What can go wrong when converting management authorities – A case study

Contact

What can go wrong when converting management authorities – A case study

There is often a great misunderstanding of the processes when selling a rent roll specifically as to what constitutes the sale of the portfolio.

There is often a great misunderstanding of the processes when selling a rent roll specifically as to what constitutes the sale of the portfolio.

To some sellers, signing the Management Authority in favour of the buyer and handing over the management file is all that is required; however, nothing is further from the truth.

As rent rolls are a bankable asset, the level of compliance and due diligence has increased significantly in line with buyer’s knowledge of the asset class.

The level of due diligence demanded by buyers has increased to such a level, it has caught many sellers off guard by this “new world order”. Interestingly, higher levels of due diligence are more evident from rent roll aggregators in comparison to smaller operations.

Given the challenges with a recent transaction, we wish to share a case study of the financial risk when not following due process.

A client engaged us to sell a small portfolio of 120 managements as they were exiting the industry. We provided the client with a comprehensive pre-market Due Diligence Checklist to be reviewed for each management file before going to market. Upon concluding our Valuation, we identified several areas of the portfolio that needed attention, including but not limited to: incomplete tenancy applications, inaccurate/incorrect bonds, incomplete property condition reports and a moderate amount of rent arrears over seven (7) days.

As sale contracts include provisions ensuring the above items are up to date and comply with Fair Trading, it is fundamental for sellers to meet these obligations to maximise their sale price.

This is the key take out from this case study; if a management file is incomplete or does not comply with legislation, even when the Management Authority is signed in favour of the buyer, the Management Authority is not for paid for until it complies.

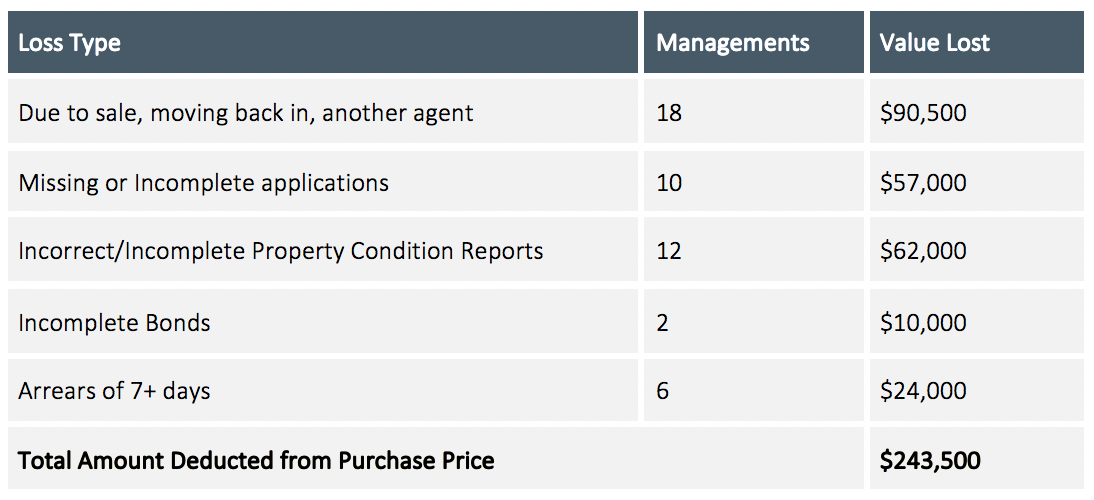

Given our client's approach to the conversion of the managements, the losses were as follows:

This demonstrates the need for sellers to ensure they follow the due diligence processes in place to maximise their sale price and retention during a rent roll sale.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

Similar to this:

Demand surges for rent rolls off the back of pandemic

Proof is in the pudding - Why small management portfolios fail