How do dwelling values compare with previous highs? - CoreLogic

Contact

How do dwelling values compare with previous highs? - CoreLogic

Low mortgage rates, a swift economic recovery, which has spurred consumer sentiment, and low listing volumes have catapulted national housing values to new record highs. By Eliza Owen, Head of Research Australia at CoreLogic.

Low mortgage rates, a swift economic recovery, which has spurred consumer sentiment, and low listing volumes have catapulted national housing values to new record highs.

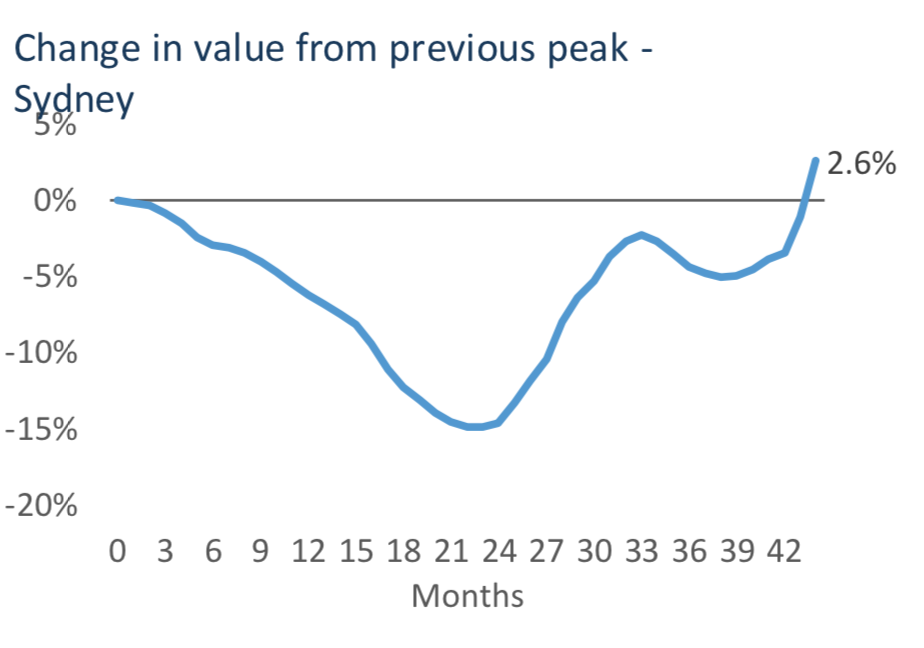

At the end of March, the CoreLogic national home value index increased a further 2.8%, placing values 5.6% above the previous market peak in October 2017.

The combined value of Australian dwellings hit $7.9 trillion dollars over the month, according to CoreLogic. This cements residential property as an extremely large and important asset class.

