Rental trends identify changing market cycles

Contact

Rental trends identify changing market cycles

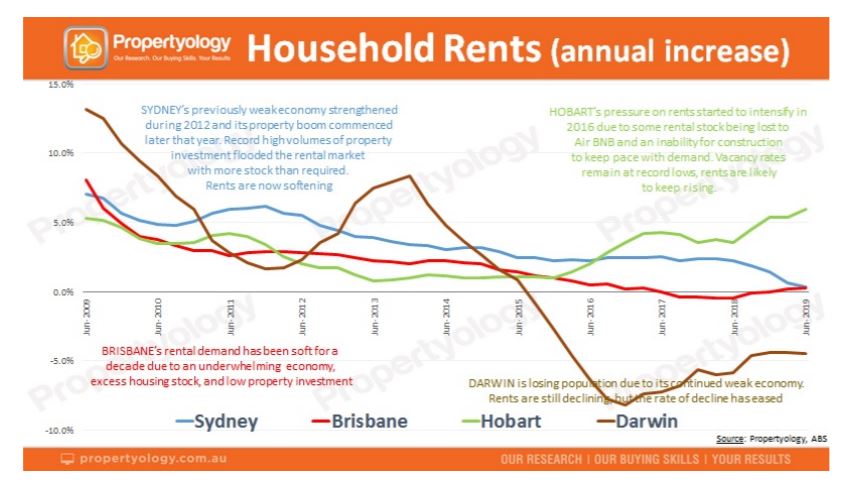

New research by Propertyology shows some rental markets are in the midst of change.

With residential vacancy rates above the equilibrium point of supply and demand in some locations and rents flat-lining or falling in others, it is clear that some markets are in the midst of change, according to new research by Propertyology.

The new Propertyology analysis identified the capital cities and major regional locations where changing rental markets pinpoint future property market performance.

Propertyology Head of Research, Simon Pressley said a number of locations have vacancy rates above three per cent, which is generally considered a balanced market place.

“When vacancy rates edge above three per cent, rents start to reduce because there is more supply than demand - property prices usually follow suit, " said Mr Pressley.

“Conversely, rents generally start to rise when vacancy rates fall below two per cent.

"This metric is also a back-of-the-beer-coaster indication of pressure building within a property market."

Mr Pressley said while there are a variety of different metrics that provide insights into future property market performance, rental market conditions are a good indicator.

“While a number of factors need to be considered to provide a clear overall picture, Propertyology believes that current rental trends are showing signs of changing property market cycles in several Australian locations," said Mr Pressley.

Mr Pressley said it is not a coincidence that Australia's best-performed property market over the last few years, Hobart, has had vacancy rates of less than 0.8 per cent since July 2016.

Hobart’s vacancy rate today is still a very low 0.6 per cent and Propertyology is forecasting further growth in Hobart for both rents and property prices.

Mr Pressley said rents for a standard house have already increased by about $100 per week over the past two years.

“Hobart has produced the biggest economic recovery of any Australian city this century," said Mr Pressley.

"Its labour market has expanded, interstate migration has been strong, and there's still an exciting pipeline of projects to come.

"Hobart’s construction sector is unable to keep pace with the extra demand for housing. "

The popularity of AirBNB and the subsequent transference of stock from the long-term tenancy pool into the leisure and corporate letting pool has also added to the rental pressure.

Propertyology anticipates that rising rents and reduced interest rates will trigger an increase in first home buyer activity, thereby further extending the growth cycle within Hobart's property market.

“Hobart still has the best overall fundamentals of all capital city property markets, " said Mr Pressley.

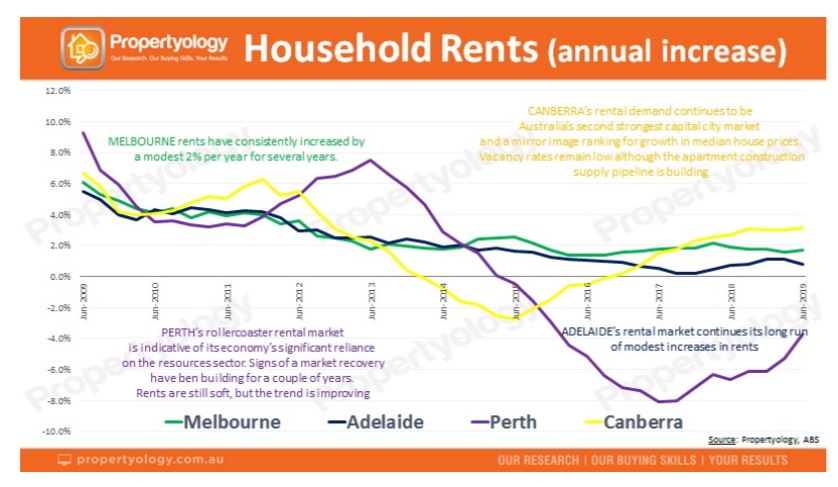

Canberra’s rental market has been Australia's second strongest capital city over the past year, according to the analysis.

Mr Pressley said its median house price growth was also ranked second behind Hobart.

“Canberra’s economy has benefited from a strong tourism sector and an increase in professional services jobs and international students," said Mr Pressley.

“While rental demand looks likely to remain strong in Canberra, new supply - especially apartment stock - may produce a reduction in rental pressure."

You can find out more about Propertyology's analysis here.

Similar to this:

NSW rental vacancy rates buck the trend for October

Sydney rental market “in line with the winter seasonal trend"