Lower supply of properties underpins Spring auction results, but interest rates start to bite says Apollo Auctions

Contact

Lower supply of properties underpins Spring auction results, but interest rates start to bite says Apollo Auctions

A common theme from our auctioneers around the country is the lower supply of properties coming to the market in the middle of the spring selling season, which is no doubt helping to underpin results and clearance rates, according Apollo Auctions Director Justin Nickerson.

A common theme from our auctioneers around the country is the lower supply of properties coming to the market in the middle of the spring selling season, which is no doubt helping to underpin results and clearance rates, according to the latest Apollo Auctions Auction Report.

That said, it is clear that the seven cash rate increases in seven months are starting to impact both buyer and seller sentiment, Apollo Auctions Director Justin Nickerson said.

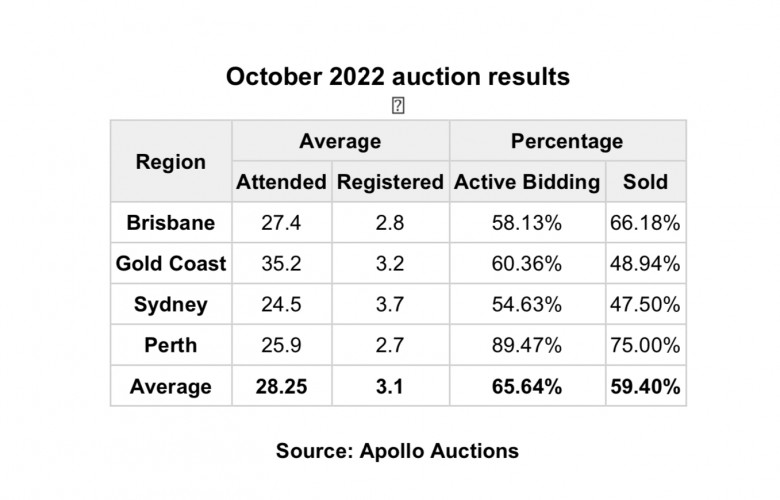

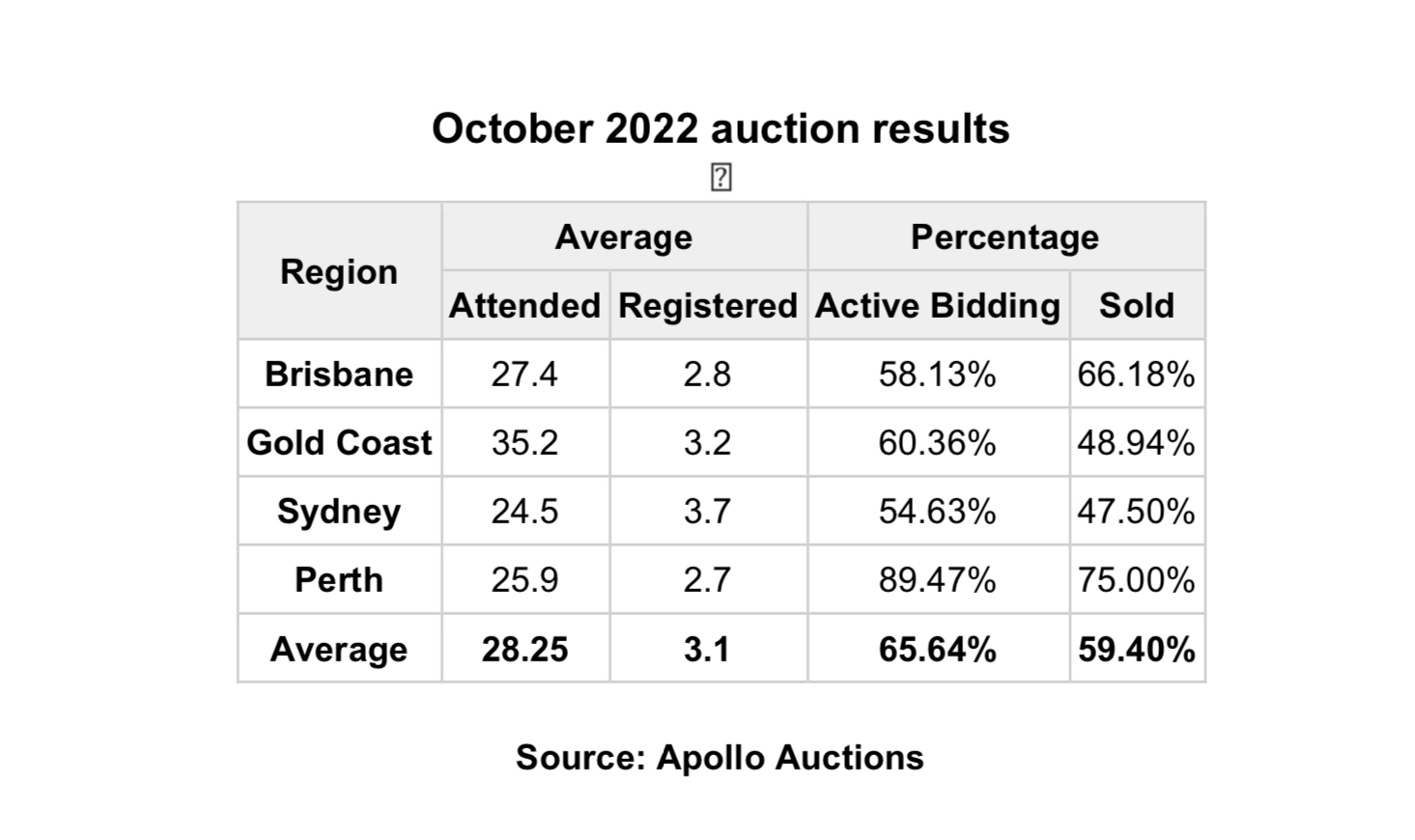

“During October, the average clearance rate across the four capital cities in this update moderated slightly – down to 59.50% from 63.1% last month – which is still within a healthy range,” Mr Nickerson said.

“Sydney’s auction market recorded a drop in the number of active bidders and in its clearance rate in October, however, the average number of attendees as well as registered bidders were stable over the month.

“In fact, all four capital cities recorded similar average attendance figures and registered bidders over the month. This shows that there remains robust demand from buyers with, perhaps, sellers’ expectations still needing to moderate more to meet the market so more properties can sell under the hammer.

“The standout cities in October continued to be Brisbane and Perth, with auction clearance rates of 66% and 75% respectively with the affordability of both cities continuing to assist with producing some stellar results for vendors.”

Source: Apollo AuctionsAccording to the Apollo Auctions team of auctioneers, there continues to be solid bidding for properties at auction with a common denominator being lower supply than usual for the spring selling season in October.

In Brisbane, this is still strong demand for newly built or recently renovated homes, according to the October auction market update.

