REIA welcomes mortgage repayments resumption across the nation

Contact

REIA welcomes mortgage repayments resumption across the nation

REIA says resumption of mortgage repayments on nearly half the deferred mortgages and small business loans is a promising sign for the economy.

The Real Estate Institute of Australia (REIA) has today welcomed the announcement by the Australian Banking Association that repayments have resumed on almost half of deferred loans for mortgages and small businesses.

President of REIA, Mr Adrian Kelly, said the news is a promising sign for agents, and players in the property market and the economy as a whole.

At a Glance:

- Banks to work with customers using 'fire sales' as a last resort as mortgage repayment resumes

- REIA underlines importance of investors and property owners engaging with their lender

- Continuance of support program, such as JobSeeker and JobKeeper, important

“The resumption of repayments in about half the cases is an encouraging sign that mortgagees will not be facing a cliff that some anticipated a few months ago,” said Mr Kelly.

“The banks’ commitment to working with customers is welcomed; and suggests fire sales will be an absolute last resort as the recovery commences.”

Mr Kelly reiterated the finance sector’s call to for investors and property owners to engage with their lender.

“Talk to your banks early and often,” said Mr Kelly.

Mr Kelly said there are still a range of factors that will have an impact on the Australian property market yet to play out.

“In June 2020 in excess of 80 per cent of Australian real estate professionals had identified the need to extend JobKeeper, JobSeeker and rental support,” said Mr Kelly.

“The continuance of support programs for property owners and tenants will be critically important as they will be relying on it for mortgage restarts.”

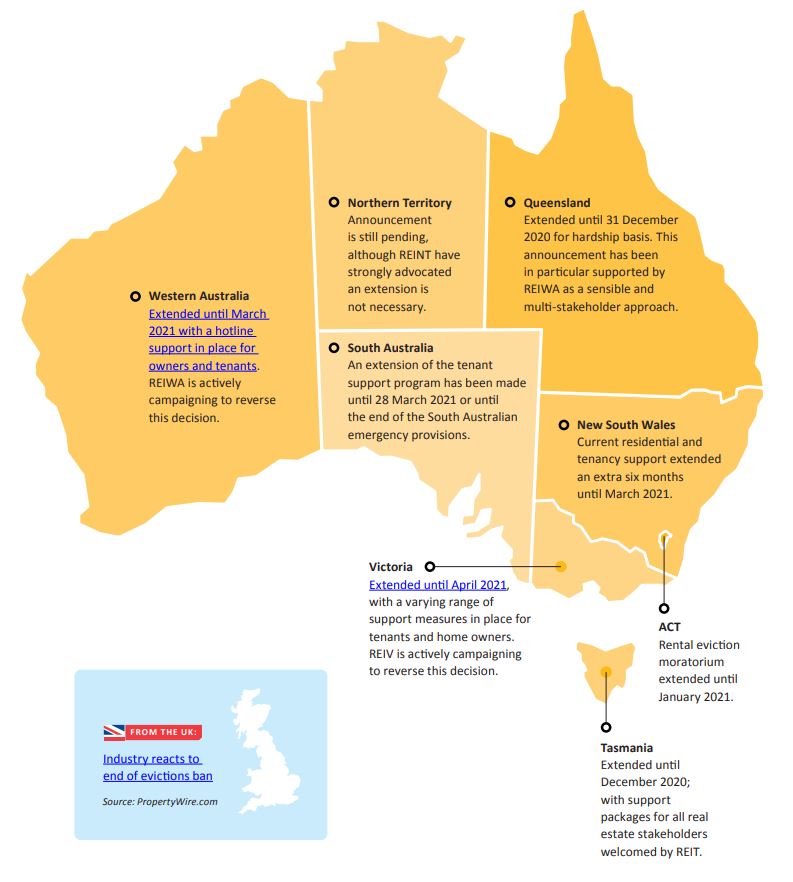

“Another major factor is the progressive end to rental eviction moratoriums which range from now in Queensland through to the end of March 2021 in Victoria.”

REIA’s authoritative guides on the Australian property market – the Housing Affordability Report and Real Estate Market Facts – will be published in December 2020 and will highlight the ongoing impact of the Covid-19 public health and economic response for all players in the real estate market.

Similar to this:

How has COVID-19 affected mortgage lending?