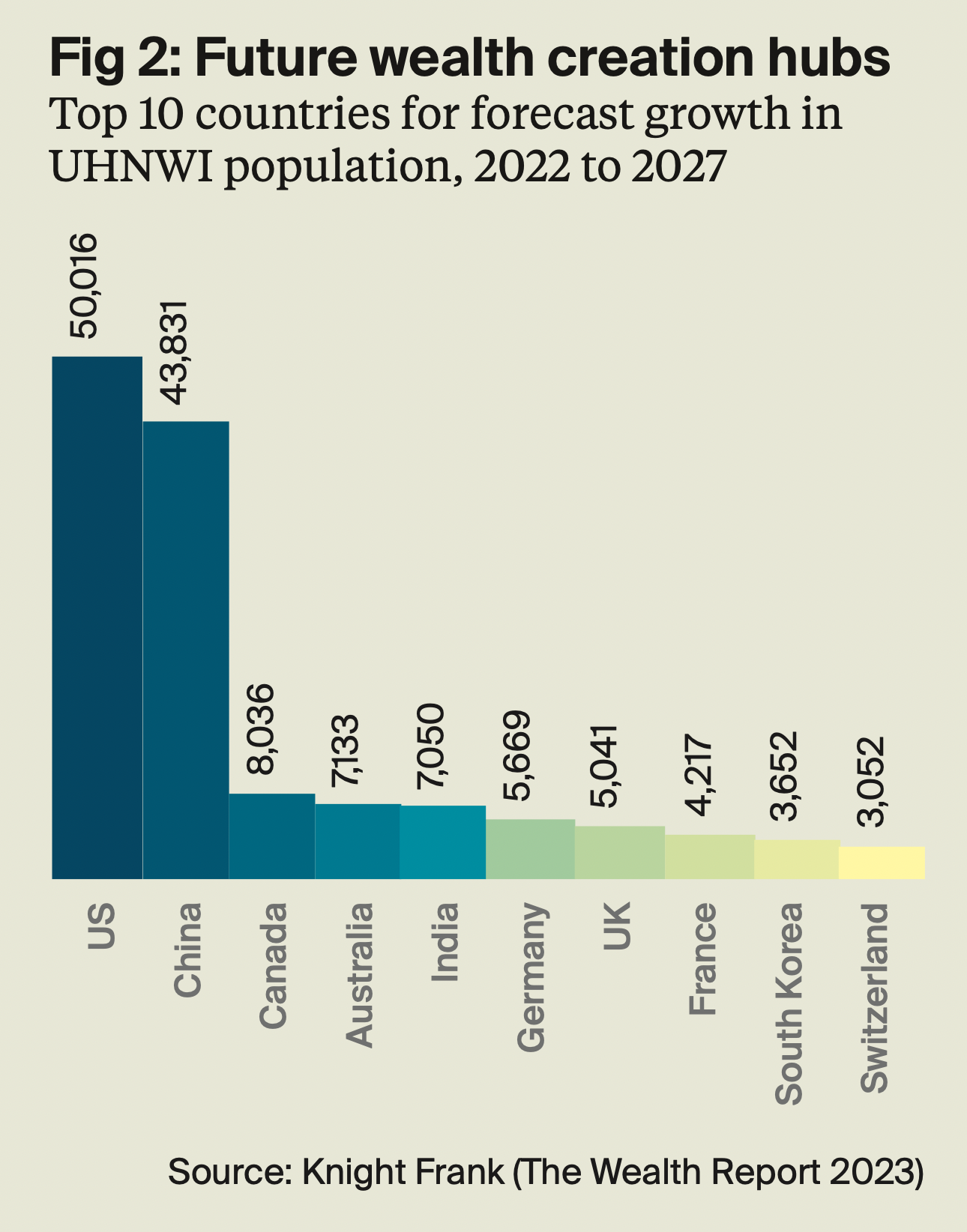

Globally the population of UHNWIs is projected to rise by 28.5% over the five years from 2022 to 2027, with Australia one of the countries set to see substantial growth by 2027, according to Knight Frank’s recently-released The Wealth Report 2023.

The number of UHNWIs in Australia - defined as those with a net wealth of more than US$30 million - is set to grow by 40.9% over the next five years from 17,456 in 2022 to 24,589 in 2027, almost 3,000 additional UHNWIs than the 31.1% growth over the past five years.

The number of high-net-worth individuals (HNWIs) - defined as those with a net wealth of more than US$1 million – is also set to grow by 71.1% between 2022 and 2027 in Australia, rising from 2,214,326 in 2022 to 3,789,629 in 2027. This level is 2.5 times the growth in HNWIs in the previous five years, between 2017 and 2022.

Knight Frank Head of Residential in Australia Erin van Tuil said while there was no formal definition, a branded residence was generally recognised as a residential property associated with an established brand, such as a hotel operator. The brand provides the property with its branding, services and amenities.

She said there was currently only one fully integrated branded residence development under construction in Australia – with Four Seasons set to manage the hotel within the new STH BNK by Beulah development in Melbourne – and one completed project in Sydney, being Crown Residences at One Barangaroo.

But many developers and brands are currently actively exploring the option, Ms van Tuil added.

“Amid a shortage of new prime stock in Australia, buyer demand for branded residences in our country is strong, with the success of Crown’s One Barangaroo development evidence of that,” she said.

“We expect to see more branded residences entering the Australian market in the future, and we know they will generate significant interest and sales.

“There is a myth in the market that offshore buyers would make up the biggest pool of purchasers for these homes, and while Australia is a favoured destination for second home purchases, the depth of the market is much greater than that.

“There are plenty of domestic buyers, particularly Sydneysiders, who are looking for a branded residence to purchase, but there just aren’t any options in the market outside of One Barangaroo.

