Market activity returns to pre-COVID-19 levels in Tasmania: REIT

Contact

Market activity returns to pre-COVID-19 levels in Tasmania: REIT

The REIT's September Quarterly Report shows market activity is on target to achieve a ninth successive record year.

The September Quarterly report for the Real Estate Institute of Tasmania (REIT) has outlined what the real estate market was hoping to see - that market activity has returned to pre COVID-19 levels and is on target to achieve a ninth successive record year of accumulated sales value.

This year it will exceed $4.1 billion.

At a Glance:

- 2959 property sales have been made, worth $1.1 Billion.

- House sales were up 32 per cent (to 1807), Units and Townhouses up 39.1 per cent (to 388) and land sale increased a massive 70.1 per cent (to 723).

- First Home Buyer (FHB) sales increased 48.4 per cent over the quarter to 518 sales. 301 FHB, acquired homes, 69 Units, and 148 land.

Interstate buyers continue to maintain a low profile acquiring just 290 properties which is 70.7 per cent below pre COVID-19 levels.

Traditionally mainland buyers represent 20 -23 per cent of total sales but today represent just 9.8 per cent.

Throughout 2020, the Tasmanian real estate market has been driven by Tasmanians who accounted for more than 90 per cent of all transactions.

Source: REIT

The lack of properties for sale has seen unprecedented pressure placed on prices which continue to rise.

Many buyers have given up on trying to find an established home and have turned to buying vacant land in the hope of building the home they want.

The fact that 1705 land sales have occurred this year should provide confidence to the Government and the building industry for the future ahead.

On the flip side, a decrease in investment in rental property is of real concern and will place pressure on this already overwhelmed resource.

Whilst acquisitions by investors increased 43 per cent to 419 sales this is still well below the previous year averages.

Source: REIT

Obviously the legislative COVID-19 protections for tenants have severely impacted investment in rental property.

Throughout the September quarter, both major real estate portals reported that Tasmanian property received the highest number of viewings of any state.

This suggests Tasmania can expect an influx of people looking to migrate or invest on the Apple Isle.

There is no evidence to suggest that prices on owner occupied property will decrease in the immediate future.

Million Dollar sales are up 24 per cent on last year to 163 sales with local buyers responsible for 82.8 per cent of these acquisitions.

