What's been the best investment long term?

Contact

What's been the best investment long term?

Although people buying and selling property quickly have done well through the pandemic, holding property long- term is always the best strategy to build wealth. But how does property compare to other asset classes? Nerida Conisbee, Ray White Chief Economist.

Although people buying and selling property quickly have done well through the pandemic, holding property long- term is always the best strategy to build wealth. Even if you buy at the absolute peak of the market, keeping a property for a long time means that it barely matters. And having a fully owned home at retirement puts you in a vastly different situation to a renter. But how does property compare to other asset classes?

Bitcoin has topped the list over the past decade

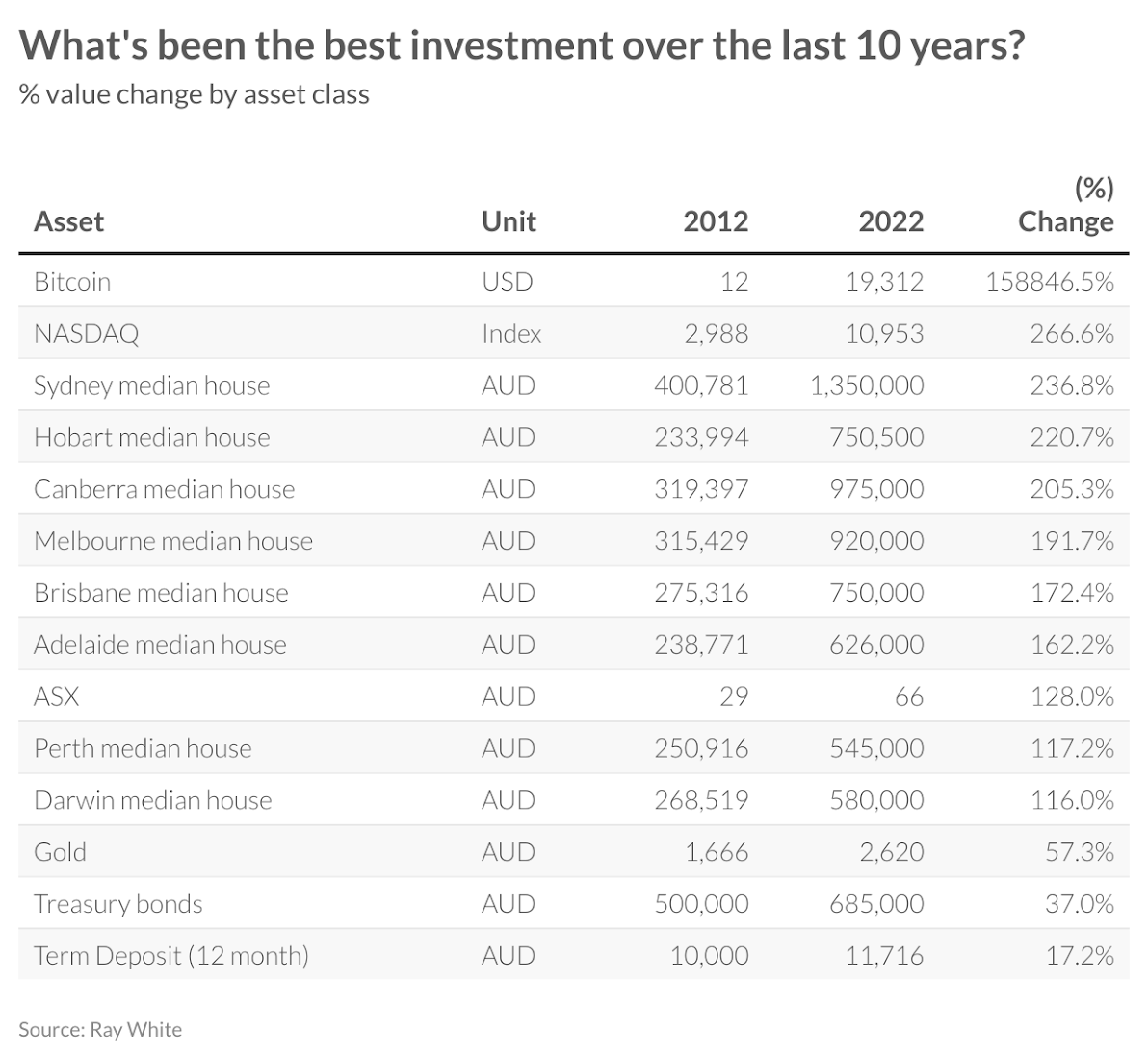

Working out the best performer by asset class is difficult for a number of reasons. When you buy it and when you sell it is critical. Entry and exit costs differ according to what you’re buying. For the share market we’ve used both the ASX and the NASDAQ, however different shares yield different returns. Similarly, you can’t buy a Sydney median-priced house, and house prices vary a lot across cities but also within suburbs. This analysis doesn’t provide a perfect comparison but does give an insight into what has performed well over the past decade and what hasn’t.

The star performer over the past decade has been Bitcoin, rising by close to 160,000 per cent. Generally seen as one of the most high-risk investments, it’s certainly paid off for anyone that invested a decade ago. At the opposite end of the spectrum are term deposits and Treasury bonds.

As opposed to Bitcoin, these are considered the most risk-free investments and their returns have reflected this. A term deposit would have only given you 12.7 per cent return over 10 years.

How did property fare over this time period? Sydney house prices have seen the most growth, up 237 per cent. They were narrowly beaten by the NASDAQ, a selection of US stocks. Hobart was also a top performer, followed by Canberra. In fact, most Australian capital cities did far better than the Australian share market. The ASX beat only Darwin and Perth over this time period.

Tax systems favour property investment and being an owner-occupier

Once purchased, the family home is a tax free asset in most of Australia (Canberra is switching from stamp duty to an annual land tax system). Buying a family home, instead of renting and investing in other asset classes, can mean much less tax is paid over time.

Property investing’s role in supply of rental properties also means some tax incentives are in place. In order to ensure a steady supply of rental housing, negative gearing and capital gains tax concessions are in place for those that buy rental properties.

Use of debt has made property the best performer for most people

While most people haven’t done well out of Bitcoin, a lot have done well out of property. One of the reasons is the use of leverage. Simply, using debt to buy a property has resulted in much better returns. When investing in other asset classes, debt is less often used.

Even small increases in the value of your home can lead to a much bigger financial gain than putting a deposit into alternative investments and then renting. As a very simple example, consider someone (let’s call him John) with $100,000 saved. John is considering whether to use his savings to get a mortgage and buy a $1 million home or put his deposit into a share portfolio instead. Both shares and housing are seeing the exact same capital growth of five per cent per annum. If John doesn’t buy a home, he will pay rent instead of paying off a mortgage.

After just one year, you already have a vastly different scenario. If John bought the house, the value of his home has increased by $50,000. Alternatively, the value of his shares would have increased by $5,000 - 90 per cent less than the capital gain of the house.

Renting long term puts you at a disadvantage given higher exposure to market fluctuations

Buying a first home is important, not just to get on to the property ladder but also because being a renter at retirement means that you are much more likely to be living in poverty. It’s also the case that being a renter makes you much more susceptible to market fluctuations.

Consider if you bought in Sydney 10 years ago, you would be paying less on your mortgage now for a home that’s worth double than what you paid for it. If you rented, you would be paying $9,360 more per year for a home that you hold no equity in.

Effectively, when you buy, you’re locking in repayments at the price you paid. Obviously, this will fluctuate according to interest rate changes but ideally over time you pay down your mortgage reducing this sensitivity. If you rent, then you will always need to pay market rent.

Nerida Conisbee, Ray White Chief Economist