“There is also strong demand for branded residences on the Gold Coast – branded residences are all about lifestyle and the Gold Coast is a true lifestyle destination.”

Knight Frank Director Residential Project Sales in Queensland Alison Hedger said the Gold Coast was a well-positioned opportunity for developers to consider best-in-class super-prime luxury branded residences as seen in established key hubs around the world.

“Within the Australian property landscape we are experiencing strong interest from key players in the branded residence space for prime sites in south-east Queensland, including the Gold Coast and Brisbane,” she said.

“The value proposition of these sites, wealth migration and forecast annual growth of 3 per cent for prime residential property on the Gold Coast over the next three years proves there is a strong case for investment in branded residences.

“For a developer to deliver a luxury branded residence project on the Gold Coast would be a landmark legacy, and we firmly believe it would be extremely successful from a sales perspective.

“The strong demand for these projects is evident, with high enquiry for prime property on the Gold Coast, including penthouse and prime waterfront residential offerings with high-end amenity, from high-net-worth individuals and ultra-high-net-worth individuals.

“The Gold Coast has come of age in the prime residential space, transitioning to an owner-occupier, rightsizing destination with demand for luxury apartments with considered and market-leading lifestyle amenity.

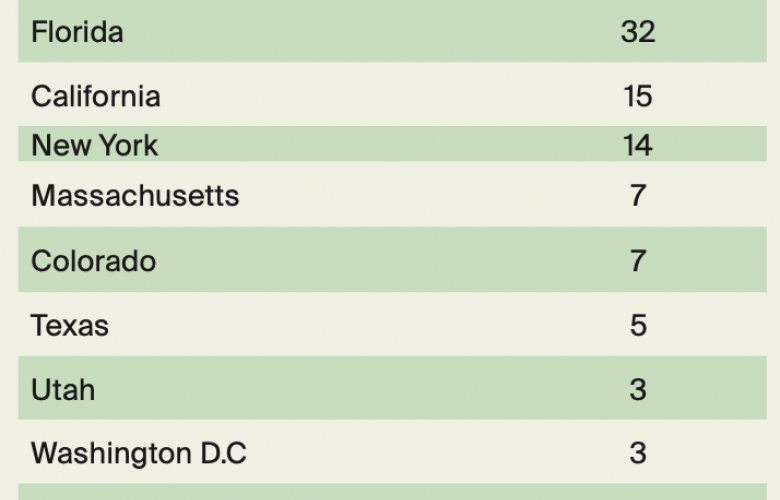

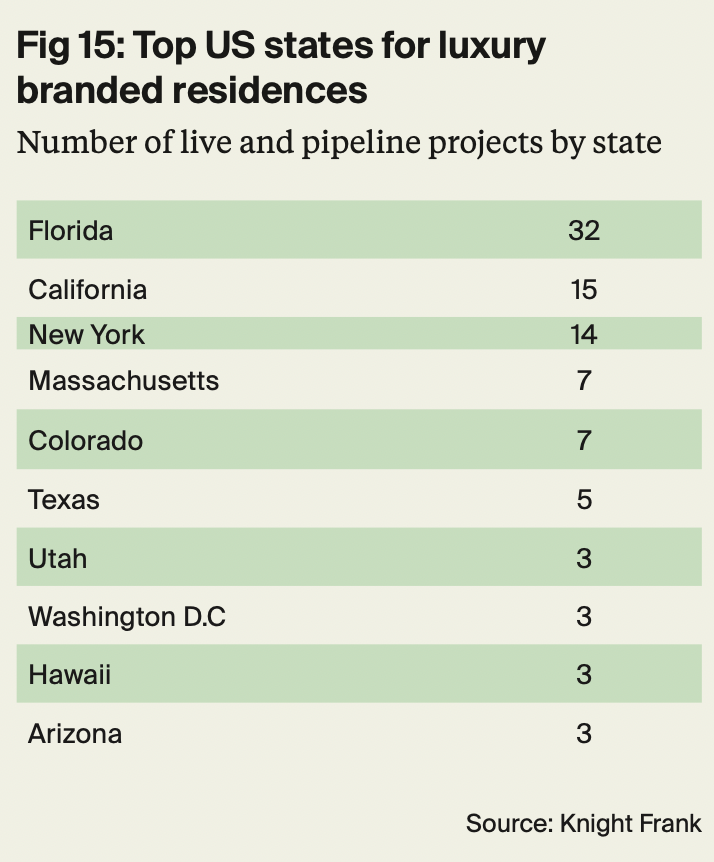

“Comparisons are often drawn between the Gold Coast in Australia and Miami in the US, given the ‘sun’ resort factors, and within the US, which has the largest number of branded residences schemes globally, Florida is leading the charge, with 80 per cent of Florida’s schemes found in Miami.

“A branded residence provides owner-occupiers with the assurance of best-in-class delivery and long- term service benefits that come with a world-class hotel brand.”

Ms van Tuil said for branded residences to be successful in terms of increased saleability and an uplift in prices, more was required than a developer just putting a brand name on their project.

“The project needs to be in the best location, built to the highest specifications and the brand needs to have strong recognition from buyers so they have certainty about what they are purchasing,” she said.

“What is most appealing to buyers is service rather than amenity – it’s not just about having access to the pool and gym, but the most desirable value-add is the service offering led by 24-hour hotel concierge from professional hotel staff.

“It gives residents of these developments service at their fingertips, and that combined with the convenience and lifestyle of these well-located projects, as well as good architecture and interior design, makes them hugely popular.”

Click here to view and download the full report.

Related Reading:

Sydney ranked 9th for the number of super-prime sales (US$10m+) over the past year - Knight Frank

Knight Frank makes new appointment to its Gold Coast Residential Project Sales team