Housing affordability declines despite rate cuts

Contact

Housing affordability declines despite rate cuts

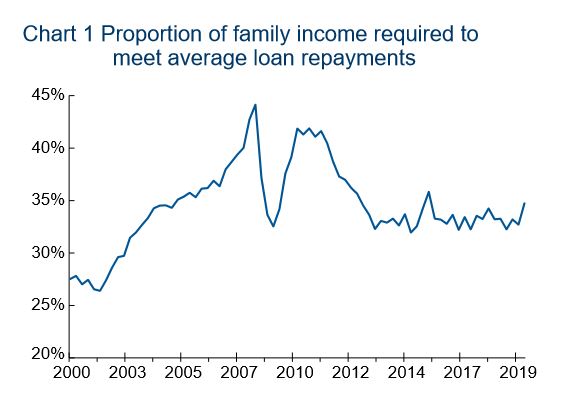

As interest rates continue to shrink on home loans, the ability for people to buy their own home also reduces, according to REIA Housing Affordability quarterly report.

Just because interest rates are tumbling, doesn't mean it has become easier to buy a house.

This was confirmed with the Real Estate Institute of Australia's latest Housing Affordability Report which revealed that affordability had declined across the nation by 2 per cent.

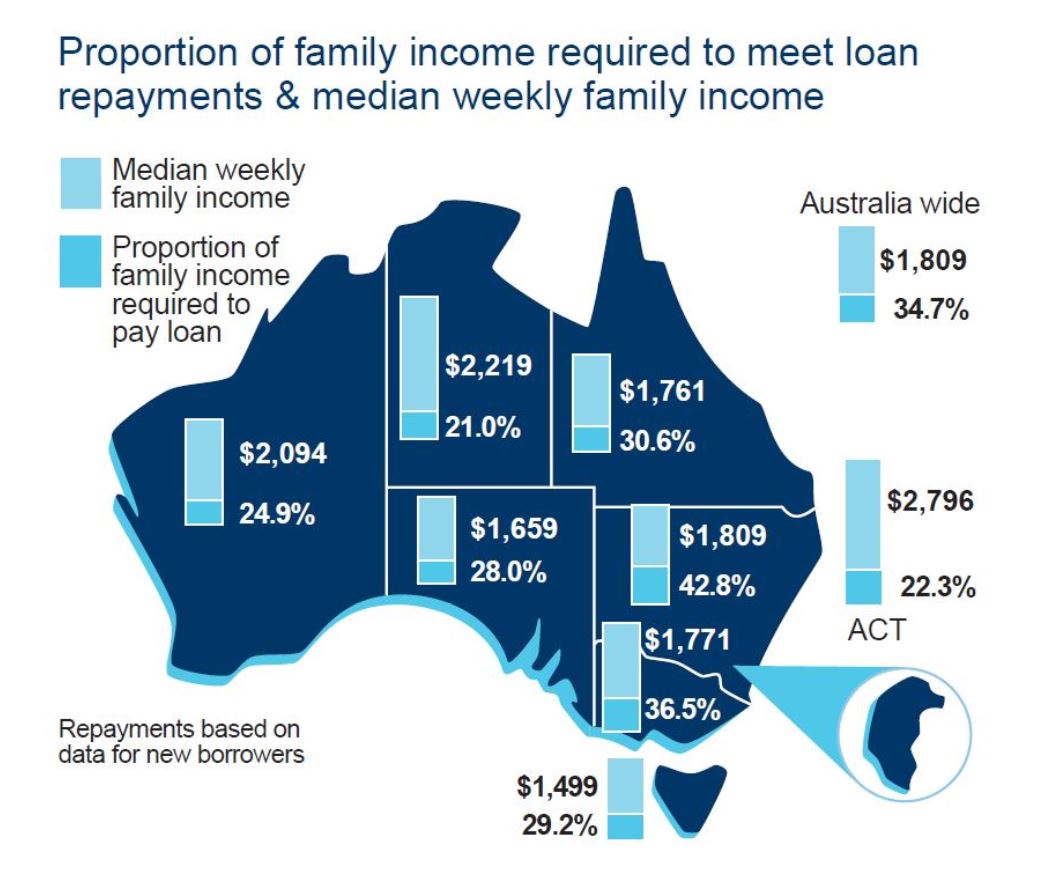

What this means is the proportion of income needed to meet mortgage loan repayments has risen to 34.7 per cent, equal to a 2 per cent increase over the quarter.

At a Glance:

- Proportion of income needed to meet mortgage loan repayments has risen to 34.7 per cent

- Quarterly average variable standard interest rate decreased to 4.8 per cent

- Quarterly average three-year fixed rate decreased by 0.3 percentage points to 3.1 per cent

“Across Australia in the last quarter, housing affordability has declined in all states and territories except for the Northern Territory where there was an improvement,” said REIA president Adrian Kelly.

Source: REIA

“During the December quarter, the Reserve Bank of Australia (RBA) reduced the official cash rate to 0.75 per cent and the quarterly average variable standard interest rate decreased to 4.8 per cent.

“The quarterly average three-year fixed rate decreased by 0.3 percentage points to 3.1 per cent.”

New South Wales had the largest decline in affordability with 3.6 percentage points.

Source: REIA

Rental affordability declined marginally over the quarter with the proportion of family income required to meet rental payments increasing 0.1 percentage points to 23.6 per cent.

Rental affordability improved only in New South Wales and Victoria as their median rents remained stable or reduced marginally.

Victoria has the highest number of first home buyers entering the dwelling market.

Source: REIA

Queensland rental affordability has remained stable over the past year.

South Australian has the lowest percentage of first home buyers entering the market with 25.6 per cent.

Rent as a proportion of family income continues to be the lowest in Western Australia.

Tasmania had the largest decline in rental affordability over the past year.

Northern Territory had the largest decline in rental affordability over the quarter.

Australian Capital Territory had the largest increase in the number of new dwelling loans over the quarter at 17.6 per cent.

To subscribe to the Housing Affordability Report click here

Similar to this:

Housing affordability improves while rental affordability declines: report

Adelaide tops the list for affordability, according to PRD report