The Winter Property Report

Contact

The Winter Property Report

The Agency's Winter Property Report gives details on what has been happening in the property market for 2020.

Welcome to The Agency’s Winter Property Report. The question on many people’s minds is what will happen to the property market for the remainder 2020? The property market has seen an unprecedented shake up to normal operations thanks to COVID-19 and this looks ready to continue for the rest of the year.

That being said, we are seeing some interesting movements in different markets. In the regional markets of NSW there is huge demand for properties. Tree-changers and sea-changers are no longer restricted to the city areas by their jobs and are moving away from the CBD office, to work at home. Areas such as Wollongong, the Central Coast, the Hunter region and the southern Highlands have experienced high demand. Agents are telling me that 70-80 per cent of buyers are coming from Sydney, which is creating this boom in the NSW regional markets.

Overall, there are a large numer of buyers who are able to get cheap loans. The series of rate cuts by the RBA put a floor under the market, which is keeping the market steady. Combined with low supply, Job Seeker and the government stimulus packages, this floor will continue to buoy the market.

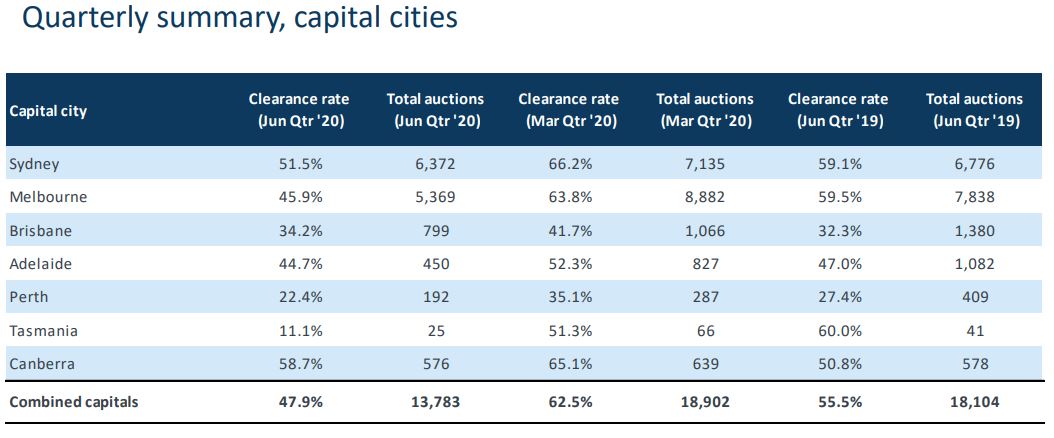

Source: CoreLogic

Cooley Auctions

In July The Agency and Cooley Auctions announced a partnership where the real estate agent would become the auctioneer's largest single client.

“The Agency team and I are thrilled to have Cooley Auctions as our auctioneering partners in NSW," said Matt Lahood, The Agency’s CEO.

"As our business continues to scale, it is the perfect service alignment, giving our agents and clients guaranteed access to this world-class team.

“I have personally known Damien Cooley since he started his career in real estate, I engaged Damien on one of his very first auctions and I have sold property for Damien.

"I am very excited about working together again so closely.”

With Cooley Auctions on-line start up Auction Now, Mr Lahood said this is an important tool during the COVID-19 pandemic and something the agents and clients will continue to benefit from.

“Auction Now allows clients to register, bid, buy and exchange online, on any device, anywhere in the world," said Mr Lahood.

Sydney

House prices in Sydney have dropped over the past month by -0.9 per cent, by -2.1 per cent for the quarter but with an annual growth of 12.1 per cent.

The median house value, according to CoreLogic is $866,110.

The Agency's CEO, Matt Lahood said inner city Sydney had seen strong growth.

"There is high interest in the inner city suburbs of Sydney, about 10 minutes from the CBD," said Mr Lahood.

"The demand is coming from people wanting to remain near work, but not necessarily be in there every day.

"Also unrenovated properties have been in high demand and have seen strong growth.

"This seems to have come about because people have more time to renovate and they can create that additional space for a home office.

"These have been selling well since January and are in the highest demand."

2/117 Kurraba Road, Kurraba Point

Melbourne

In Melbourne house values have dropped by -1.2 per cent in the past month, down by -3.2 per cent for the quarter but increased by 8.7 per cent for the year.

The median house value for Melbourne is 678,334.

Mr Lahood said the introduction of Stage 4 restrictions to the metro area, due to the second wave of Coronavirus, has certainly disrupted the industry.