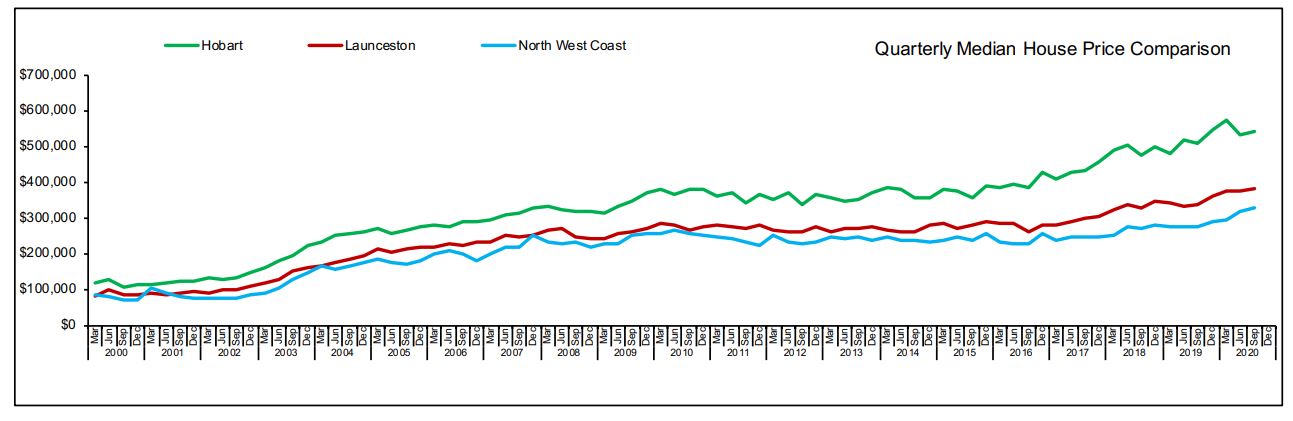

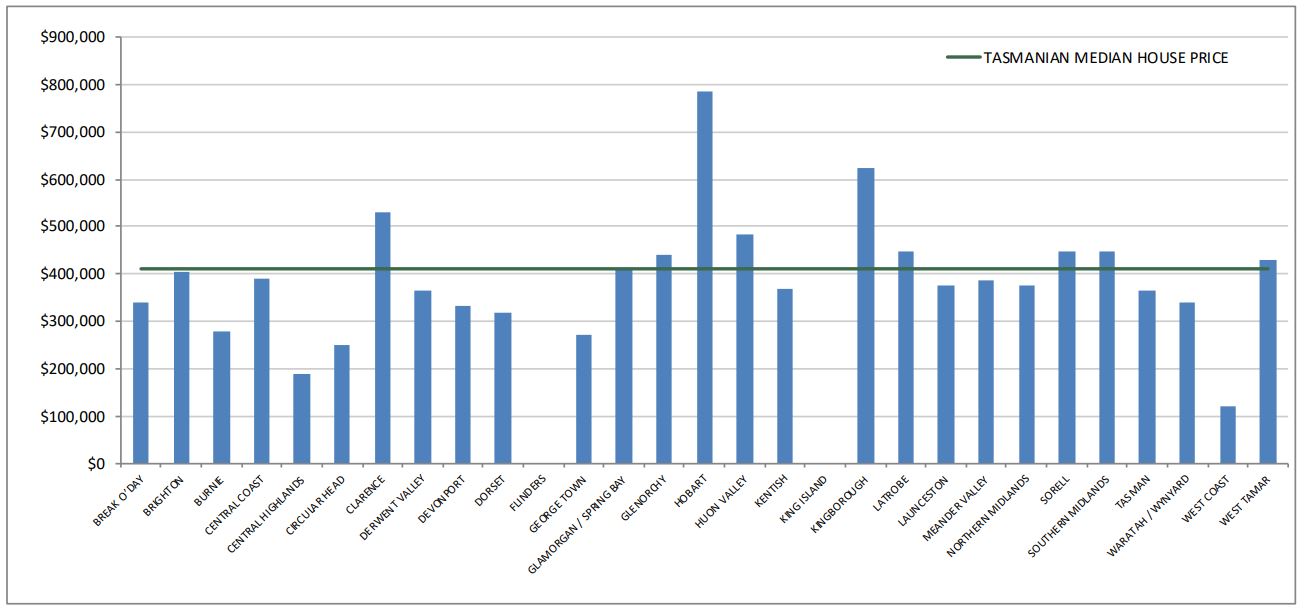

House sales numbers and median prices across all major population centres increased in number over the quarter. Greater Hobart’s median price grew to $545,000, Launceston to $383,500 and the North West Centres to $330,000.

Rentals

The rental market continues to perform also.

Vacancy rates are steady and the median rents for houses increased across the State:

- Hobart 2.2 per cent - 3-bedroom home $450 per week

- Launceston 1.9 per cent - 3 bedroom home $360 per week

- North West 2.5 per cent - 3 bedroom home $310 per week

Best performers

Devonport recorded the highest number of sales for the quarter (64) as a suburb with median sale price being $330,500.

Launceston was the highest performing municipality around the state with 344 sales.

The most affordable suburbs are located in the North West with Roseberry and Queenstown representing with a median sale price around $100,000.

All regions continue to suffer from an acute shortage of properties to sell.

Strong buyer demand and a lack of stock to fill their need will continue to put upward pressure on prices.

To find out more about the report, click here.

Similar to this:

Tasmanian sellers 'need to readjust expectations', says REIT

House sales increase across Tasmania

Tasmanian housing debt deal needs to be managed carefully, says REIT