Which regions have seen the highest rent value increases over the year? - CoreLogic

Contact

Which regions have seen the highest rent value increases over the year? - CoreLogic

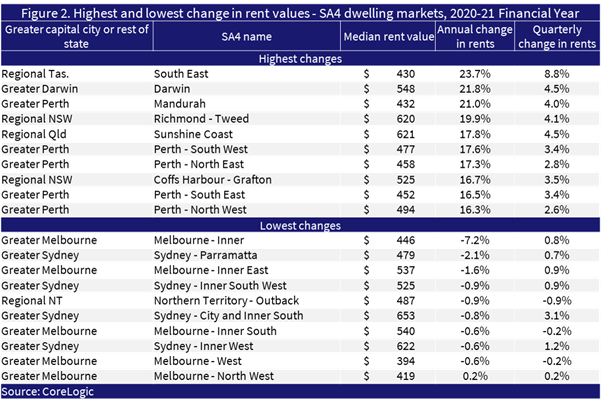

CoreLogic data across 88 SA4 markets₁ shows that, as with the current housing market upswing, rental market increases have been broad-based. Annual rent increases were observed across 79 of the 88 SA4 markets analysed, ranging from a 0.2% rise in the North East and North West Melbourne rent markets, to a 23.7% increase in rent values across the South East of Tasmania.

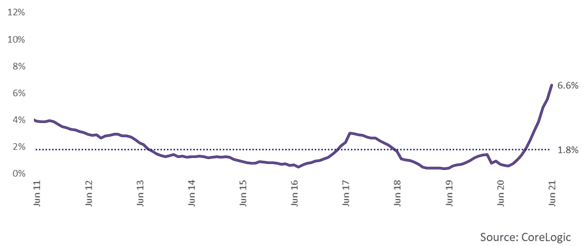

The CoreLogic Quarterly Rental Review for June showed a strong uplift of 6.6% in rent values over the year. This follows a decade of relatively subdued annual rent growth, averaging 1.8% since June 2011. The annual growth rate of 6.6% marked the strongest annual uplift in over a decade.

CoreLogic data across 88 SA4 markets₁ shows that, as with the current housing market upswing, rental market increases have been broad-based. Annual rent increases were observed across 79 of the 88 SA4 markets analysed, ranging from a 0.2% rise in the North East and North West Melbourne rent markets, to a 23.7% increase in rent values across the South East of Tasmania.

Areas which had seen a decline in rent values over the year were largely concentrated across Greater Sydney and Greater Melbourne, with the exception of a slight decline in Outback Northern Territory rent values.

Figure 2 outlines the highest and lowest gains in rent values for the 2020-21 financial year, while the full list of SA4 results is provided in figure 5. Among the top 10 regions for annual growth in rents were five Perth markets, Darwin, and regional, lifestyle markets of Australia.

Figure 1. Rolling annual growth in rent values and decade average, national dwellings

The South East of Tasmania tops the list with rent value growth of 23.7%. Applying this growth figure to the median rent suggests an increase of $83 per week in rent over the year. The region has seen a -19.3% decline in total rent listings counted over the June 2021 quarter, compared with June 2020. Net internal migration data suggests for the year to June 2020, the South East region saw a positive migration trend, of an additional 660 people moving to the region from other parts of Australia. Historic overseas migration to the region has also been positive, and may have contributed to upward pressure on rent values. While regional migration data is lagged to the previous financial year, more recent provisional migration estimates also shows positive internal migration across regional Tasmania more broadly.

Greater Perth is comprised of six SA4 submarkets, five of which are featured in the top 10 list for annual growth in rental values. Across these five regions, rental markets have tightened significantly in the past year, seeing an average decline of -29.5% in rental listings counted between the June 2020 and June 2021 quarters. In the case of Mandurah, the volume of rental listings had declined over -40%. Detailed ABS employment data suggests that each of these regions had also seen an uplift in employment across the mining industry over the past 12 months, which may have added to the demand for rental properties in these markets.

It is also worth noting for Perth and Darwin rental markets that strong uplifts in rent values may be exacerbated by a longer term retreat of investor activity. In 2014, a shift in housing demand was created by a decline in mining activity, and subsequent mining employment. Available rent listings (figure 3), and investor financing for the purchase of housing, trended down fairly consistently through the late 2010s, as investors responded to a fall in rental returns. The recent uplift in housing demand may be exacerbated across Perth and Darwin by this backdrop of slowly dwindling rental supply.

For more information, visit www.corelogic.com.au.

Similar to this:

CoreLogic: National rents record highest annual growth in over a decade

Mortgage serviceability cheaper than renting on over a third of Australian properties - CoreLogic

Federal budget 2021-22: Increasing home ownership on the coalition’s terms - CoreLogic