Housing values dip lower as sales recover

Contact

Housing values dip lower as sales recover

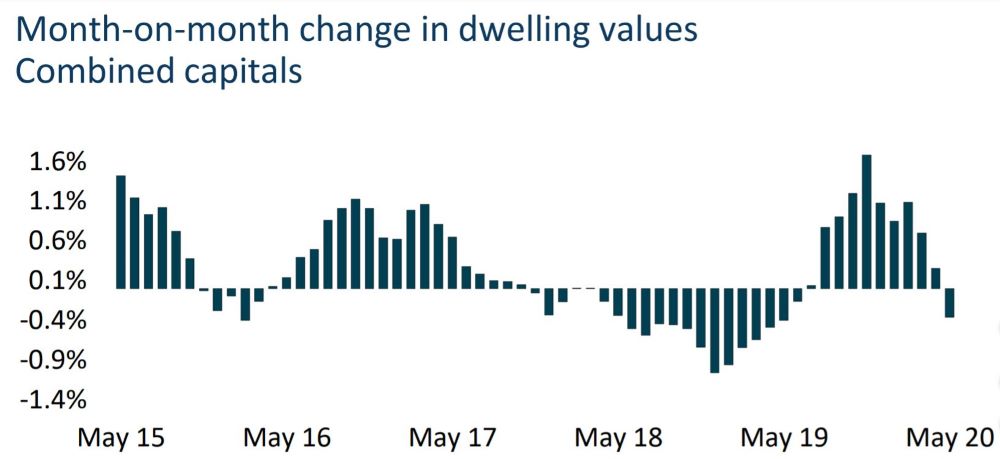

CoreLogic Home Value Index results for May show Australian dwelling values posted their first month-on-month decline since June last year.

The CoreLogic national Home Value Index showed a slight decline over May down by 0.4 per cent, with five of the eight capital city regions recording a fall in values.

The reduction in values through May comes as transaction activity in the market shows more positive signs.

The CoreLogic estimate of sales activity bounced back by 18.5 pe rcent in May after a (revised) drop of 33 per cent in April.

“Considering the weak economic conditions associated with the pandemic, a fall of less than half a percent in housing values over the month shows the market has remained resilient to a material correction," said CoreLogic Head of Research, Tim Lawless.

"With restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values could be milder than first expected.”

Source: CoreLogic

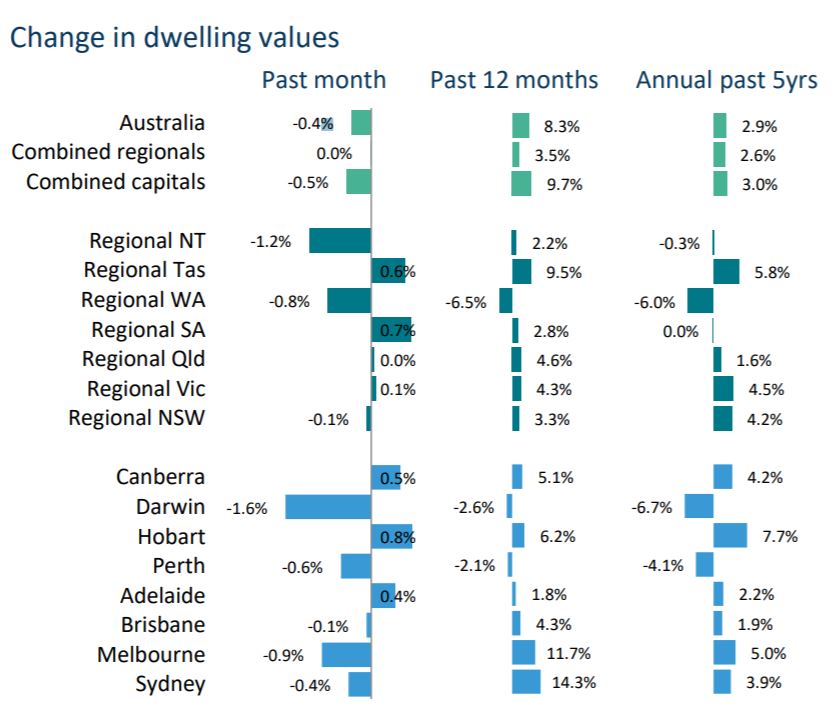

Across the state capitals, Melbourne’s housing market has posted the largest falls over the month, down 0.9 per cent in May, following a 0.3 per cent reduction in April.

Values were also down over the month in Perth (-0.6 per cent), Sydney (-0.4 per cent), Brisbane (-0.1 per cent) and Darwin (-1.6 per cent), but rose in Adelaide (+0.4 per cent), Hobart (+0.8 per cent) and Canberra (+0.5 per cent).

Regional markets have been more resilient to value falls, with the combined regional index holding firm through May.

In Sydney, The Agency's CEO Matt Lahood told WILLIAMS MEDIA he saw the capital city's house prices would be remaining stable for the foreseeable future.

"Given Australia's record low interest rates, the lower levels of available housing stock combined with high levels of buyer demand is also keeping prices fairly stable.

"The main variable that could affect price stability in the future is the level of unemployment, but if the rates of unemployment remain similar to today's rates - this should not impact housing prices."

In Queensland, Paul Arthur, CEO, Sotheby's International Realty told WILLIAMS MEDIA the high end luxury market has remained stable.

"We haven't seen a deterioration in property values in the high end luxury market, " said Mr Arthur.

"We cover Port Douglas, the Whitsundays, Brisbane and the Gold Coast and have experienced very good price activity.

"Stock is low, so there is no decrease in property pricing or distressed sales."

Paul Niardone of The Agency in Western Australia told WILLIAMS MEDIA they had not seen too many changes in house valuations compared to the east coast.

"We were coming from a lower starting point," said Mr Niardone.

"We have seen a lot more sales at the lower end of the market bringing the average sales price down with more turnover."

In Victoria, Peter Kakos of The Agency told WILLIAMS MEDIA prices are remaining relatively strong in most areas as supply and demand still plays a pivotal part in the current market.

"At this time of year we would normally have 2-3 times more property on the market so a lot of buyers remain frustrated by lack of choice in the market," said Mr Kakos.

"Some varying price points have certainly been affected more than others."

Source: CoreLogic

Although some areas have avoided a reduction in values since March, every region has lost momentum and the longer term outlook remains uncertain, according to Mr Lawless.

“Eventually government stimulus will wind back and borrower repayment holidays will expire," said Mr Lawless.

"In the absence of these policies, housing values could come under some additional downwards pressure if economic conditions haven’t picked up towards the end of the year.”

Although housing values are currently slipping or stabilising, recent history implies most home owners have some level of buffer that will help protect against negative equity.

National home values remain 8.3 per cent higher than they were a year ago, with Perth (-2.1 per cent) and Darwin (-2.6 per cent) the only capital cities where values remain lower than at the same time last year.

The high annual capital gain is mostly attributable to the earlier growth trajectory of housing values across Sydney (+14.3 per cent) and Melbourne (+11.7 per cent), with the remaining

capitals showing a more sustainable history of price rises.

Similar to this:

Housing values remain stable in April

Worldwide yield potential as residential rental values outperform capital values

Housing downturn loses some steam with CoreLogic House Value Index down 0.6% in March