Price growth takes a breather, but not everywhere - Ray White

Contact

Price growth takes a breather, but not everywhere - Ray White

According to Ray White Chief Economist Nerida Conisbee, May's interest rate decision is almost certainly a hold and the next change in rates will be a decline. If however we see an increase, this would likely put a further dampener on price growth.

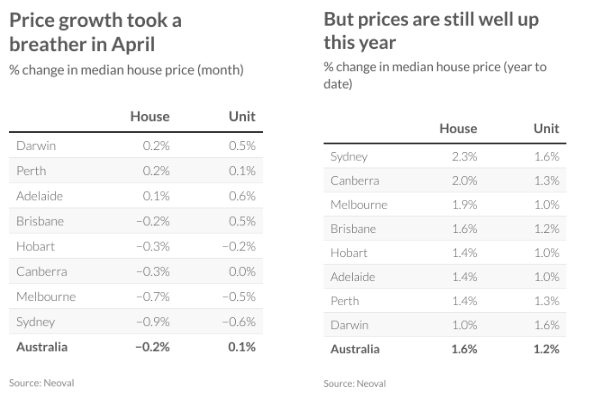

After rising by 1.8 per cent since the start of the year, Australian house price growth took a breather, declining slightly by 0.2 per cent. The stabilisation wasn’t completely unexpected. The drivers of price growth are still in place - there is a shortage of stock, population growth continues to accelerate and construction problems continue. But at the same time, we have had 10 interest rate rises and many people are coming to the end of their fixed loans. We are in recovery but it is likely to be stop/start for quite some time.

The stabilisation in April is good news for buyers. While the promised price crash never materialised, it is unlikely we will see a similar price boom like we saw during the pandemic. Prices are not running away in most of our capital cities. However, there are exceptions.

Perth’s growth continues off the back of strong mining conditions. In April, prices increased by 0.2 per cent and are now almost back at where they were at the peak in 2022. Adelaide also saw an increase. However, the best performer has been Darwin where prices are now well exceeding last year’s peak.

Elsewhere, we saw declines. Sydney’s price growth has been the strongest since the start of the year, increasing by 3.2 per cent over the first quarter of 2023. In April, it softened slightly by 0.9 per cent. Melbourne saw a similar pattern, increasing by 2.6 per cent over the first quarter but falling by 0.7 per cent in April.

While house prices came back a little in April, it was not the case for units. Unit prices increased by 0.1 per cent and are now up 1.4 per cent since they bottomed out in October last year. The strongest unit growth market is Brisbane where prices were up 0.5 per cent in April.

May's interest rate decision is almost certainly a hold and the next change in rates will be a decline. If however we see an increase, this would likely put a further dampener on price growth.