"There is strong buyer demand for quality homes and this has been all the way through the first part of the year," said Mr Lahood.

"WIth the introduction of Stage 4 restrictions we will have to wait and see.

"The number of leasings is holding for now but we are still seeing demand."

14-16 Fitzroy Street, St Kilda

Perth

The western state could be seen as an anomaly when considered next to its eastern cousins.

CoreLogic has reported house values have dropped by -0.6 per cent over the past month, dropped -2.2 per cent for the quarter and reduced by -2.5 per cent for the year.

The median value for homes in Perth is $439,092.

The market has increased its sales activity thanks to the little or no cases of COVID-19.

"There is strong buyer demand in Perth," said Mr Lahood.

"The REIWA has reported an increase of sales by 68 per cent in the Perth metro region."

Gold Coast

Prices have remained steady on the Gold Coast brought about by low stock on the market and a continuing high buyer demand.

Domain's June House Price Report shows an increase of house pricing over the year of 4 per cent, with a median house price of $650,000.

Queensland's more relaxed lifestyle areas, such as the Gold Coast, are predicted to boom now that city dwellers realise they can work anywhere that has an internet connection.

2301/26-28 Alexandra Avenue, Mermaid Beach

Illawarra/Wollongong

The Wollongong property market has been performing well.

“Whilst this has been driven in part by COVID-19 and an increased desire for non-metropolitan living, there is little doubt the lifestyle, value for money and ease of access to Sydney, has maintained this attractive regional location,” The Agency, CEO, Matt Lahood said.

With so much going for it, including a world-class university, a prominent steel works industry, well developed infrastructure and a stunning natural coastline, Wollongong and the Illawarra area offers an attractive and affordable alternative to Sydney living.

Joe Abboud of The Agency, Illawarra said they had seen a definite increase in both price and enquiry in the area since COVID-19.

"There are two markets where most of the action has been happening," said Mr Abboud.

"The first home buyers have always been there and the Illawarra offers affordable housing.

"People are starting to look outside the city areas, for lifestyle, beaches and open spaces

"The second group is specifically around the North Wollongong and Thirroul areas that have seen an influx of buyers from outside the area, especially Sydney.

"Quite often at an auction, you may have 11 registered bidders and they will all be from Sydney."

Domain's June House Price Report shows house prices increased over the year by 7.4 per cent, with a median house price of $725,000.

Southern Highlands

The Southern Highlands and Southern Tablelands property markets have experienced a significant increase in demand predominantly as a result of Covid-19, said The Agency partner, Ben Olofsen to WILLIAMS MEDIA.

"In the Southern Highlands 87 per cent of buyers are relocating from Sydney as a result of them being able to work from home and re-evaluating and bringing forward long term property goals," said Mr Olofsen

"These factors coupled with a sense of urgency and limited stock have seen property prices increase on average between 3-5 per cent and days on market reduce by 40 per cent.

"In the month of July, as the Southern Highlands no. 1 selling agency, The Agency - Southern Highlands sold 22 properties with a total value of $27.4 million."

Below are a few examples of our July sales.

- 4 Sir James Fairfax Cct, Retford Park Bowral: on market for 24 days, 4 contracts issued, new suburb record of $2 million - previous suburb record was $1.75m.

- 628 Sally Corner Rd, Exeter: on market for 10 days, 2 contracts issued, sold for $1,425,000 – listed 12 months ago at $1.1mil

- 1 Argyle Street, Mittagong: on market 3 days, 5 contracts issued, sold for $3 million – vendors expectations $2.8 million

Central Coast

On the Central Coast, north of Sydney, they are selling a property every second day, according to The Agency's Brian Whiteman.

"It has a lot to do with how we are doing things, we have learnt to do it right," said Mr Whiteman.

"With COVID-19, people were putting off staff but we put another on, to increase the care around the buyer.

"The Central Coast is seen as a lifestyle choice and with the completion of the North Connex tunnel, which comes off the M1, people will be in the Sydney CBD in an hour."

Mr Whiteman said working from home is another reason for the increase in sales in the area.

"I often see couples for market appraisals and both are working from home, so anything near water, renovated or well-maintained is very popular," said Mr Whiteman.

"The Renovator's Delight is not so popular at the moment, but there is definitely an influx of out-of-town buyers from Sydney, along with locals who are buying."

13 Grandview Stree,t Shelly Beach sold by agent Brian Whiteman of The Agency

New Projects with Steven Chen

The second quarter of 2020 was an interesting period as we were challenged through our usual course of business during the COVID-19 environment. Self isolation, industry shut down and uncertainty within the economy has been the major headlines and a reality globally.

