The slowdown we had to have?

Contact

The slowdown we had to have?

A slow down of the housing market will be a relief to most says Nerida Conisbee, Ray White Group, Chief Economist.

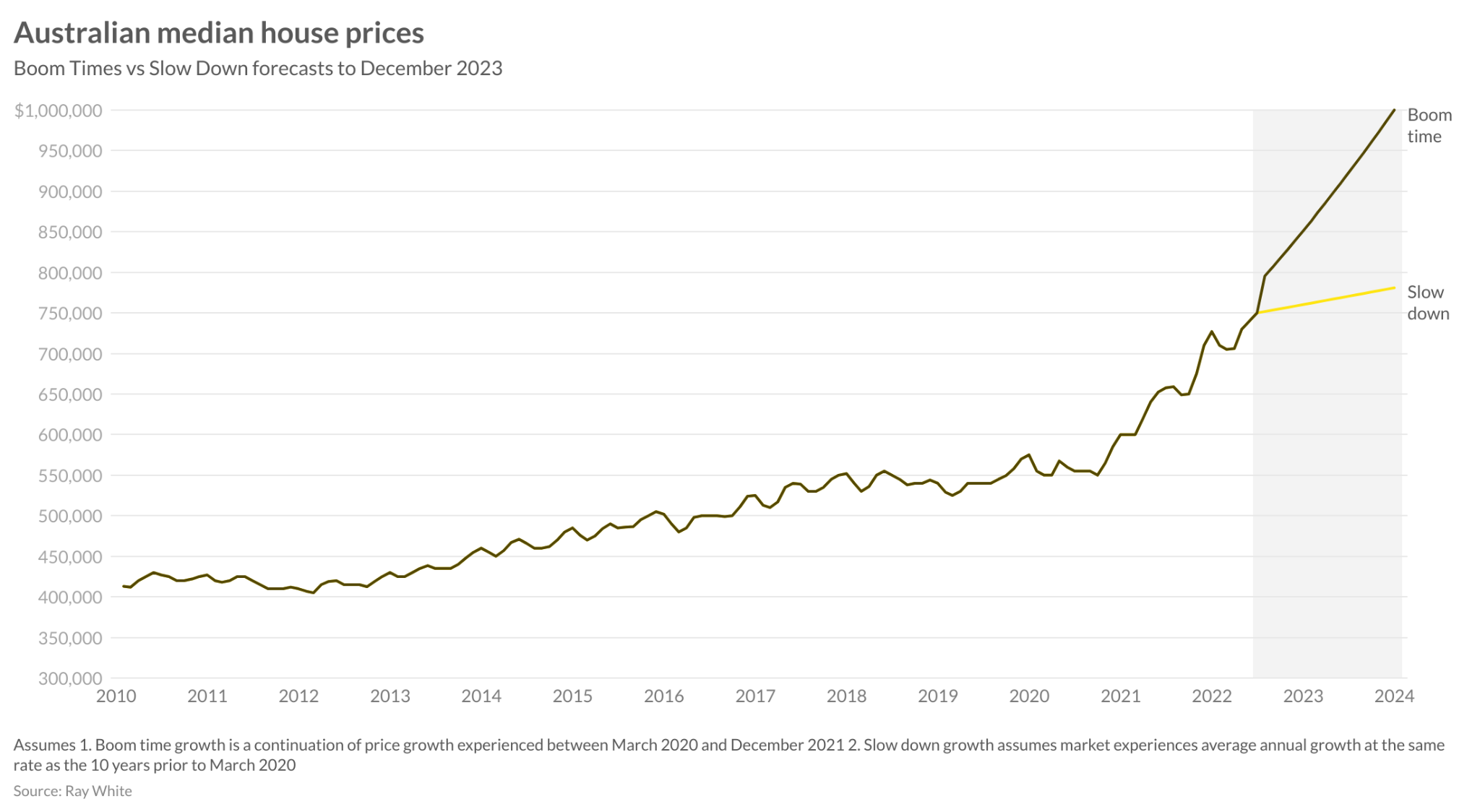

Australia’s median house price increased by 32 per cent from March 2020 to December 2021, making it the fastest period of price growth we have ever experienced.

Since the end of last year, the market has slowed considerably. Nationally, the median has gone up by 3.2 per cent over the past six months, however in Sydney and Melbourne, prices have come back 1.4 per cent in both cities.

Elsewhere conditions are still mixed - in Adelaide for example, prices have continued to climb at a fast pace. Depending on what data set you are using, the extent of the slowdown differs however there is consensus that as interest rates start to rise, we are at the start of a new cycle.

Strong inflation, rising interest rates and a subsequent economic slowdown that results in rising unemployment will be challenging for pretty much everyone. A slow down to fast house price growth in contrast will be a relief to most.

Australia’s median house price would have hit $1 million by the end of next year if growth continued at the same rate as it did through most of 2020 and all of 2021. Sydney’s median, already at $1.38 million would have exceeded $2.2 million in less than 18 months. Clearly this red hot growth had to finish at some point.

It is nice to see the value of your home increase but high levels of house price growth over a short time period is challenging for a number of reasons. Australia has ranked low in global housing affordability rankings for some time now and debt levels have risen to record levels.

Many first home buyers feel increasingly locked out of the housing market, particularly those that can’t rely on help from family. Lack of affordable housing is a challenge for government at all levels, is expensive to fix using tax incentives and politically unpopular to use planning policy.

Most sellers are subsequent buyers and a fast moving market makes selling and buying stressful. Most people hold property long term and fluctuations in the market year-to-year often make very little difference to overall performance over the hold period.

For now, we are seeing very little evidence that the market will see a sharp correction in pricing. Distress is still not evident among homeowners and banks are well capitalised. Investors are no longer seeing sharp capital gains but rental returns have increased. Alternative investments such as shares are seeing very high volatility. Large increases in construction costs will keep housing costs higher than they otherwise would.

Overall the market isn’t free falling and we are continuing to move into a much more normal market than what we have experienced over the past two years.

This opinion piece written by Nerida Conisbee, Ray White Group, Chief Economist.