Expats, Locals and Couples looking for more space dominate Market

Contact

Expats, Locals and Couples looking for more space dominate Market

Melbourne, Sydney and Brisbane agents say more qualified local and expat buyers are coming into the market, making the most of low AUD and very low interest rates.

Ray White Agent Christine Rudolph and her New Farm agency has been busy in the past week seeing highly qualified buyers through the doors of all of their inspections.

"COVID has been the opportunity to drill down precisely for our clients, to make sure that anyone coming through their open homes is pre-approved with finance and in a position to buy now," said Ms Rudolph.

"The consistent upside, has been the conversion of deals for our clients and a sustained level of confidence reflected from buyers making decisions.

"The motivation of buyers has been quite interesting to uncover, including 4 young professional couples who had never previously considered moving into the house market, but confined to apartment living, deciding to look for more space and size."

Ms Rudolph said in a week, the four couples were competing for the Californian bungalow which sold at 5 School Road, Hendra.

5 School Road, Hendra sold for $855,000 by Ray White agent Christine Rudolph. Photo: Ray White

The couple who secured the sale for $855,000 had been confined to renting an inner-city apartment and decided because they were both working at home, they needed more space.

"In another case, a young doctor on the front line, originally due to fly to London for an overseas medical posting, decided that rather than spend money on rent during his delayed travels, purchased an apartment with repayments at the same cost as rent," said Ms Rudolph.

Ms Rudolph said this is the perfect time to list your home with so many eager buyers like Amy and Ryan excited to secure their slice of Australia’s real estate market.

“It's a great time coming out of COVID for sellers to jump in and capitalise on the shortage of quality supply and the optimism we are seeing," said Ms Rudolph.

"It's a terrific time to take advantage of this buyer optimism.

“We have an advantage for our sellers of making sure that every buyer who we take through their doors is a genuine, highly qualified prospect."

Lisa Davies of Ray White Upper North Shore told WILLIAMS MEDIA: "We are are starting to see a pattern emerging of Australian expats wanting to secure prestige properties with plans of moving their families home to Australia.

"The exchange rate advantage and global pandemic combine to make a move to Sydney a very attractive proposition right now is what the buyers are telling me.”

Read more: Hong Kong and Taipei buyers via Facetime inspection Ray White

John McGrath, founder of McGrath Estate Agents told WILLIAMS MEDIA locals are feeling more confident, many foreigners are continuing to avoid Australian residential property for investment due to hefty application fees and rising state taxes, according to the newly released Foreign Investment Review Board report for FY2019.

"In FY2016, there were 33,258 approvals to buy new homes or vacant land, which are the only types of property that foreign residents can purchase for investment," said Mr McGrath.

"In FY2019, there were 5,770. That’s a massive drop."

Read more: John McGrath – Fewer foreigners buy but locals regain confidence

McGrath's Regional Sales Manager, James Hayashi, told WILLIAMS MEDIA people working from home now had specific needs when buying a home.

“Since Covid-19 hit and people were forced to work from home, we’ve found that as well as a dedicated home office space, buyers have added outdoor areas and balconies to their wish lists," said Mr Hayashi.

"Obviously, buyers are wanting a quiet room in which to work from home but they also see the need for a “breakout space” like a balcony with a view or a backyard rather than looking onto the brick wall of the house or apartment opposite.”

Auctions

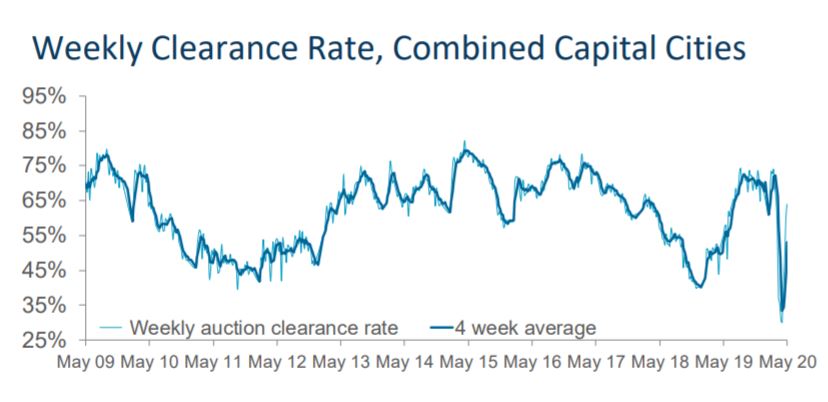

This week, 400 capital city homes were scheduled for auction, with preliminary results returning a 64 per cent clearance rate.

The previous week saw 480 homes scheduled for auction and a final clearance rate of 59.9 per cent.

One year ago, there were 930 homes taken to auction and a 55.2 per cent clearance rate.

Source: CoreLogic

It is important to interpret clearance rates with caution given auction volumes remain substantially lower than usual.

Sydney, one of Australia’s largest auction markets, returned a preliminary clearance rate above 70 per cent, suggesting the relaxation in social distancing policies specific to housing are having an immediate and positive impact on home auctions, although the number of auctions remains well down on last year.

Source: CoreLogic

In Melbourne, 118 homes were scheduled to go under the hammer this week.

So far 93 auctions have been reported, returning a preliminary success rate of 60.2 per cent.

The previous week saw a final clearance rate of 56.5 per cent across 163 auctions.

There were 193 auctions scheduled in Sydney this week, returning a preliminary clearance rate of 73.4 per cent.

In comparison, last week saw 216 homes taken to auction with a success rate of 66.3 per cent.

Similar to this:

Market Wrap: How the market performed as restrictions ease

Market wrap and updated regional report

Higher auction volumes see preliminary clearance rates bounce back