Stamp duty reforms an "insult" to home buyers, as bidders versus banks after another flat auction rate

Contact

Stamp duty reforms an "insult" to home buyers, as bidders versus banks after another flat auction rate

Industry body the Real Estate Institute of New South Wales (REINSW) have slammed the stamp duty reforms as an "insult" to genuine home buyers, while bidders struggle with tight bank lending after another weekend of flat auctions across the nation.

Australian auction clearance rates are continuing to slide, with the seventh consecutive weekly reading below 50 per cent.

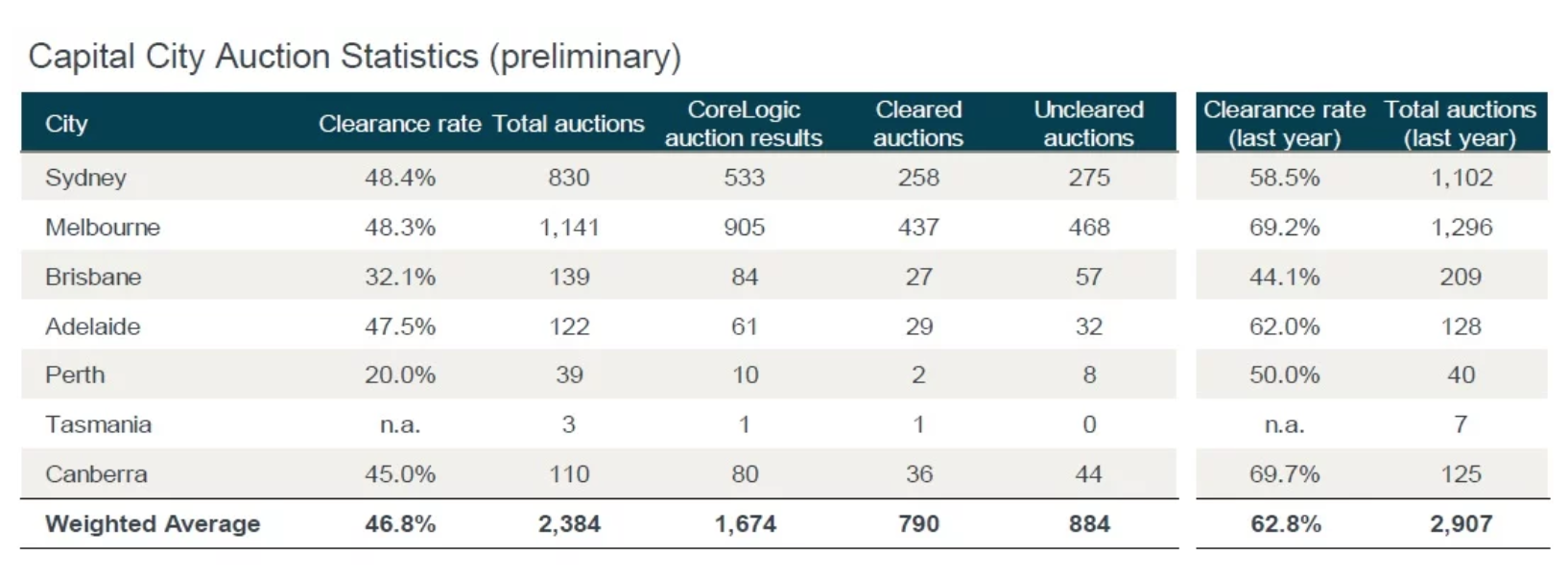

According to CoreLogic, a preliminary combined capitals clearance rate of 46.8 per cent was achieved - the weakest preliminary reading for the current downturn in the housing market.

"Given this week’s preliminary result is the lowest we’ve seen yet, it’s likely that as final results are collected, this week’s final clearance rate could come in lower again, potentially nudging the low 40 per cent range," CoreLogic said in a statement.

Average clearance rates have continued to track below 50 per cent for seven consecutive weeks - a considerably softer trend to what was seen over the same period last year when clearance rates were tracking around the low-mid 60 per cent range.

Source: CoreLogic

"The weakening weighted result is largely attributed to softening conditions across the two largest auction markets of Melbourne and Sydney; these two cities have accounted for 83 per cent of all auctions held so far this year," CoreLogic said.

