Lower investor demand reflected in shrinking apartment pipeline - JLL

Contact

Lower investor demand reflected in shrinking apartment pipeline - JLL

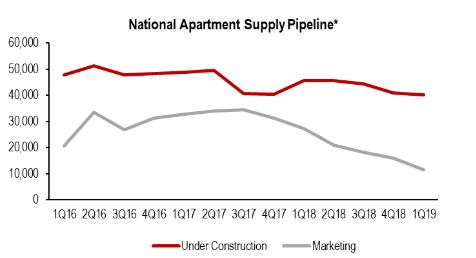

The number of apartments under construction in Australia’s six major capital cities has fallen by around 10% over the past year, according to JLL'S 1Q 2019 Apartment Market Reports.

The number of apartments being marketed Australia's capital cities has fallen by 48% over the past year, according to JLL’s 1Q 2019 Apartment Market Reports.

The JLL reports that cover inner city apartment markets showed it was largely Melbourne holding up the construction numbers, with 18,540 apartments under construction in the city (up 15% on a year ago).

However, the data also shows the number of apartments being marketed in Melbourne fell by 51% over the past year (1Q 2018 – 1Q 2019).

At a glance:

- JLL has released its 1Q 2019 Apartment Market Reports, showing the number of apartments under construction in Australia’s six major capital cities has fallen by around 10% over the past year.

- The number of apartments being marketed Australia's capital cities has fallen by 48% over the same time period.

- According to JLL, most buyer groups, with the exception of first home buyers, have been very inactive over the past few years.

Of the other capital cities, Sydney has seen a 24% fall in construction over the past year and a 77% reduction in apartments marketed, while Brisbane experienced a 36% reduction in construction and 59% reduction in apartments marketed.

JLL’s Australian Head of Residential Research, Leigh Warner, said the decline in the supply pipeline illustrates how the pre-sales requirements put on developers by financiers in Australia makes our supply pipeline very responsive to prevailing demand conditions.

“We’ve seen quite a few projects that we’ve been tracking for some time be redesigned for other land uses including office, hotels and student accommodation by existing or new owners," he said.

"This has particularly been the case in Melbourne.

“The medium-term danger now is that it will take some time for the supply pipeline to get going again and, with still very strong levels of national population growth, we could quite easily move into supply shortages over the next few years at the national level.

"This could result in real pressure on renters in some parts of the country in particular and move us from a housing price affordability crisis into a rental affordability crisis if we are not careful.”

JLL’s Australian Head of Residential Research, Leigh Warner. Source: JLL

According to JLL, most buyer groups, with the exception of first home buyers, have been very inactive over the past few years, but that the retreat of domestic and foreign investors from the market has had the biggest impact on slowing demand.

Mr Warner said APRA’s macro-prudential measures over the past few years to slow investor credit growth had been a sticking point for domestic investors.

“While these measures have recently been eased, it will take time for this to have any impact on investor demand," he said.

"Like all buyers, many will hold off to see where falling prices settle, while investors will also be eager to see the result of the Federal election and whether Labor’s proposed property taxation changes come into effect,” he said.

He added s significant decline in offshore investment is also undoubtedly responsible for the slump in apartment demand and subsequent fall in construction activity, particularly since this demand is almost entirely in new housing stock.

Source: JLL

"The Latest Foreign Investment Review Board (FIRB) data showed residential FIRB applications fell by 58% to $12.5bn in FY18 and was around 83% below the $72.5 bn peak level achieved in FY16," he said.

“The fall in overseas demand cannot really be attributed to any one thing.

“State and Federal imposts on foreign investors and credit constraints definitively contributed to the decline, but changes to Chinese capital restrictions likely had a much larger impact.

"And the late stage of the cycle and better opportunities elsewhere also likely played a role.”

Tough conditions to continue in the short term

Mr Warner said JLL expected conditions to remain tough in the short-term, with many parts of the country to see further downward pressure on prices and rents before starting to stabilise in late-2019.

“The combination of still tight credit, the Federal election and buyers holding off to see where prices will settle in some markets will all remain headwinds in the short-term," he said

“However, we think the medium-term outlook is very different.

We have not significant over-built in aggregate and very low completions over the next few years, along with continued strong population growth, will see us quickly move into an under-provision of space and see rental markets tighten once more."

Similar to this:

Investors show confidence in WA apartment market

Gold Coast apartment market "shedding ‘boom and bust’ reputation