Movement of expats back to Australia: Knight Frank

Contact

Movement of expats back to Australia: Knight Frank

A survey by Knight Frank shows Australian expats are starting to make the move home.

Many enquiries to global real estate agents Knight Frank were coming from expatriates since the start of the COVID-19 pandemic, so they undertook a survey to find out exactly what the picture was.

One figure that stood out immediately was 64 per cent of expats surveyed said the COVID-19 lockdown had influenced their decision to buy a property in their home country.

This didn't mean they were all ready to move home as only 29 per cent had considered a permanent change.

14 per cent were buying a property as a second home, however, 57 per cent were looking for a 50/50 home where they could have a base back home.

What are Australian expats doing?

In Australia where we are fifth on the list of expats returning home, according to the survey, Michelle Ciesielski, Head of Residential Research for Knight Frank told WILLIAMS MEDIA an influx of expats returning home usually happens when the dollar is low.

"Currency can make a significant difference for a prime property being purchased," said Ms Ciesielski.

"This has been the case in recent years and is likely to continue with a low Australian dollar.

"The coronavirus pandemic became an added incentive for Australian expats to consider their position in world.

"This has seen choices made to permanently move back home, purchase now with a lower Australian dollar with the intention to be a primary residence over the longer term or take the investment opportunity to buy another second home in their portfolio."

Ms Ciesielski said when the survey was compiled, Australian expats surveyed had a budget of more than A$5 million to buy a prime residential property back home.

"High-net-worth Australian expats...requirements continue to span from luxury apartments, close to the CBD, to private self-sustaining lifestyle properties and in many instances they want at least one of each residence.

"This allows the flexibility of business priorities through the week living in the city pad and retreat to the safe-haven country or coastal property for the balance of their time."

What’s motivating expats to buy a property back home?

“Time in lockdown has underlined the importance of family for many and focused their minds on the type of lifestyle they want to lead,” said Victoria Garrett, Knight Frank’s Head of Residential in Asia Pacific.

“For expats with older parents back home or young children heading to boarding school abroad - and the prospect of a potential 8 or 12-hour flight to reach them – the COVID-19 pandemic has meant many are rethinking their long-term plans.”

The Knight Frank survey found that being close to family members was cited by expats as the main reason for their property search, followed by a new job offer, whilst a better healthcare system back home ranked third and their children’s educational needs in fourth place.

With expats reconsidering their options, this will have implications for the corporate relocation industry, international schools and multinational corporations globally.

Although currency ranks low as the key motive for expats purchasing back home, 57 per cent of our prime agents noted that the expats they were dealing with had cited it as an influencing factor.

For expats taking a USD-denominated salary and purchasing in the UK, Australia or New Zealand there is a significant currency play compared with just two years ago.

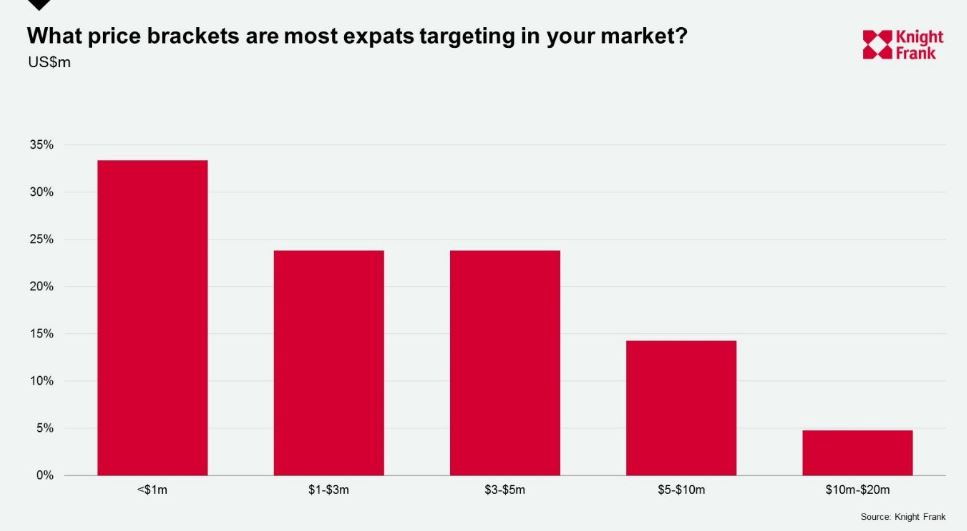

Within the prime segment, what price bracket are most expats targeting? (US$)

Most expat budgets sit below US$3m but higher budgets are evident in markets such as Australia, Switzerland and France.

Families want a home where their children can stay longer or can come back to if they need to bunker down together and in some cases they are willing to stretch that bit further to have the luxury of space and a waterfront location.

Similar to this:

Three sales over $7m in four weeks to Australians and lots of enquiry from expats

Expats returning home make up 30% of enquiry coming from offshore

Expats, Locals and Couples looking for more space dominate Market