Household financial comfort slides across regional Australia

Contact

Household financial comfort slides across regional Australia

Household financial comfort fell markedly across regional Australia during the six months to December 2019, according to ME Bank’s latest Household Financial Comfort Report.

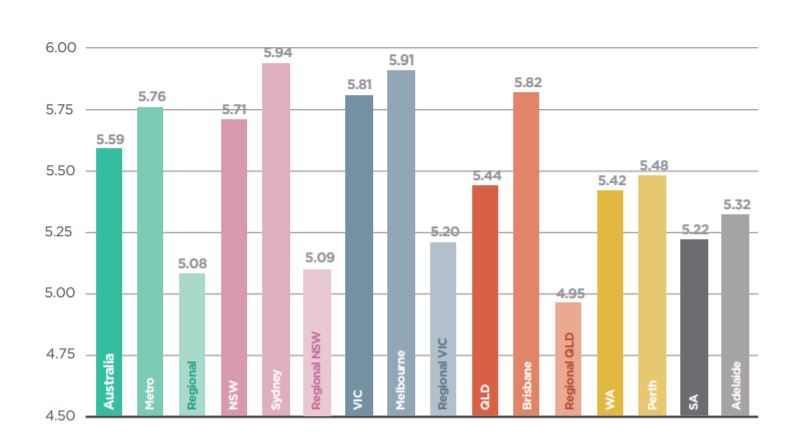

While ME Bank’s latest biannual survey showed the financial comfort of metropolitan households increased 3 per cent to 5.76 out of 10 to near record highs – especially in eastern Australia – financial comfort for regional households fell 4 per cent to 5.08, continuing a decline over the past year to approach its lowest point in the past eight years.

ME’s Consulting Economist, Jeff Oughton, said the gap in financial comfort between regional and metropolitan households had now reached a record 13 per cent, almost twice the historical average of 7 per cent.

“The sharp fall in financial comfort in regional areas is likely a result of ongoing drought and recent bushfire catastrophes, which have significantly lowered already low levels of financial comfort," said Mr Oughton.

"‘Comfort with cash savings’ fell 9 per cent and the ‘ability to deal with financial emergencies’ fell 7 per cent, while long-term retirement comfort deteriorated, with ‘anticipated standard of living in retirement’ down 7 per cent.

"Regional Queensland reported the largest fall in comfort, down 14 per cent to 4.95, dipping below regional New South Wales (5.09) and Victoria (5.20).

“In contrast, the improvement in the financial comfort of metropolitan households reflected significant gains in all key drivers, with record high levels of comfort approached in Sydney (up 1 per cent to 5.94), Melbourne (up 3 per cent to 5.91) and Brisbane (up 10 per cent to 5.82).”

Comfort index across larger states and metropolitan areas. Scores out of 10. Note: sample sizes for regional areas of South Australia and Western Australia are small and unpublished. Source: MEBank

Overall national household financial comfort up only slightly

The notable falls in financial comfort across regional Australia dampened an overall rise in national financial comfort, with ME Bank’s overall Household Financial Comfort Index improving by 2 per cent to 5.59 out of 10 during the six months to December 2019.

Across the 11 key drivers that make up the Index, 10 of the drivers improved – with notable improvements in household ‘comfort with debt’ and recent ‘changes to their financial

situation’.

Record low mortgage rates and rising house prices improving comfort with debt in the major cities.

Mark Bevan, Managing Director of Joust, a home loan auction site, said borrowers from capital cities and regional areas can all auction their home loan for the best rates via their website.

"Some of our lenders are more aggressive chasing business in specific geographies," said Mr Bevan.

"Borrowers are finding that often the most competition unfolds for larger home loans.

"The larger home loans are frequently for high value properties in the major capital cities of Melbourne and Sydney.)"

Mr Bevan said Australians have something of a reputation for being fearless borrowers.

"Our level of household debt is recognised as world class," said Mr Bevan.

"The current low interest environment in Australia is certainly making borrowing for homes very inviting.

"Regulators and lenders are trying to manage the demand for home loans by being prudent with lending standards and credit assessment processes."

Across the 11 key drivers that make up ME’s Household Financial Comfort Index, the biggest improvement was with ‘comfort with debt’, up 5 per cent to 6.55 out of 10, reaching record highs.

‘Comfort with debt’ increased 7 per cent for households in metropolitan areas, particularly those with mortgages on their homes or on an investment property."

Mortgage stress eases further and expected debt management improves

Consistent with a significant fall in home loan rates, sustained low unemployment and improved property prices in most of Australia, mortgage stress eased a bit further during the past six months.

Nevertheless, there remains generally high levels of mortgage stress and significant other financial stress amongst households.

The proportion of households contributing more than 30 per cent of their disposable household income towards their mortgage fell a further 2 points to a still high 41 per cent of households, 5 points lower than a couple of years ago.

Recent improvements to households’ financial situation

Another driver of overall comfort that improved significantly was comfort with ‘recent changes to households’ financial situation’ – up 4 per cent to 5.25 out of 10 – its highest level in four years – due to a large rise of 5 per cent to 5.41 in metropolitan regions, but not regional areas (unchanged at an index of 4.76).

Over a third (36 per cent) of households indicated their ‘financial situation had improved over the past year’ with the main reasons being less concern about living cost pressures, fewer households reporting falls in income, more households reporting improvement in employment status and improvements in cash savings.

‘Comfort with the ability to manage a financial emergency’ only saw a slight improvement (up 1 per cent to 4.82), but was significantly lower than average among single parents (3.17 out of 10).

It also remains the lowest of all drivers across the Household Financial Comfort Index – especially for regional areas.

Record low Reserve Bank official interest rates helping, but divide households

For the first time in the latest survey, ME asked households if they thought they were ‘better’ or ‘worse off’ as a result of the historically low official interest rates.

Overall, slightly more households reported being better off (27 per cent), compared to worse off (23 per cent), while the remaining half of households reported they weren’t impacted positively or negatively.

Put another way, a net positive impact from very easy monetary policy.

“Those households paying off a mortgage felt they were far better off than those renting or who already own their homes," said Mr Oughton.

"When it came to investors with debt, results show they feel they’ve benefitted the most (60 per cent ‘better off’) from the flow on to record low mortgage rates – an indication of the high level of gearing among residential property investors in Australia.”

In terms of life stage, young singles and couples with no children appeared to be the biggest winners, with over half (51 per cent) saying they were ‘better off’, followed by couples with young children (41 per cent).

Property price optimism revised higher

The Report revealed household optimism regarding the outlook for residential property prices has continued, with both owner occupiers (47 per cent) and investors (51 per cent) revising up price expectations for 2020.

Brisbane investors and owner occupiers were the most optimistic about higher property prices (67 per cent and 61 per cent, respectively), followed by Melbourne owner occupiers (55 per cent) and Sydney investors (51 per cent).

Owner occupiers in Perth (29 per cent) remain the least optimistic in this regard.

Similar to this: