$14.3 billion in gross resale profits for March 2019 quarter

Contact

$14.3 billion in gross resale profits for March 2019 quarter

CoreLogic's March 2019 data shows Sydney and Melbourne are responsible for nearly half of the $14.3 billion in gross resale profits, every capital city increased in the share of loss-making resales over the March 2019 quarter, and units continue to be much more likely to resell at a loss than houses.

The March 2019 quarter results highlighted that 87.9% of resales made a gross resale profit (gain) for a total of $14.3 billion. This result was down on the previous quarter (89.5% for December 2018) and against the previous year (91.0% March 2018) but the real kicker is that it was, in fact, the lowest proportion of profit-making sales since March 2013.

Report author and research analyst Cameron Kusher said, “When relatively few properties are selling at a loss (pain) it’s a general indicator of a stronger housing market.”

On the flipside, he said, “If a higher proportion of properties are reselling at a loss, it’s a sign of weaker housing market conditions. We compare across all health metrics: capital cities vs regions, houses vs units, investors versus owner occupiers and hold periods (the impact of the length of time you’ve held onto a property on results).”

Sydney and Melbourne are responsible for nearly half of the $14.3 billion in gross resale profits. Their respective share of national total profits was 24.3% (Sydney) and 23.5% (Melbourne) thanks largely to their higher cost of housing, plus the strong growth in dwelling values prior to the recent downturn.

On the pain side, Australia had a total of $486.8 million in realised gross losses from resales over the March quarter, with the highest share of losses nationally seen in Perth (24.8%) and Sydney (19.9%).

Source: CoreLogic Pain & Gain March 2019 quarter report.

In the regions, three areas (all of which are linked to the resources sector), recorded at least 40% of all resales at a loss over the quarter. The share of losses in many of these areas is now lower than at the peak, but their material decline in values results in elevated losses; a reflection that housing values remain well below their peaks in these areas.

Areas recording the lowest proportion of pain (resales at a loss) are in regions surrounding Sydney and Melbourne: in fact, some of these are recording even fewer resales at a loss than the capital cities themselves.

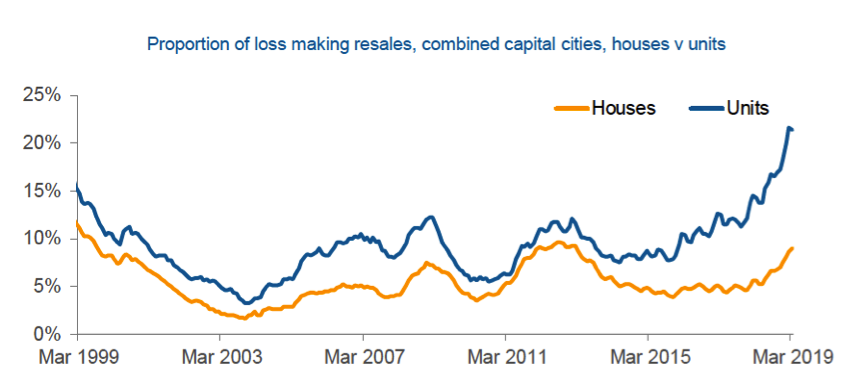

Houses vs units:

There’s a reasonable gap between the proportion of houses reselling for a gross profit (sitting at 90.5%) and units (a much lower 79.5%). Both dwelling types are seeing the rates of ‘pain’ results climbing quite rapidly but units continue to be much more likely to resell at a loss than houses. Each individual capital city, except for Hobart, and all rest of state regions recorded a greater share of unit resales at a loss than houses.

Just 79.5% of units made a profit-making resale during the March 2019 quarter: the lowest share since January 1999 and well down from 82.1% the previous quarter and the 85.4% seen a year earlier.

Source: CoreLogic Pain & Gain March 2019 quarter report.

The share of houses resold for a profit during the March quarter was the lowest share of profit-making resales since September 2013, down against the 91.7% of the previous quarter and the 92.9% seen a year earlier.

Investors Vs Owner Occupiers:

Investors continue to be more likely to resell their properties at a loss compared to owner-occupiers. Possibly because in a falling market, investors have the benefit of taxation rules. They would seemingly be more prepared to incur a loss because they (unlike owner-occupiers) can offset those losses against future capital gains. This could, in turn, result in more supply becoming available for purchase at a time in which demand for housing remains below average due to weak conditions and tight credit.

Capital city housing markets:

Every capital city saw an increase in the share of loss-making resales over the March 2019 quarter compared to the previous quarter, and it’s a similar story over the past 12 months too: Hobart was the only capital city in which the share of resales at a loss is currently lower relative to the March 2018 quarter.

The share of resales at a loss in Melbourne is the highest they’ve been since August 2014, for Brisbane since November 2013, for Adelaide’s since June 2016 and in Perth, we haven’t recorded this level of resales at a loss, ever.

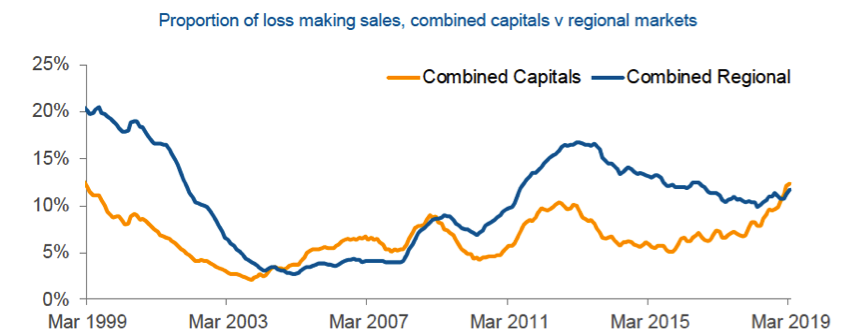

Although combined capital cities continue to record a lower proportion of resales at a loss than regional markets, loss-making resales across the combined capital cities increased by more than regional markets and we expect this to climb further as the housing market conditions deteriorate with the negative impact of lower values flowing through to resales.

Source: CoreLogic Pain & Gain March 2019 quarter report.

As at March 2019, 91.1% of all capital city houses resold over the quarter were at a profit (down against the previous quarter’s 92.5% and the 94.4% seen a year earlier. It was, in fact, the lowest it has been since February 2013.

For capital city units, 78.6% resold at a profit over the quarter, down from 81.8% the previous quarter and 85.7% a year earlier. It was slightly higher than the previous month, but before that had been the lowest share of profit-making unit resales since the three months to June 1997.

With housing market conditions continuing to weaken since March 2019, we would expect the share of capital city houses and units reselling for a loss to continue rising.

Regional performance

In Australia’s combined regional markets, 89.8% of houses resold at a profit over the March 2019 quarter (down from 90.1% the previous quarter and from 90.9% a year earlier). 81.5% of regional units resold at a loss over the quarter: less than the previous quarter (83.0%) and the 84.6% recorded a year earlier. The combined regional markets didn’t see the same deterioration in market conditions that have been experienced in the capital cities, however, we expect the share of loss-making resales to continue to climb over the coming quarters too.

Source: CoreLogic

Click here to view the CoreLogic Pain & Gain March 2019 quarter report.

Read more about CoreLogic data:

Downturn eases but becomes more widespread - CoreLogic

Auction clearance rates rise by 6.6 percentage points over March quarter - CoreLogic

Housing downturn loses some steam with CoreLogic House Value Index down 0.6% in March