What Spring selling season will look like under COVID-19

Contact

What Spring selling season will look like under COVID-19

Eliza Owen of CoreLogic highlights the activity and patterns of real estate activity in the lead up to the industry's busiest time of year.

Spring is just around the corner and usually the busiest time for the real estate industry.

What is usual in 2020, however, is not what it has been in the past.

CoreLogic data has highlighted amid the pandemic the significant slowdown of transaction activity in response to COVID-19 restrictions.

At a Glance:

- New listings fell 50.3 per cent from mid-March to early May

- In the four previous years new listings rose 6.3 per cent between late July to late August

- This year the equivalent period has seen a 9.6 per cent decline in new listings nationally

The resulting loss of employment, lower consumer sentiment and border closures have had a much larger impact on the number of properties marketed and sold, than property prices themselves.

This was seen from the Stage 2 restrictions implemented from March 25.

Source: CoreLogic

New listings fell 50.3 per cent from mid-March to early May.

This exacerbated the seasonal dip in for sale listings throughout March and April.

According to Eliza Owen, Head of Research Australia, CoreLogic, Melbourne has reached the halfway mark of its Stage 4 restrictions in late August and national listings activity has completely diverged from the usual listings patterns in the lead up to Spring.

"In the 4 years prior to the pandemic, the number of new properties listed for sale nationally has, on average, increased 6.3 per cent between late July and late August," said Ms Owen.

"This year however, the equivalent period has seen a 9.6 per cent decline in new listings nationally.

"Unsurprisingly, this can be attributed to a sharp fall in new listings across Melbourne."

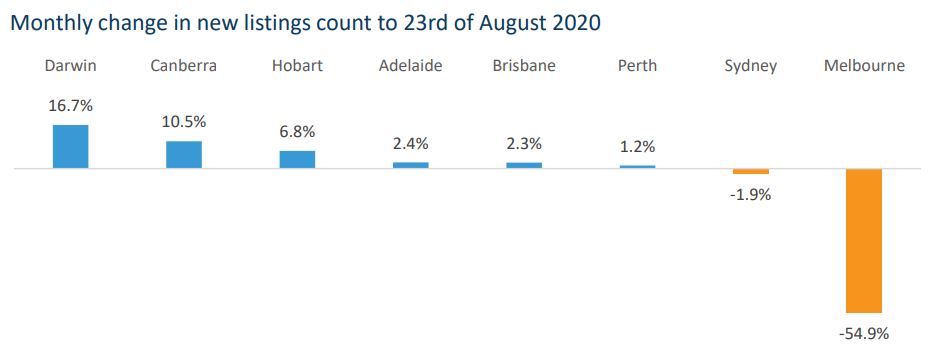

The decline in new listings across Melbourne’s property market was 54.9 per cent in the month to August 23rd, accounting for over 100 per cent of the national decline.

Conversely, most other capital cities saw an increase in new listings, as greater levels of consumer confidence, and lower levels of COVID-19 cases, saw vendors ramping up for the spring selling season.

Across Sydney however, new listings had also started to slip marginally.

The severe drop-off in listings is validated by a fall in the number of comparative market analysis reports generated across CoreLogic platforms by real estate agents in Victoria.

The average number of reports generated per week in Victoria fell 24.6 per cent from July over the month of August to date.

Source: CoreLogic

Why do transactions slow in times of strict social distancing?

The reasons for slowed transaction activity during COVID restrictions are two-fold.

The first is the physical limitation of buying and selling property under social distancing rules.

Property sales may be less scalable as fewer people can physically inspect, show and value property.

The second is the economic uncertainty generated by stage 4 lockdowns.

As consumption falls and unemployment spikes, vendors feel less confident selling their property and getting their desired price.

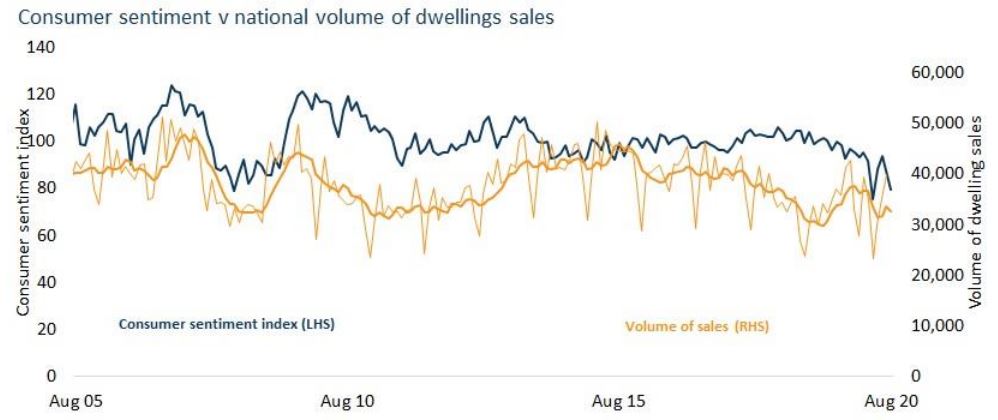

This is further supported by the close movement exhibited between sales volumes and the consumer sentiment index.

Significant falls in monthly sales volumes have closely aligned with this indicator.

Source: CoreLogic, Westpac-Melbourne Institute

The drop in sales volumes in times of high economic uncertainty, such as around the GFC and the national Stage 2 restrictions in March and April, indicates sellers and buyers are less likely to participate in property transactions during negative economic shocks or periods of heightened uncertainty.

Additionally, a vital part of the tight lid on new listings has been mortgage repayment deferral offerings from banks.

This has meant that people who cannot currently service their mortgage do not have to list as a distressed or motivated seller.

This dynamic may change in the lead up to March 2021, when banks may need to end repayment deferrals.

Property owners who have deferred their mortgages, but are not in a position to reinstate their repayments by the end of March, may decide to offload their property in the lead up to this expiry date.

It’s reasonable to expect mortgage arrears will increase from currently low levels, which could gradually see a larger number of distressed listings come on the market.

Industry should brace for a subdued selling season

The intention to sell and buy property is evidently linked to consumer confidence, which in turn has been influenced by case numbers of COVID-19, and the stringency of government response in impacting economic activity.

The initial restrictions through March and April saw a sharp drop in listings nationally, but these recovered quickly.

A similar pattern was seen in sales volumes.

The low cost of debt and strong recovery in consumer confidence created pent-up demand for property as Australia got ahead of the virus curve.

This was perhaps one of the few ‘V-shaped’ recoveries observed amid the pandemic.

However, once restrictions are repealed in Melbourne this time around, the recovery in transaction activity is likely to be weaker.

That is because employment is taking another hit, consumer sentiment is dampened by the reality of a second outbreak of the virus, and a reduction in fiscal support is only a month away.

Ultimately, the second round of restrictions across Victoria is likely to create a weaker ‘spring selling season’ than in previous years.

Similar to this:

LJ Hooker to open seven new offices in time for a busy spring selling season

What to expect this spring property season

To buy or not to buy… is spring the season to purchase property?