CoreLogic’s Q1 Rental Review reveals diversity of rental conditions

Contact

CoreLogic’s Q1 Rental Review reveals diversity of rental conditions

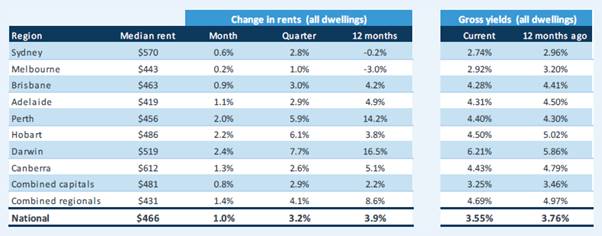

CoreLogic’s Rental Review for the March 2021 quarter revealed a surge in national rental rates of 3.2% however the drivers of this growth are diverse, with the regions, Darwin and Perth collectively driving much of the increase.

CoreLogic’s Rental Review for the March 2021 quarter revealed a surge in national rental rates of 3.2% however the drivers of this growth are diverse, with the regions, Darwin and Perth collectively driving much of the increase.

Across the combined regional markets, rents rose 4.1% in the first quarter of the year while rents in the combined capitals increased 2.9%. Regional units recorded the highest quarterly rental growth of 4.8% compared to the 2.0% rise in capital city units. Capital city house rents were up 3.3% while regional houses rose by a higher 4.0% in the three months to March.

Houses and units in Darwin showed the strongest growth in rental rates over the quarter, up 8.2% and 7.0% respectively.

CoreLogic’s Research Director Tim Lawless, says “While housing rents are rising at the fastest pace since 2007, the headline reading hides the sheer diversity of rental conditions around the country. At one end of the spectrum we have Perth and Darwin where annual rental growth is well into double digits and accelerating. At the other end is Melbourne and Sydney where rents are down over the year.

“The annual decline in rents across Australia’s two largest cities is attributable to falling rents in the unit sector, where closed international borders have created a demand shock in a market that was already challenged by high supply. Melbourne unit rents have fallen by -8.2% over the year and Sydney unit rents are -4.9% lower.

“Some inner city precincts of Melbourne have seen unit rents fall by more than -20% over the past 12 months. Prospects for a material improvement in rental conditions across these inner city high density precincts are largely dependent on a return of tenancy demand from international students and visitors, who were previously a key component of rental demand.

“Although rents are generally rising, housing values have been rising at a faster rate which has seen rental yields compress across most of the capital cities. The exceptions are Perth and Darwin where rents have risen at a faster pace than housing values, driving a rise in yields. The opposite is true in Sydney and Melbourne where rental yields are plumbing new record lows.

“Outside of Sydney and Melbourne, with mortgage rates so low, yields are generally high enough to provide investors with positive cash flow opportunities from the outset,” says Mr Lawless.

Key highlights – March Quarter

- National rental rates rose by 3.2% over the first quarter of 2021; the largest quarterly increase in the national rental index since May 2007.

- Combined capital city dwelling rents rose 2.9% in the March quarter, while regional rents increased 4.1% over the same period.

- Unit rents rose across both regional and capital city markets, with regional units recording the highest quarterly rental growth of 4.8% compared to the 2.0% rise in capital city units.

- Capital city house rents were up by 3.3% over the three months to March 2021 and rents across regional houses rose by a higher 4.0% quarterly.

- Houses and units in Darwin show the strongest growth in rental rates over the quarter, up 8.2% and 7.0% respectively.

- Canberra was not only the most expensive market to rent a house across the capital cities, but also the most expensive capital city unit rental market in the quarter at $513p/w.

- Melbourne recorded the weakest growth in rents over the three months to March 2021, with house rents up 1.6%, while unit rents were unchanged over the quarter.

- National gross rental yields were recorded at 3.55%, down from 3.71% over the December quarter and 3.76% a year earlier as dwelling values outperform rental growth.

- Darwin was the highest yielding capital city, up 21 basis points over the month to 6.21%. Sydney remains the lowest yielding at 2.74%.

For more information or to buy the Quarterly Rental Review report click here.

Similar to this:

Top 10 areas for greenspace in Sydney revealed - CoreLogic

How do dwelling values compare with previous highs? - CoreLogic

Busiest week for auctions since the week prior to Easter 2018 - CoreLogic