Brisbane expected to record biggest rise in house prices, says report

Contact

Brisbane expected to record biggest rise in house prices, says report

New research from BIS Oxford Economics has indicated that while there are positives emerging for Australia's residential market, they are a way off being felt.

The most significant recovery from Australia's housing downturn will occur outside the major markets of Sydney and Melbourne, says a new report.

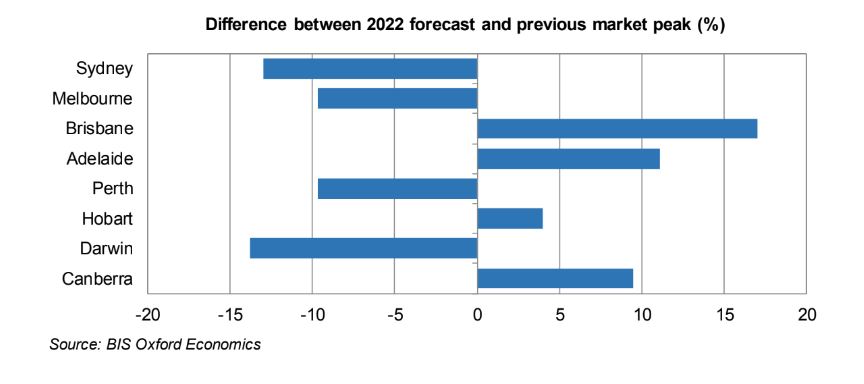

Findings from the BIS Oxford Economics' Residential Property Prospects 2019 to 2022 forecast released on Monday indicate the greatest upside to house prices is expected to emerge in Brisbane, although it will not be immediate.

According to the report, there remains an oversupply of dwellings in the state, mainly in the apartment sector, keeping any price rises modest in 2019/20, with an acceleration in price growth expected to emerge the following year.

BIS Oxford Economics' Residential Property Prospects 2019 to 2022 - At a glance:

- The greatest upside to house prices is expected to emerge in Brisbane.

- Moderate price rises are expected to tick over in Canberra and Adelaide.

- Median house prices in both the Sydney and Melbourne markets are expected to still be below their respective peaks of June 2017 and December 2017 by June 2022.

Elsewhere, the median house prices for both Sydney and Melbourne markets are expected to still be below their respective peaks of June 2017 and December 2017 by June 2022.

The company believes the sharp falls in construction across New South Wales and Victoria will "see the balance tip toward a tightening market by the end of 2020/21", placing upward pressure on prices, but at the same time being "mitigated by the higher interest rates for investors and stricter lending policies being applied to borrowers across the board".

The view from 601/24 Annie Street. As seen on Luxury List.

BIS Oxford Economics estimates that most state markets are in oversupply, with some at best being close to balance.

The company believes that, in the short term, economic conditions are forecast to be relatively muted and this will also play on demand.

An acceleration in economic growth is not expected until 2020/21 after residential construction bottoms out, and both improving building activity and business investment begin to drive economic growth.

BIS Oxford Economics Associate Director and study author, Angie Zigomanis, said mixture of conservative lending by banks, new dwelling completions having peaked in 2019/20, and a softening of rental growth would continue to contain investor demand and in turn keep a lid on prices despite recent (and expected further) reductions in interest rates.

“Supply is running at record levels, with new dwelling completions having exceeded 200,000 in each of the past four years and expected to have peaked at a record of just under 227,000 dwellings in 2018/19,” he said.

“This compares with underlying demand for new dwellings averaging around 195,000 per annum in the same period, which in itself is a record.”

Click here for more analysis from BIS Oxford Economics.

Similar to this:

Is construction sector really facing "biggest fall since GFC"?

How Gen Y will reshape the property market

Housing downturn 'should not be overstated', says CBRE economist