Meanwhile, the Treasurer’s statement on Stamp Duty reforms has been slammed by industry group REINSW as an insult to those trying to purchase a home in New South Wales.

"It’s nothing more than hype and bluster in the lead up to the election," the industry body said in a media statement.

REINSW CEO Tim McKibbin said the State Government’s intention to index Stamp Duty by reference to the Consumer Price Index (CPI) starting from 1 July 2019 without adjusting the tax brackets is a real sleight of hand.

“NSW Treasurer Dominic Perrottet has acknowledged that the stamp duty rates have not been amended since they were introduced in 1986 and then says that he is going to apply indexation (CPI) to the set of tax brackets that are 32 years out of date!” Mr McKibbin said.

Pictured: REINSW CEO Tim McKibbin.

“In 1986 the Sydney median house price was $93,576 and the median unit price was $86,109.

“At that time the overwhelming amount of property transactions did not attract the higher rates of tax. Now with the Sydney median house price at $956,000 and the median unit price at $730,000 the overwhelming amount of transactions do attract the higher rates of tax.”

Mr McKibbin said by sitting on their hands for 32 years successive Governments have unconscionably profited at the expense of the home buyers including the most vulnerable - first home buyers.

“The first tax bracket tops out at, $14,000. I ask rhetorically when was the last time you heard of someone buying a house for $14,000?" he told WILLIAMS MEDIA.

Melbourne

A preliminary clearance rate of 48.3 per cent was recorded across Melbourne this week, with 1,141 auctions held across the city, this was an increase on last week’s 45.7 per cent final result when a much lower 266 auctions were held.

“Richmond topped the auction market over the weekend, based on both auction volume (14) and sales (nine)," Real Estate Insitute of Victoria (REIV) CEO Gil King told WILLIAMS MEDIA.

“Brunswick recorded an 89 per cent clearance rate from nine auctions while all seven listings in St Kilda East sold over the weekend. Craigieburn was the top performing suburb outside of the inner ring with seven sales from nine listings.”

Pictured: 32 Harold Street, Kensington. Passed in at auction by Simon Mason and Jerome Feery of Jellis Craig Kensington. As seen on Luxury List.

Listing agent Jeremy Desmier of Fletchers told WILLIAMS MEDIA tightened lending is having a significant impact on bidders.

"I can't remember a deal falling over on finance in the last five years or so. Very few people want to put 'subject to finance' - they're happy to get an approval from the bank and just go for it. What we're seeing now is people are not bidding at auction, they're waiting for a private sale and buying subject to finance, and more and more people are being knocked back on the finance now," he said.

Sydney

In Sydney, 48.4 per cent of homes sold at auction this week, after last week saw Sydney’s final auction clearance rate fell to its lowest since December 2008 (42.6 per cent). Volumes were relatively steady across Sydney week-on-week with 830 auctions held, up on the 813 held last week.

Pictured: 128 Commonwealth Street, Surry Hills. Sold at auction for $2.1 million by Dean Jarman of Ray White. As seen on Luxury List.

"There is no doubt media reports and changes to lending criteria have impacted buyers, but what that means is those that have finance approved and are clear on what they are looking for are making the most of the lower prices in the current market," REINSW President, Leanne Pilkington told WILLIAMS MEDIA.

Across the rest of Australia

Results across each of the smaller markets were varied this week, with Adelaide recording the highest preliminary auction clearance rate of 47.5 per cent, while in Perth only 20 per cent of auctions cleared.

In Brisbane, a 32.1 per cent preliminary clearance rate was recorded across 139 auctions.

Apollo Auctions recorded a 53.3 per cent clearance rate across their weekend auctions.

"It was a strong weekend of clearance for South East Queensland with the clearance rate in excess of 50 per cent. Although registered bidder numbers were down, the actual bidding percentage was the highest it has been all year with almost 3/4 of all registered bidders participating," auctioneer Justin Nickerson told WILLIAMS MEDIA.

Related reading:

Louis Christopher: "Crash territory"? Low clearance rates prompt questions over state of market

First home buyer? Why you should be considering the Northern Territory

New Zealand's 'foreign buyer ban' comes into effect, as questions linger about its long-term impacts