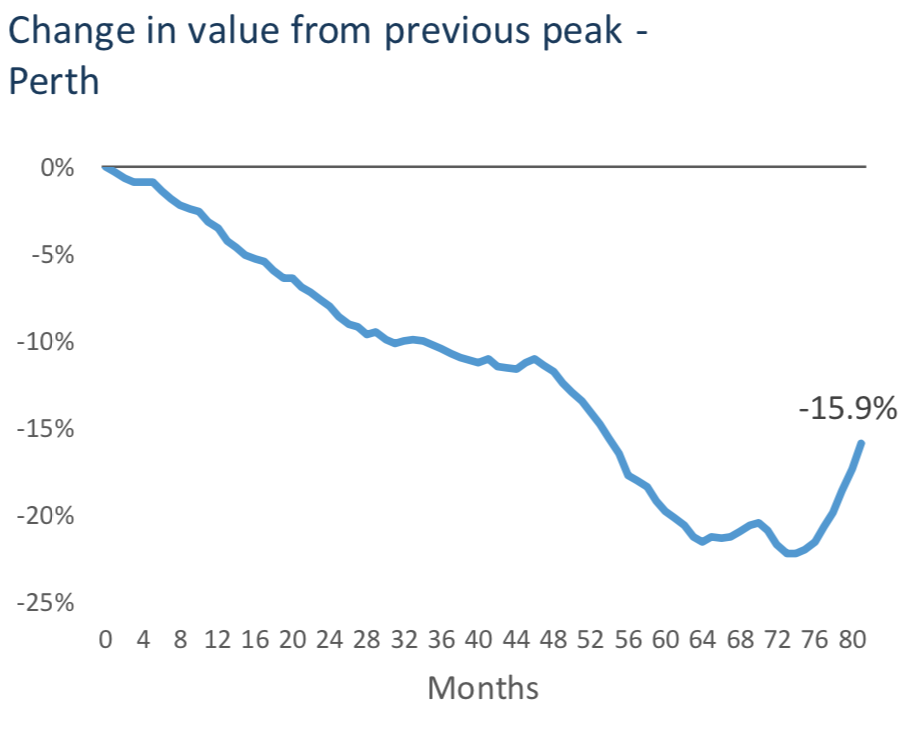

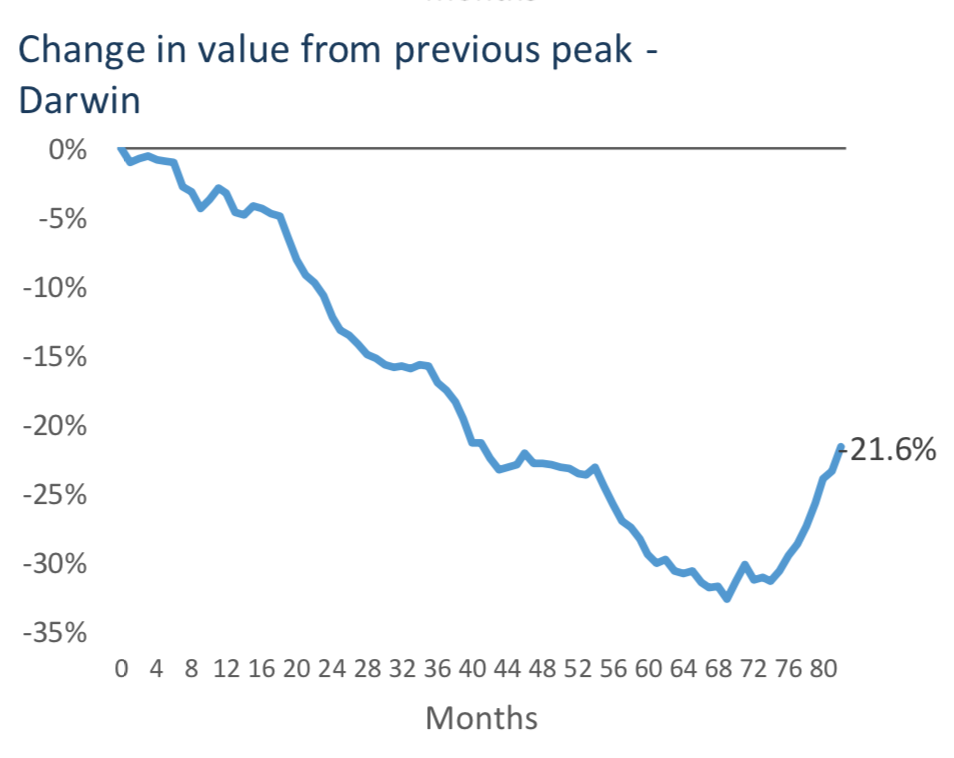

Comparing current capital city values with previous peaks adds some perspective to the current upswing particularly in Perth and Darwin, where values remain substantially below their record highs from 2014.

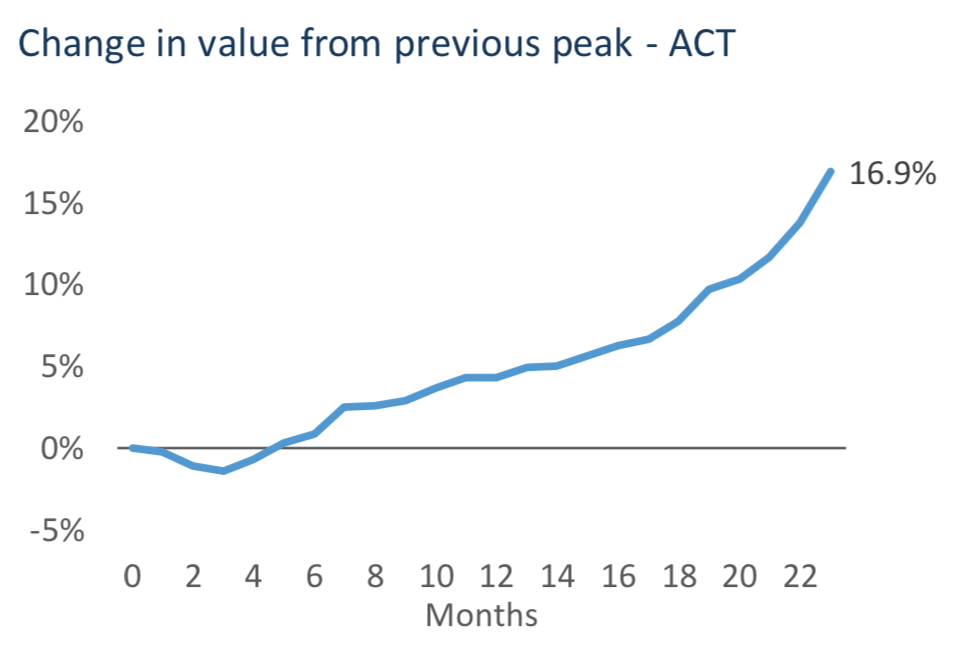

It also highlights the very different dynamics across capital cities such as in the ACT, where dwelling values have hit a new record high every month for 19 months.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

This article was first publsihed by CoreLogic.

Similar to this:

Australian housing prices soar by 500% over past 25 years - REIA

Busiest week for auctions since the week prior to Easter 2018 - CoreLogic