Property Investors Seek Subdivision Opportunities in Slow Market

Contact

Property Investors Seek Subdivision Opportunities in Slow Market

According to Joe Hanna, Group CEO and Managing Director of PropTech Group, more property investors are turning to subdivision as an opportunity to unlock value even in a slow market.

With much of Australia's real estate market retreating from the highs set during the last year, more property investors are turning to subdivision as an opportunity to unlock value even in a slow market.

Especially if they have the assistance of a good agent, investors can purchase a single property into two or more with a higher total value.

Subdivision isn't for everyone because it can require some sophistication and a significant investment of time and patience.

I recently spoke with Sydney property investor Max Sim, who, with his wife, has invested in seven properties, including one that they subdivided in Maitland, near Newcastle.

"The best part is that we completed the build in under a year, and we had tenants in immediately," Sim told me. He said the worst part of the experience was having to spend months evaluating sites only to find that most of them did not fit their investing criteria.

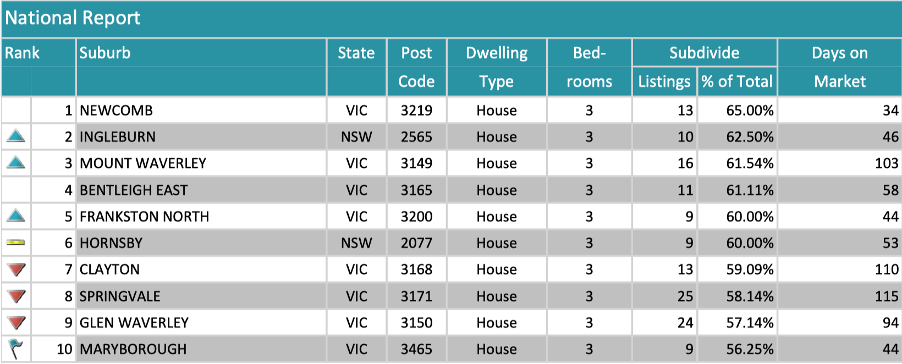

A new report from the PropTech Group's subsidiary Real Estate Investar helps investors overcome this obstacle. It identifies the top 50 suburbs in every state with the most subdivision opportunities.

The report ranks suburbs by the share of listings that are potential subdivision opportunities. Real Estate Investar identifies these opportunities by the presence of specific keywords in the listing description (like "two titles").

I was startled to find that eight of the ten suburbs with the most opportunities to subdivide are in my state of Victoria. Only two of the top ten are in New South Wales, and no other state ranks.

The suburb with the most opportunities to subdivide is Newcomb, Victoria. In Newcomb, the listing descriptions of 65% of the three-bedroom house listings during the past year have included keywords that indicate subdivision opportunities.

A typical listing in Newcomb is 11 Ferry Grove, which, as I write this, is listed with a price guide of $699,000 - $749,000. The first line of the property description by agent Yan Lin of Hayeswinckle East Geelong is "Invest, Reside or Subdivide."

Ingleburn, NSW, is the second-ranked suburb. Sixty-three per cent of three-bedroom house listings in Ingleburn over the past 12 months offer opportunities to subdivide.

Australia's third-ranked suburb is Mount Waverley, VIC, where 62% of three-bedroom houses marketed during the past year have presented subdivision opportunities.

Subdivision can unlock value because, in many cases, prices have not risen to account for the potential gains subdivision provides.

Subdividing takes time. If you buy when the market is low and then work through the legal process, the market may have turned for the better by the time the subdivision is complete. That would further increase your return on investment.

The benefits of subdividing can be higher profits, equity, and cash flow. Another advantage of having two smaller property investments is that if one goes untenanted for a while, the other can still provide cash flow.

There are risks, of course. If done inexpertly, you could accidentally reduce the total value of your holdings by creating less attractive blocks.

You can also face unexpected costs and delays.

Many savvy investors, however, have decided that subdividing is the right strategy for today's market.

By Joe Hanna, Group CEO and Managing Director of PropTech Group.