Is it time to fix and forget your home loan?

Contact

Is it time to fix and forget your home loan?

Interest in fixed rate home loans has increased since the RBA's emergency cash rate cut to 0.25 per cent.

Home loan comparison site Mozo has stated fixed home loan rates are now lower on average than variable interest rates.

Analysis by the company found that 66 per cent of lenders reduced their one year fixed home loan interest rates after the emergency rate cut in March.

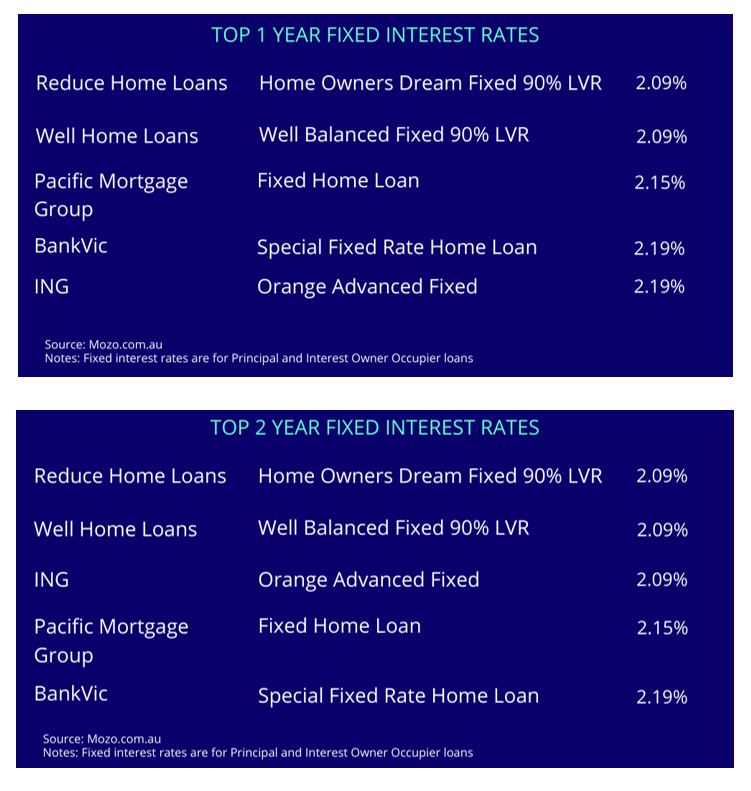

Borrowers can now lock into a fixed rate of 2.09 per cent for a maximum of three years and guarantee record low repayments.

At a Glance:

- 2.09 per cent is the lowest fixed rate on the market now

- 66 per cent of lenders have reduced their one year fixed rates since the emergency rate cut

- Average one year fixed rate is 2.82 per cent compared to the average variable rate 3.45 per cent

“The big four banks have slashed their fixed interest rates and left their variable rates untouched after the RBA’s emergency rate cut," said Mozo Director Kirsty Lamont.

"Smaller lenders and neobanks have struggled to make these reductions.

"Normally after a rate cut, these smaller lenders broadcast their ability to immediately pass on the rate cut to their customers, but there has been silence after the emergency March cut.

"Big banks seem to have deeper pockets and more agility across their loan books in these unprecedented times which has seen them cut their fixed home loan rates.”

Ms Lamont said after the second rate cut in March, 66 per cent of one year fixed home loan rates changed, compared to 20 per cent after the first rate cut.

"This market movement was similar across two, three, four and five year fixed home loans and reduced the fixed home loan average," said Ms Lamont.

Fixed home loans rates now have lower averages compared to variable rates.

Source: Mozo

The average fixed rate for one year term is 2.82 per cent, two years 2.73 per cent, three years 2.80 per cent, four years 3.12 per cent and 3.16 per cent for five years.

These are all well below the average variable interest rate of 3.45 per cent.

“Right now there are great deals available for borrowers who are happy to lock in a rate," said Ms Lamont.

"The full economic impact of Covid-19 is still unknown causing uncertainty and fear, fixed interest rates are a great way to lock in a payment plan for your home loan.

"When looking for a fixed rate home loan it’s important to consider the automatic revert rate, so you aren’t forced to refinance at the end of your term.

“With so many fixed home loans offering low interest rates, we might see a shift in Australia from a majority variable rate market to a predominantly fixed rate market."

Ms Lamont said many countries around the world have a majority fixed rate market, like the United States where it’s common to have a 30 year fixed rate.

“With the Reserve Bank stating that it will not lower the cash rate below the current rate of 0.25 per cent, it would be safe to assume that interest rates are as low as they can go," said Ms Lamont.

"Most lenders have struggled to pass on all the rate cuts made over the last year, so now could be a great time to fix your home loan and guarantee you’ll get the same low rate for a couple of years.”

Mark Bevan CEO, Joust

Live auction platform Joust has noted an increase in interest for fixed home loan rates as well.

"Our consumer behaviour data shows that the level of enquiry on Joust for fixed rate home loans was only 10 per cent of all loan enquiries in March," said CEO Mark Bevan.

"This percentage increased to 16 per cent in April - which indicates that consumers have an increasing appetite for fixed rate home loans following the various lenders responses to the RBA's emergency cash rate cuts."

Similar to this:

Fixed rate home loans remain unpopular

Mortgage Choice data shows fixed rate demand lowest in eight years

New data shows 'unsurprising' growth in demand for fixed home loans