In the project marketing space we have seen a slow down in off plan sales with developers holding off on launching major and boutique projects across the eastern seaboard of Australia. The majority of developers have been challenged and are looking for clarity with the view to launch their products in the last quarter of 2020. We have numerous clients who are ready to launch and have paused in the current climate to see how the market performs over the next 3- 6 months. Further to the COVID-19 situation, there have been concerns over international issues between Australia and Asia with propaganda from Chinese retail buyers and major Chinese developers retracting from the Australian market. This is of extreme concern, especially in the longer term to our economy.

What we have experienced on a positive note and on a micro level, is the local market uptake on brand new finished stock. In particular, that from experienced developers and builders. One of our recent launches in May 2020 saw a huge spike in enquiry and with social distancing at open house inspections relaxed. We saw over 80 groups attend 2 weekend inspections of a newly completed project Casa Residences stage 2 in Erskinville NSW from the experienced B1 group. Our team transacted in excess of $4m in sales in 8 days. All were local owner occupiers capitalising on attractive interest rates and several were tenants that were of the mindset of paying their own mortgages rather than their current landlords. We have also seen a spike with local investors, again coupled by low interest rates seeing positive returns on the current rental yields.

Off market development sites have also transacted well during this period with a positive sentiment with developers looking to fulfuil their pipeline for late 2020 and the first half of 2021. Our recent off market transaction saw The Agency Projects transact a boutique site in Alexandria for over $12m with the purchaser confident about the market in the last quarter of 2020 as to which they will launch. July to September will be an interesting quarter as we trade through a recovery or trade through continued volatility.

Investor's Corner with Maria Carlino

The coronavirus pandemic is having a major impact on both the economy and the rental market. There’s no sugarcoating it: the coronavirus pandemic has been bad news for most landlords who own NSW residential property. According to the REINSW, total vacancies across NSW rose every month between March 2020 and June 2020.

The NSW vacancy rate now stands at 4.5%, up 0.4% from May and 1.5% since March.

REINSW’s data also reveals that Sydney’s inner suburbs have been hardest hit. The vacancy rate rose 0.8% to 5.8% over June and has now gone up 3.3% since March. Anecdotally, we’ve noticed this has largely been the result of decreased demand from professionals, overseas students and service workers who often choose to live close to the city centre where they work or study.

Interestingly, demand for rental properties has actually increased further away from the city centre. The vacancy rate has fallen 0.4% in outer Sydney over the past four months and 0.7% in the Illawarra.

It seems in these areas, where a higher proportion of people are employed in sectors such as healthcare, construction and manufacturing, the effect of closedowns and social distancing has been less pronounced.

While these figures seem bad, they may not even tell the full story. In October, we’ll start to see JobKeeper wage subsidies tail off and the current JobSeeker boost reduced. We’ll also see the end of many mortgage pauses - most banks have allowed borrowers a maximum freeze of six months. This means many tenants may find it more difficult to pay the rent, at exactly the same time as landlords with a mortgage who’ve been suffering financial hardship must begin meeting repayments again.

As a landlord, vacancies are often the enemy. The average vacancy costs an investor around $2,700 and, with the market as it is right now, you may be staring down the barrel of a bigger loss.

That means if your rental property becomes vacant, there are many things you should do - some of which is mandated by law.

Until 15 September 2020, there’s a moratorium on evicting tenants who are financially disadvantaged due to COVID-19, unless you first attempt to negotiate a rent reduction.

There are also extended notice periods for terminating a lease in certain other circumstances, such as where there’s a fixed-term lease or periodic agreement.

In cases where a residential tenant is suffering genuine financial hardship as a direct result of COVID-19, insurers have indicated they won’t pursue the tenant for unpaid rent.

From a practical point of view, you should be prepared to be flexible when it comes to negotiating rent if it means securing a long-term lease. After all, the average loss when a rental property stays vacant is $2,700, which is the equivalent of around a $50 rent reduction per week taken over 12 months.

Another thing every landlord should be doing to protect their income right now is to make sure they claim the maximum deduction. If your depreciation schedule is out-of-date or not comprehensive, you’re leaving money on the table. After all, after mortgage interest, depreciation is the highest deduction available.

For instance, a lot of investors with an older property don’t know they’re eligible for depreciation. Many also fail to realise they can often boost their cash flow by claiming an immediate deduction of up to $300 on eligible purchases. Nor do they understand that they can often claim depreciation on assets valued under $1,000 at an accelerated rate.

