New research identifies markets to buy if Labor restricts negative gearing

Contact

New research identifies markets to buy if Labor restricts negative gearing

A Labor triumph in Saturday's election could make certain housing markets more attractive for the remainder of the year, according to data from the Select Residential Property Research Group.

Investors should buy properties because of their capital growth potential over the long-term and not because they can claim negative gearing benefits for a temporary period of time, according to Select Residential Property.

With this Saturday election to determine whether there will potential changes to negative gearing from January 1, 2020, the research group has identified 34 city markets that savvy investors should consider before changes to negative gearing are potentially implemented at the start of next year.

According to the research, the best properties in each suburb on the list were established houses with strong capital growth prospects in more exclusive suburbs.

Established investment properties bought before 1 January 2020 will still be eligible to claim negative gearing taxation deductions if Labor pushes ahead with restricting the policy to new property only.

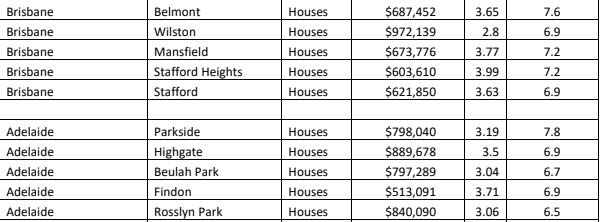

The suburbs across Brisbane and Adelaide with the highest forecast annual growth (far right column). Source: Select Property Residential

Mr Sheppard said it was no surprise that the properties with the best chances of solid capital growth are established houses.

“Investors should buy properties because of their capital growth potential over the long-term, not because they can claim negative gearing benefits for a temporary period of time,” he said.

“Negative gearing currently offers the owner, a legal taxation deduction for anyone who invests in income-producing assets, including established property.

“However, those investors quickly start paying tax when their property becomes positively geared after only a few years – something that Labor seems to not want to talk about.”

"The research identified locations that are likely to produce solid annual price growth next year because of a number of factors including more demand than supply."

The suburb with the highest annual growth forecast was Parkside in Adelaide, where house prices are predicted to increase by 7.8 per cent next year.

Brisbane's Belmont had the second highest forecast annual growth of 7.6 per cent, while Mansfield and Stafford Heights- also in Brisbane - recorded forecast annual capital growth of more than seven per cent.

Mr Sheppard said Mansfield State High School was always in demand from parents wanting their children to attend the well-regarded public school, which might underpin that suburb’s property price performance.

“Stafford Heights, located about eight kilometres north of Brisbane, has also been a suburb in demand for a while now partly due to gentrification as well as many homeowners renovating its many post-war properties,” he said.

While Sydney and Melbourne’s markets generally have experienced price softening over the past two years, Mr Sheppard said the analysis showed plenty of suburbs where buyers are keen to purchase.

"While the suburbs identified mostly had high median house prices, he said that was a reflection of the desirability of those locations."

“Woronora might be some 27 kilometres from the Sydney CBD, but it is also located on both sides of the picturesque Woronora River, which is why so many people want to live there,” he said.

“Likewise, in Caulfield North in Melbourne, which is one of the city’s premier suburbs, partly due to Caulfield Park, which is 26 hectares in size, and has a number of playgrounds and sport fields.”

By Sean Slatter

Similar to this:

New research identifies housing markets where prices are 'set to soar'

REINSW reveals suburbs most vulnerable to Labor negative gearing changes

Ray White and REIA welcome SQM report on Labor's negative gearing policy