It's all good for housing affordability in Australia

Contact

It's all good for housing affordability in Australia

CoreLogic's Head of Research, Tim Lawless takes a look at housing affordability and its improvement over 10 years.

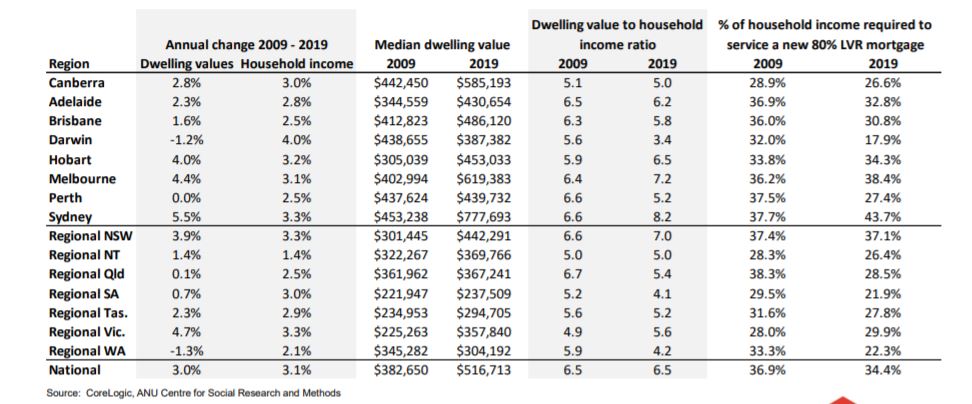

Nationally, dwelling values have risen at roughly the same pace as household incomes over the past decade providing a relatively steady ratio of dwelling values relative to household incomes.

At the same time, mortgage rates have fallen to generational lows, leading to an improvement in loan serviceability.

The decade ending in June 2019 has seen the national median dwelling value rise from $382,650 to $516,710, an annual increase of 3.0 per cent.

At a glance:

- In the last decade the national median dwelling value has risen from $382,650 to $516,710.

- In the last decade household incomes have risen from $59,020 to 79,872.

- Ratio of dwelling values to household incomes has moved from 6.1 to 7.0

At the same time, household incomes (according to estimates from the ANU Centre for Social Research and Methods) have risen at the annual pace of 3.1 per cent, up from $59,020 per annum in 2009 to $79,872 in 2019.

Over the same period, average mortgage rates (according to RBA statistics) fell from 5.1 per cent in 2009 to 4.1 per cent in June this year.

The wash up from these movements is that housing affordability, based on the ratio of dwelling values to household incomes, is broadly unchanged across Australia and households are generally dedicating less of their income towards servicing a new mortgage.

Nationally, the ratio of dwelling values to household incomes has varied over the past decade, moving through a low of 6.1 in late 2012 to a recent high of 7.0 in early 2018.

Source: CoreLogic, ANU Centre for Social Research and Methods.

In June 2019 the ratio was recorded at 6.5 which is equivalent to where it was in 2009.

A ratio of 6.5 simply means the typical Australian household is spending 6.5 times their gross annual household income in order to purchase the typical dwelling.

While the national reading is the same as it was ten years ago, five of the eight capital cities and four of the seven non-capital city regions have recorded an improvement in the ratio of dwelling values to household incomes.

The lowest ratio can be found in Darwin where the typical household is spending only 3.4 times their gross annual household income to purchase a dwelling (down from 5.6 ten years ago).

While most areas have seen housing values become more affordable relative to incomes, some areas have seen affordability worsen.

Sydney, Melbourne and Hobart have seen housing values rise at a faster rate than household incomes which has eroded affordability.

The typical Sydney household is now spending 8.2 times their gross annual household income in order to purchase the median value dwelling, up from 6.6 ten years ago.

Melbourne households are spending 7.2 times their annual income (up from 6.4 in 2009) and Hobart households are spending 6.5 times (up from 5.9).

Across the regional areas of Australia, the only areas where the ratio of dwelling values to household incomes has worsened is Regional NSW (6.6 in 2009 / 7.0 in 2019) and Regional Victoria (4.9 in 2009 / 5.6 in 2019).

It’s a similar story with mortgage serviceability.

Despite mortgage rates falling to the lowest level since at least the 1950’s, households in Sydney, Melbourne and Hobart are generally dedicating a larger proportion of their incomes towards servicing a new mortgage than they were in 2009.

Based on the proportion of household income required to service a new 80 per cent LVR mortgage, Sydney households are dedicating 43.7 per cent of their gross annual household income on mortgage repayments compared with 37.7 per cent ten years ago.

When mortgage rates were around 9 per cent in early 2008, Sydney households were dedicating a much larger 54.2 per cent to service a mortgage.

Melbourne households are dedicating 38.4 per cent on average to service a new 80 per cent LVR mortgage (up from 36.2 per cent in 2009) and Hobart households spend an average of 34.3 per cent of their income on a new mortgage (33.8 per cent ten years ago).

The smallest portion of income dedicated to new loan repayments is in Darwin at just 17.9 per cent of income.

Although housing affordability has worsened relative to ten years ago in Sydney and Melbourne, the decline in home values together with a subtle rise in household incomes and lower mortgage rates has seen affordability and serviceability record a temporary improvement in these areas.

Since June, dwelling values have surged higher while income growth has remained sluggish, implying that the improvement in housing affordability that has been delivered via a fall in home values is now being eroded.

Longer term strategies for improving housing affordability should include both supply and demand side considerations, as well as taxation reform.

On the supply side, ensuring infrastructure programs, land release and town planning policies are keeping pace with population growth is important.

On the demand side, population growth drives housing demand, as do stimulus measures such as first home buyer grants and tax concessions.

Incentivising jobs growth and infrastructure improvements in more affordable areas would support a redirection of population growth into areas where housing prices are more achievable.

Removing stamp duty would also help to improve housing affordability and housing mobility by lowering the transactional costs associated with purchasing a home.

A more detailed overview of housing affordability measures and changes over time can be found in the recently released Housing Affordability report released in conjunction with ANZ, available to download here.

Similar to this:

Housing affordability improves while rental affordability declines: report

House price expectations become positive, yet housing affordability remains a big issue