Reasons to consider building an investment property - BMT

Contact

Reasons to consider building an investment property - BMT

BMT Tax Depreciation look at how to get into the property investment market by building from scratch.

Are you a seasoned investor, or are you looking to get a foot on the property investment ladder?

Whatever the case, building a property from scratch mightn’t be your first choice. If your research shows it might be a good option for you, don’t make the mistake of putting it in the ‘too hard basket’.

Why build an investment property?

Building an investment property takes much more time than simply purchasing an established dwelling. Investments are here to make you money, so what’s the point of waiting?

To put it simply, it’s a game of short-term pain for long-term gain.

It’s no secret that newer properties attract the quality tenants. Plus you will often find that you can charge a higher rental rate compared to older properties in the area. The capital growth of the property will also likely work in your favour. When combined, these factors outweigh the pitfalls of putting cash flow on hold while the property is built.

Depreciation deductions when building an investment property

Depreciation deductions are amplified for new properties. They allow the investor to choose assets that will result in higher deductions sooner.

For example, if you installed a rangehood worth $350 you could receive a first-year deduction of approximately $58 using the diminishing value method. But say you instead installed a cheaper fan worth $295 you could claim the full $295 in the first year with the immediate deduction.

The deductions you can claim over the entire time you use the newly built property as an investment will also be significantly higher compared to an established dwelling.

This is due to a number of factors. First you can claim capital works deductions on the whole property for up to forty years. Capital works deductions are claimed on things like the structural component and fixed assets.

You can also claim depreciation on all of the plant and equipment assets in the property. New properties aren’t impacted by the 2017 legislation changes so this adds more money to your pocket.

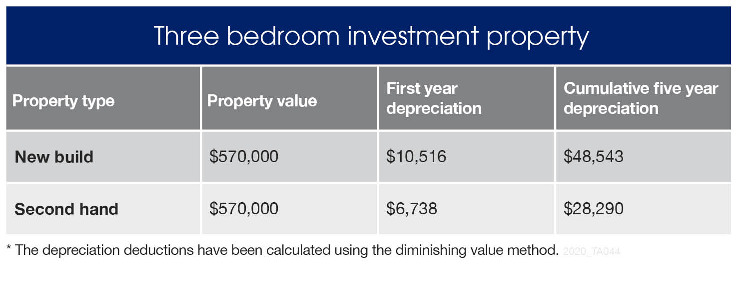

If you’re sceptical, the table below shows the difference in depreciation deductions for a new and second-hand property with the same values.

In the first five years alone, the newly built property generates $20,000 more in depreciation deductions than the second-hand property.

It’s worthwhile to get a depreciation estimate from a specialist quantity surveyor, such as BMT Tax Depreciation, when you start building your investment property.

They can help ensure you build the property that will generate the highest depreciation deductions possible. Whether your strategy is to get higher deductions in the earlier years of ownership, or more uniform deductions over time, BMT will point you in the right direction.

BMT provide obligation-free depreciation estimates for any type of property. To learn more, contact the team on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

This is a sponsored feature article.

Read more from BMT Tax Depreciation:

Data shows more than 12% of property investors are completely missing out - BMT

Tips for finding the perfect investment property in 2021 - BMT