20 holiday hotspots ready for price growth revealed

Contact

20 holiday hotspots ready for price growth revealed

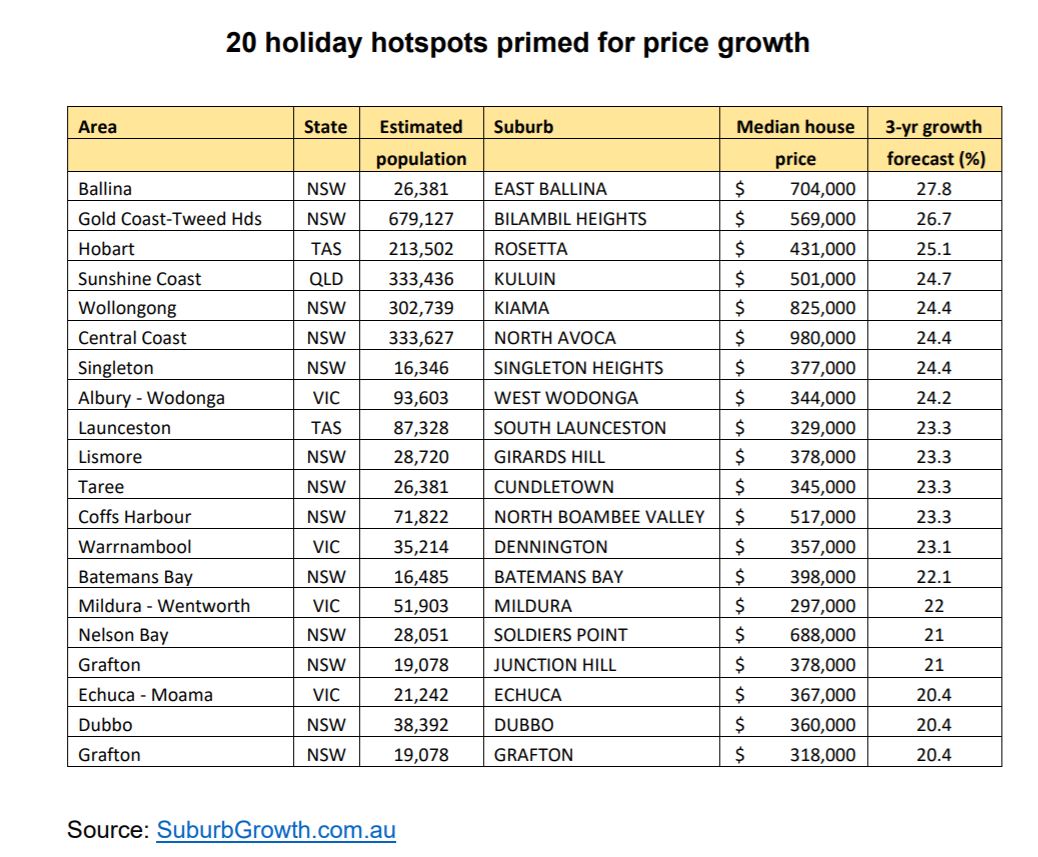

SuburbGrowth.com.au analysis has identified 20 holiday locations that are set to grow over the next three years.

New research has revealed 20 holiday locations with forecast median house price of up to 28 per cent over the next three years.

The analysis by SuburbGrowth.com.au – part of the Select Residential Property Research Group (SRP) – identified suburbs in four different States where prices are predicted to strengthen over the period.

SRP Director of Research Jeremy Sheppard said the research focused on suburbs within holiday locations, which also had solid market fundamentals outside of the tourism sector.

“While some of these locations might be better known as holiday destinations, they also have significant local populations – in some cases, hundreds of thousands of people who live there all-year round,” said Mr Sheppard.

“What this means is that these markets have solid fundamentals primed for growth, including the economic principals of demand and supply that apply upward housing price pressure.”

Mr Sheppard said with about one in three people now working from home either parttime or full-time, many people were also choosing to live in more desirable locations near the beach or the bush permanently.

“These areas are much more than just holiday locations,” he said.

“They are also thriving communities in their own right, with sound local economies and property markets with buy-in prices as low as $297,000 in one location.”

According to SuburbGrowth.com.au, the median house price in East Ballina in Northern New South Wales is forecast to grow by about 28 per cent over the next three years.

“Not only is East Ballina a coastal suburb, but the region is located just south of Byron Bay as well as being within commuting distance of the Gold Coast,” said Mr Sheppard.

Mr Sheppard said there’s also potential for more growth in the Ballina region over the next 20 years.

The analysis found that Bilambil Heights in the Gold Coast-Tweed region may experience a median house price increase of nearly 27 per cent over the next three years.

122A Broadwater Esplanade, Bilambil Heights is on the market through Mason Garten of Ray White Real Estate. Photo: Luxury List“The region is well-known for its abundance of natural beauty, which draws millions of tourists each year,” said Mr Sheppard.

“However, suburbs like Bilambil Heights are also popular with local residents because of its topography as well as location within an easy commute of the Gold Coast.”

The SuburbGrowth.com.au research found that the Hobart suburb of Rosetta may see a 25 per cent increase in median house price over the three-year period.

Mr Sheppard said as well as having direct access to the River Derwent, Rosetta was also only 15 minutes’ drive from Hobart.

The Sunshine Coast suburb of Kuluin came in at number four on the list, with its median house predicted to grow by nearly 25 per cent.

“The Sunshine Coast is in the midst of a major infrastructure boom, including the creation of the cutting-edge new Maroochydore City Centre,” said Mr Sheppard.

“Not only does Kuluin have affordable house prices, it is also located a few minutes from the new city centre precinct, which will help to underpin its price performance over the coming years.”

The research also identified market potential in Kiama in Wollongong, with prices forecast to increase by about 24 per cent over three years.

15 Pacific Street, Kiama is for sale through Monique Field of Smile Elite. Photo: LuxuryList

Mr Sheppard said the allure of Kiama as a holiday destination was already wellestablished, however, its location within a thriving regional centre was also a feather in its property cap.

“While tourists might head to Kiama each year for holidays, its residents get to enjoy its myriad attractions every day, including a number of popular surfing spots,” said Mr Sheppard.

“On top of that, Wollongong is expected to go from strength to strength in the years ahead given its location just 120 kilometres south of Sydney.”

The SuburbGrowth.com.au analysis uses 17 market variables to help determine the locations with the best chance of superior price growth over the next three years.

Similar to this:

Investing in a holiday home is no holiday