The NSW Residential Tenancy Laws changed, with a range of amendments made to the Residential Tenancies Act 2010 and also the new Residential Tenancies Regulation 2019.

These changes are far-reaching - from water efficiency requirements to smoke detectors, new agreements, more disclosure requirements, and tenants being allowed to make changes of a ‘minor nature’.

As Victoria is now under Stage 4 ‘Stay at Home’ restrictions it means workplaces in metropolitan Melbourne will remain closed unless part of a permitted industry. Real estate is not classified an essential service and so our Melbourne offices are now closed.

The Agency team is still on hand to help you, but it will be through phone and online communication. The Agency has a well-structured contingency plan in place that allows all our team members to work from home.

Contingency plan:

- For properties available on the market, we have conducted ‘walk through’ videos for each of the properties on the website. This video will be sent to every enquiry we receive.

- Prospective tenants moving from an old home to a new home are currently in question, and we will communicate the government response as soon as we have this confirmed.

- There is an understanding that if the contract and date of home relocation is already established this will be permitted. But we will clarify as soon as possible.

- Property Management services – attending to your current tenants’ queries; emergency repairs will be carried out with precautionary COVID-19 best health practices.

- Client meetings will be conducted via phone, Facetime and Zoom.

- Our offices will remain closed until further notice from the Victorian Government.

Maria Carlino, National Head of Property Management

Insurance with Tim Clifford

Due to the uncertainties created in the property market as a result of COVID-19, many property owners have been prompted to take a detailed look at their insurance policy, many for the first time. Whilst this has been required for the current situation, it has highlighted that it is often not until a disaster hits that people realise what sort of cover they're missing. Underinsurance is one area often overlooked by property owners, but it has the biggest potential to cause severe financial hardship. According to the Australian Securities and Investments Commission, a home is underinsured when the insurance covers less than 90 per cent of the rebuilding costs. It’s alarming that 1.8 million households don't have any home insurance at all, according to the Australian Bureau of Statistics, and for those that do have insurance, 80 per cent don't have the correct cover, according to the Insurance Council of Australia.

For most policy holders, this issue stems from a lack of understanding rather than an intentional reduction in cover to save on their premium. One of the most common issues for underinsurance is inaccurate building sum insured estimations based on incorrect information such as initial building costs or using the market value of the property. For example, many insurance policy holders neglect to estimate on all components that are required when rebuilding a house. These considerations include the increased cost of building materials when compared with the original build and the additional services required for a total rebuild, including demolition costs and architectural fees.

The Insurance Council suggests policy holders should review their property on a room-by-room basis to adequately assess their contents, and use an insurance calculator to provide an accurate assessment of the appropriate building sum insured amount. It should be noted that the insurance calculator is not intended to replace a professional valuation by an appropriately qualified person such as a valuer or quantity surveyor. To better understand these complexities and ensure you are adequately protected, please contact Honan Insurance Group at [email protected].

Finance with John Kolenda

The Reserve Bank of Australia (RBA) is set to stay on the interest rate sidelines as eastern states battle further outbreaks of COVID-19, with Victoria in lockdown due a second wave of the coronavirus.

The RBA is likely to keep its cash rate at an all-time low of 0.25 per cent for the rest of the year. It could even be years before the RBA increases rates again.

While not much activity is expected around official interest rates, home loan customers are still in a strong position with lenders offering a new round of rate cuts.

If you have a home loan rate with a ‘3’ in front of it talk to your bank, or better still seek expert assistance from a mortgage broker.

All owner occupiers should now be paying a rate in the low ‘twos’ and saving more than 1.0 per cent on a variable loan. On an average loan this saves hundreds of dollars a month.

Mortgage holders should also not be afraid to seek a lower rate even if they have been on a six-month repayment holiday.

Banks will offer a better deal if you are ready to resume repayments so don’t be complacent about your interest rate as this can potentially cost you a lot of money. Contact a mortgage broker to make sure you are getting the best terms possible.

We are pleased to also announce Finsure Group has finished the 2019-20 financial year in a strong position despite COVID-19 challenges by achieving record settlements of $4.5 billion for the June quarter, a 37 per cent rise on the corresponding period.

These results – announced to the ASX by BNK Banking Corporation – were an outstanding performance against the backdrop of the coronavirus pandemic. Finsure settled $15.6 billion in loans during FY20, bringing the total Aggregation loan book to $45.4 billion.