This trend was expected with tens of thousands of people flocking to Brisbane and Southeast Queensland over the past two to three years and a lot of people choosing to initially rent before purchasing, Mr Nickerson said.

“On the Gold Coast, our local auctioneers headed by Mark McCabe have seen outstanding auction results in the multimillion-dollar market as well as the median $1 million market,” he said.

“It is becoming more commonplace to see one to two registered bidders competing at Gold Coast auctions, which for experienced agents and auctioneers is something we are quite used to, and the clearance rates at around 54 per cent show that success is still a more common outcome.”

In Melbourne, according to auctioneer, Andy Reid, the market is still managing to produce some brilliant results.

“The main reason for that is the significant drop in supply – down 50 per cent compared to the same time last year – in what would normally be the peak time for properties to list onto the market,” Mr Nickerson said.

“October saw some further changes in the Greater Sydney market, according to our local auctioneers in the Harbour City.

With the contraction of the gap between developer and owner-occupier spending in mid seven-figure to low eight-figure markets, campaign outlier offers slowing down, increased bidder registration, and activity across all markets, the “run to auction” rate in Sydney has increased, Mr Nickerson said.

“According to our Canberra auctioneer, Jenna Dunley, clearance rates in the ACT are still well above average, albeit a little lower than this time last year, while prices have still grown year on year,” he said.

“With uncertainty in the finance space, many experienced agents and sellers are looking to lock in a deal are choosing auction as the no-brainer avenue for success in Canberra.”

According to Perth auctioneer, Richard Kerr, low supply and media sentiment continue to be the predominant drivers of the market. However, this month saw a rise in the inability of some buyers to obtain finance when they had been previously pre-approved or even approved to purchase property.

“Sellers in the west are speaking of their preference for an auction campaign in the current climate, as whilst the volume of unconditional bidders may be slightly lower than their conditional rivals, they prefer the certainty of an unconditional bidder,” Mr Nickerson said.