Strong sales at auctions as prices above reserves achieved: Market Wrap

Contact

Strong sales at auctions as prices above reserves achieved: Market Wrap

Capital city sales are showing strong interest at auctions again, according to Brad Gillespie of The Agency in Sydney and Brad Pearce of Miles Real Estate in Melbourne.

In Sydney this week, there was a surprising sale in the unit market with 106/828 Elizabeth Street, Waterloo going under the hammer through The Agency's Brad Gillespie.

It sold on Saturday and was considered a surprise as it is in a particularly high investor area which has been hit by COVID-19.

"Waterloo has a high level of investment properties, but this auction absolutely bolted on Saturday," said Mr Gillespie to WILLIAMS MEDIA.

106/828 Elizabeth Street, Waterloo sold above reserve through The Agency's Brad Gillespie. Photo: The Agency

"There were 15 registered bidders on Saturday and the opening bid was above the price guide at $800k.

"The price guide was $790k.

"This high bid tactic has not been seen for some time."

Mr Gillespie said there was a crowd of over 60 people and 20 contracts out on the property.

"It sold for $941k, that was $91k above reserve," said Mr Gillespie.

"There has been an increase in people coming through open homes, this combined with stock levels being low, is creating competition.

"This property had 186 groups through prior to the auction."

In Victoria, a very strong sale was achieved for a townhouse at 3/5 Jolliffe Crescent, Rosanna that went more than $200k over the reserve at auction, through agent Brad Pearce of Miles Real Estate.

3/5 Jolliffe Crescent, Rosanna sold above reserve through Brad Pearce of Miles Real Estate. Photo: Miles Real Estate.

"It was on the market for 28 days and we had 120 groups through at that time," Mr Pearce told WILLIAMS MEDIA.

"There were 4 bidders on the day with the reserve set at $1,050 million but it finally sold for $1,275 million."

Auctions

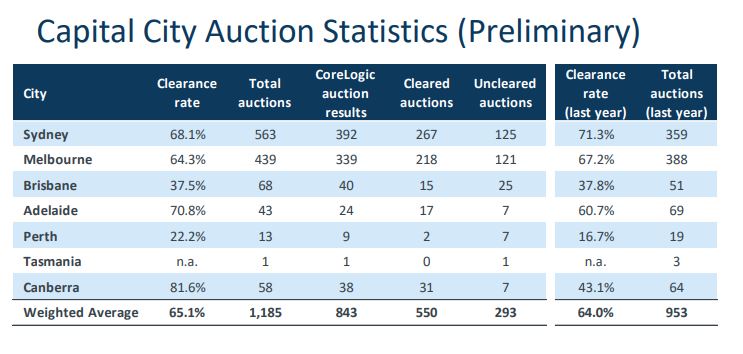

CoreLogic has reported that auction volumes were down week on week across the combined capital cities, with a total of 1,185 homes scheduled for auction.

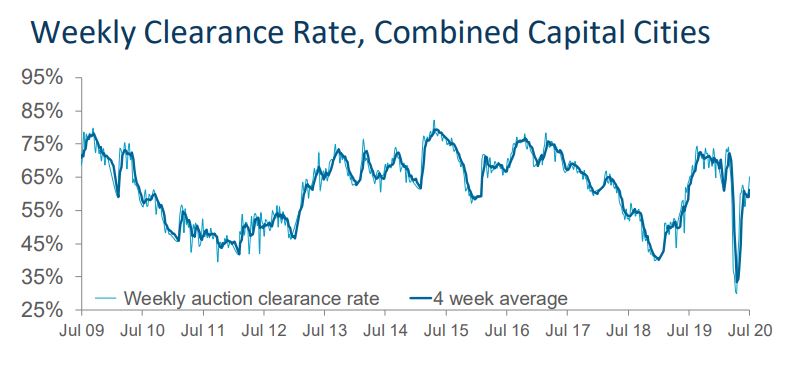

The lower activity which we have historically noted over school holiday periods, returned a preliminary clearance rate of 65.1 per cent.

This was higher than last week’s preliminary figure of 64.5 per cent across a higher 1,485 auctions, which later revised down to 60.6 per cent at final collection.

Source: CoreLogic

Looking at results from the first week of July last year, a lower 953 homes were taken to auction with a success rate of 64 per cent according to final figures.

Across Australia’s two largest auction markets, the lower activity across both cities saw the clearance rate improve.

There were 439 Melbourne homes taken to auction returning a preliminary clearance rate of 64.3 per cent, which was higher than last week’s preliminary figure of 62.7 per cent across 645 auctions, with a final result of 61 per cent.

“Hoppers Crossing, Mount Waverley, Mulgrave and South Melbourne each sold all 4 listings under the hammer.” said REIV CEO Gil King.

Source: CoreLogic

In Sydney, 563 homes were auctioned this week returning a preliminary clearance rate of 68.1 per cent, higher than last week’s 66.9 per cent preliminary result, when a higher number of auctions were held (644).

In Queensland, according to Justin Nickerson of Apollo Auctions, the state continued to defy the sceptics with another strong weekend of auction performance.

"The overall clearance remained solid, partly fueled by a rise in sales prior to auction - which bears monitoring in the coming weeks," said Mr Nickerson.

"With restrictions on attendance changed from 20 to 100 in place, crowds were back in earnest - with a handful of properties exceeding the 50 mark.

"Strong volume persists now for entirety of July - suggesting the usual winter malaise may be avoided this year."

The final clearance rate last week came in at 62.9 per cent.

Similar to this:

Market Wrap: How the market performed as restrictions ease